In the realm of financial planning, ensuring that one’s end-of-life expenses are covered can bring peace of mind to individuals and their families. Two common options for addressing these concerns are life insurance and funeral insurance, each offering distinct benefits and considerations. As consumers navigate the complexities of these insurance products, understanding the differences between them becomes crucial in making an informed decision. This article aims to elucidate the key features, advantages, and potential drawbacks of life insurance and funeral insurance, providing readers with the essential knowledge needed to determine which option best aligns with their personal and financial goals. By exploring these two types of coverage, individuals can make choices that not only safeguard their loved ones from unexpected financial burdens but also reflect their unique needs and circumstances.

Understanding the Differences Between Life Insurance and Funeral Insurance

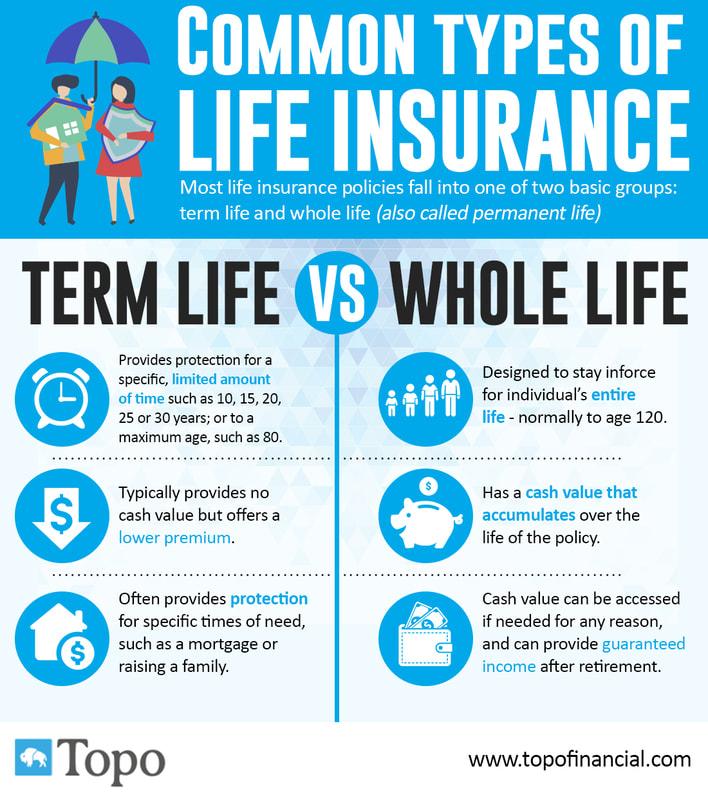

When navigating the world of insurance, it’s crucial to distinguish between life insurance and funeral insurance, as each serves a distinct purpose. Life insurance is designed to provide a comprehensive financial safety net for your loved ones in the event of your passing. It typically covers a wide range of financial obligations, such as:

- Outstanding debts like mortgages or loans

- Living expenses for dependents

- Future education costs

- Estate taxes

On the other hand, funeral insurance is more focused and serves to specifically cover the costs associated with your funeral and burial services. This type of insurance is often chosen for its straightforward nature, offering a simpler application process and smaller coverage amounts. While both types of insurance provide peace of mind, understanding these differences will help you choose the policy that best aligns with your financial goals and family needs.

Evaluating Costs and Benefits: Which Policy Offers More Value

When it comes to assessing the financial implications of life insurance versus funeral insurance, understanding the costs and benefits of each policy is crucial. Life insurance typically offers a more comprehensive financial safety net, as it provides a lump-sum payment to beneficiaries that can be used for a variety of purposes, such as paying off debts, covering living expenses, or investing in future needs. This flexibility, however, often comes at a higher premium cost compared to funeral insurance.

On the other hand, funeral insurance is designed specifically to cover funeral-related expenses. Its primary advantage is that it usually involves lower premiums, making it an attractive option for those primarily concerned with covering immediate end-of-life costs. While it lacks the broader financial support offered by life insurance, it can be a practical choice for individuals with tight budgets or those who already have other financial plans in place. When deciding between the two, consider these key factors:

- Premium Costs: Life insurance generally has higher premiums but offers more extensive coverage.

- Coverage Scope: Funeral insurance is limited to funeral costs, whereas life insurance provides broader financial security.

- Financial Goals: Evaluate whether you need comprehensive financial support or just coverage for funeral expenses.

Assessing Your Personal Needs: Choosing the Right Coverage for You

When contemplating between life insurance and funeral insurance, it’s crucial to evaluate your personal circumstances and financial goals. Life insurance is generally designed to provide a financial safety net for your dependents, covering expenses like mortgages, education, and living costs in the event of your passing. This type of insurance can be particularly beneficial if you have young children, significant debts, or dependents relying on your income.

On the other hand, funeral insurance is more focused, covering only the costs associated with your funeral and burial. This can be an attractive option if your primary concern is ensuring that your final expenses are not a burden on your family. Consider the following factors to make an informed decision:

- Your current financial obligations and whether life insurance might provide broader coverage.

- The age and dependency of your beneficiaries—life insurance can offer long-term financial support.

- Your budget, as funeral insurance often comes with lower premiums.

- Your end-of-life preferences and whether you have other means to cover these costs.

Expert Recommendations on Selecting Between Life and Funeral Insurance

When it comes to making a decision between life insurance and funeral insurance, it’s essential to consider your specific needs and financial situation. Life insurance is typically designed to provide a broad financial safety net for your beneficiaries. It covers various expenses such as outstanding debts, mortgage payments, and provides long-term financial security for your loved ones. Funeral insurance, on the other hand, is more focused and is primarily intended to cover the costs associated with your funeral and burial services. This can be beneficial if you are primarily concerned with not burdening your family with these immediate expenses.

- Consider your financial goals: If your goal is to leave a substantial inheritance or ensure your family can maintain their current lifestyle, life insurance may be more appropriate.

- Evaluate your current debts and expenses: If you have significant debts or ongoing financial obligations, life insurance might offer more comprehensive coverage.

- Assess your health and age: Life insurance premiums can be higher for older individuals or those with health issues, whereas funeral insurance often has more lenient underwriting processes.

- Understand the cost differences: Funeral insurance typically has lower premiums, but also a smaller payout compared to life insurance.

In Summary

the decision between life insurance and funeral insurance ultimately depends on your personal circumstances, financial goals, and the specific needs of your beneficiaries. Life insurance offers broader financial protection, supporting your loved ones with a safety net that extends beyond funeral expenses, potentially covering debts, living expenses, and future financial needs. On the other hand, funeral insurance provides a more targeted solution, ensuring that the immediate costs of a funeral are covered without imposing a significant financial burden on your family. By carefully considering factors such as coverage scope, premium costs, and your long-term financial objectives, you can make an informed choice that aligns with your priorities and provides peace of mind for you and your loved ones. Remember, consulting with a financial advisor or insurance specialist can also provide valuable insights tailored to your unique situation, helping you navigate this important decision with confidence.