When planning a trip, most travelers focus on the excitement of new experiences and destinations, often overlooking the potential challenges that can arise far from home. While no one anticipates facing a medical emergency or unexpected situation abroad, being prepared is essential. This is where travel insurance, particularly the coverage for emergency repatriation, plays a crucial role. Understanding can provide peace of mind and ensure you are adequately protected in the event of a serious incident. In this article, we will explore the key components and benefits of emergency repatriation coverage, guiding you through what you need to know to make informed decisions about your travel insurance options. Travel Insurance“>

Travel Insurance“>

Understanding Emergency Repatriation Coverage in Travel Insurance

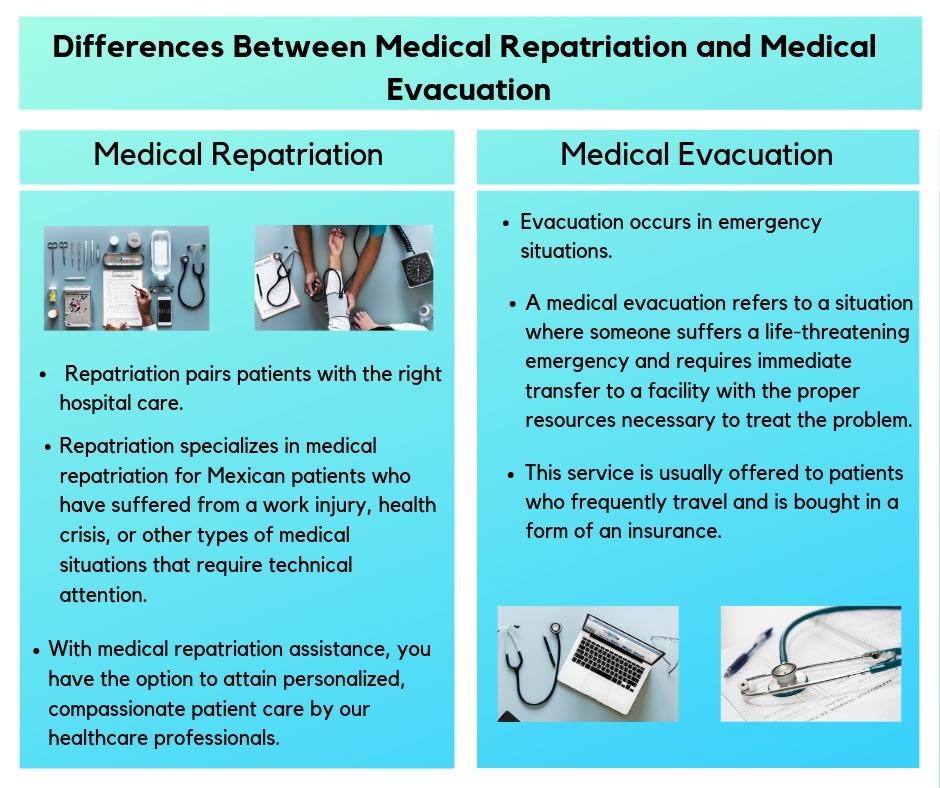

When it comes to travel insurance, one crucial component is the coverage for emergency repatriation. This coverage is essential for ensuring that, in the event of a medical emergency or unexpected incident abroad, you can be safely transported back to your home country. Here’s what is typically covered under this provision:

- Medical Evacuation: If you require immediate medical attention that is not available locally, the insurance will cover the cost of transporting you to the nearest adequate medical facility.

- Repatriation of Remains: In the unfortunate event of death, the policy usually covers the cost of transporting your remains back to your home country.

- Travel Companion Expenses: Some policies include coverage for a travel companion to accompany you during the repatriation process, ensuring you are not alone during this critical time.

- Family Visits: If you’re hospitalized abroad for an extended period, the insurance may cover the travel expenses for a family member to visit and stay with you.

Understanding these elements of emergency repatriation coverage can provide peace of mind, knowing that you are prepared for the unexpected during your travels. Always read your policy carefully to understand the specific terms and conditions, as they can vary significantly between providers.

Key Inclusions and Exclusions in Repatriation Policies

Understanding what your travel insurance covers for emergency repatriation is crucial for ensuring peace of mind during your travels. When reviewing your policy, you’ll typically find key inclusions such as:

- Medical Evacuation: Coverage for transportation to the nearest medical facility equipped to treat your condition.

- Return of Mortal Remains: Arrangements and expenses for returning a deceased policyholder’s remains to their home country.

- Accompanying Family Member: Costs covered for a family member to accompany you during the repatriation process if medically necessary.

- Medical Escorts: Professional medical staff provided to assist during transport if required by your health condition.

On the flip side, it’s equally important to be aware of common exclusions that might limit your coverage:

- Pre-existing Conditions: Many policies do not cover medical issues related to pre-existing conditions unless specified.

- High-Risk Activities: Injuries resulting from activities deemed hazardous, such as extreme sports, may not be covered.

- Non-Emergency Situations: Routine medical check-ups or non-urgent procedures are generally excluded.

- Self-Inflicted Injuries: Incidents arising from self-harm or suicide attempts are typically not covered.

Essential Steps to Ensure Comprehensive Repatriation Coverage

To ensure that your travel insurance provides thorough emergency repatriation coverage, consider these essential steps:

- Review Policy Details: Carefully examine the terms and conditions of your travel insurance policy. Look for specific mentions of emergency repatriation and confirm what scenarios are covered, such as medical emergencies, natural disasters, or political unrest.

- Understand Medical Evacuation Procedures: Verify that your policy includes coverage for medical evacuation to your home country or the nearest appropriate medical facility. This can be crucial in situations where local medical services are inadequate.

- Check Coverage Limits: Ensure the policy’s coverage limits are sufficient to cover potential costs, including transportation, medical care, and any additional expenses that might arise during repatriation.

- Clarify Pre-existing Conditions: Understand how your policy handles pre-existing medical conditions. Some insurers may require additional premiums or provide limited coverage for conditions you had prior to purchasing the policy.

- Contact Emergency Assistance Services: Familiarize yourself with the insurer’s emergency contact numbers and procedures. Quick and effective communication can be vital during an emergency.

By following these steps, you can ensure that your travel insurance policy provides comprehensive protection for emergency repatriation, offering peace of mind during your travels.

Expert Tips for Selecting the Best Travel Insurance for Repatriation Needs

Choosing the right travel insurance for emergency repatriation can make a significant difference during unforeseen events. To ensure you select the best policy, consider the following expert tips:

- Comprehensive Coverage: Ensure the policy includes medical evacuation and repatriation of remains. These are crucial for covering expenses if you need to be transported back home due to medical emergencies or in the unfortunate event of death abroad.

- Provider Network: Check if the insurer has a global network of providers. This can facilitate smoother coordination during emergencies, ensuring you receive timely assistance.

- Policy Limits: Pay attention to the limits on repatriation costs. Some policies may cap these expenses, so choose one that offers sufficient coverage for your destination.

- Pre-existing Conditions: Verify if the insurance covers repatriation related to pre-existing medical conditions. Some plans may exclude these, so it’s vital to read the fine print.

- 24/7 Assistance: Opt for a policy that provides round-the-clock support, offering peace of mind that help is just a call away, regardless of time zones.

Concluding Remarks

understanding the nuances of is crucial for any traveler. This aspect of your travel insurance policy ensures that you have the necessary support and financial protection in situations that require your immediate return to your home country due to unforeseen emergencies. By familiarizing yourself with the specifics of your policy, such as coverage limits, exclusions, and the process for initiating a claim, you can travel with confidence, knowing that you are prepared for the unexpected. Always take the time to read the fine print and consult with your insurance provider to clarify any uncertainties. This proactive approach will ensure that you have the peace of mind needed to fully enjoy your travels, secure in the knowledge that you are protected should an emergency arise.