Whole life insurance is often presented as a dual-purpose financial product, offering both a death benefit and a savings component. As an investment, it has sparked considerable debate among financial advisors and consumers alike. On one hand, whole life insurance policies provide a guaranteed return on the cash value component, tax-deferred growth, and lifelong coverage, which can be appealing to those seeking stability and security. On the other hand, these policies often come with higher premiums compared to term life insurance, and the investment returns may not match the potential gains from other investment vehicles. This article explores the advantages and disadvantages of whole life insurance as an investment, providing a comprehensive analysis to help individuals make informed decisions based on their financial goals and risk tolerance.

Understanding Whole Life Insurance as an Investment

Whole life insurance is often marketed as a dual-purpose financial product that combines insurance coverage with an investment component. While it offers several appealing features, it also comes with certain drawbacks. On the positive side, whole life insurance provides guaranteed cash value accumulation. This means that a portion of your premium payments is allocated towards building cash value, which grows tax-deferred over time. This feature can be particularly attractive to those seeking a conservative investment vehicle with predictable growth. Additionally, whole life policies offer a death benefit that is guaranteed to be paid out to beneficiaries, providing peace of mind and financial security.

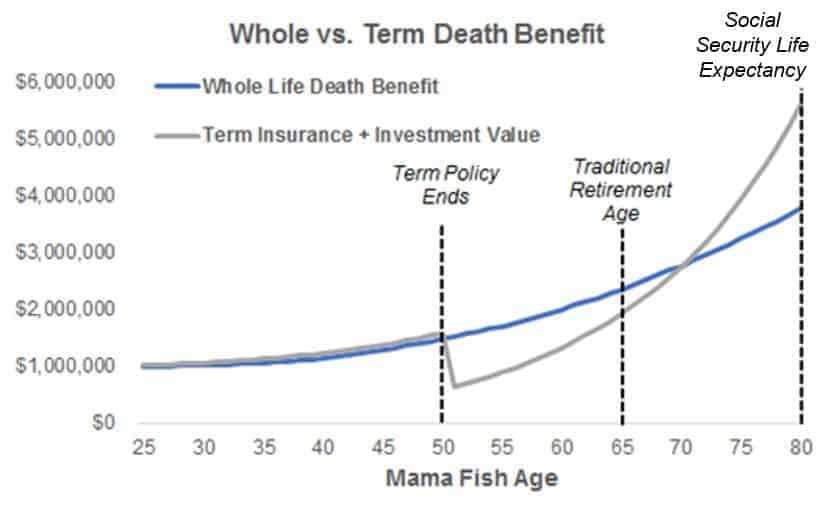

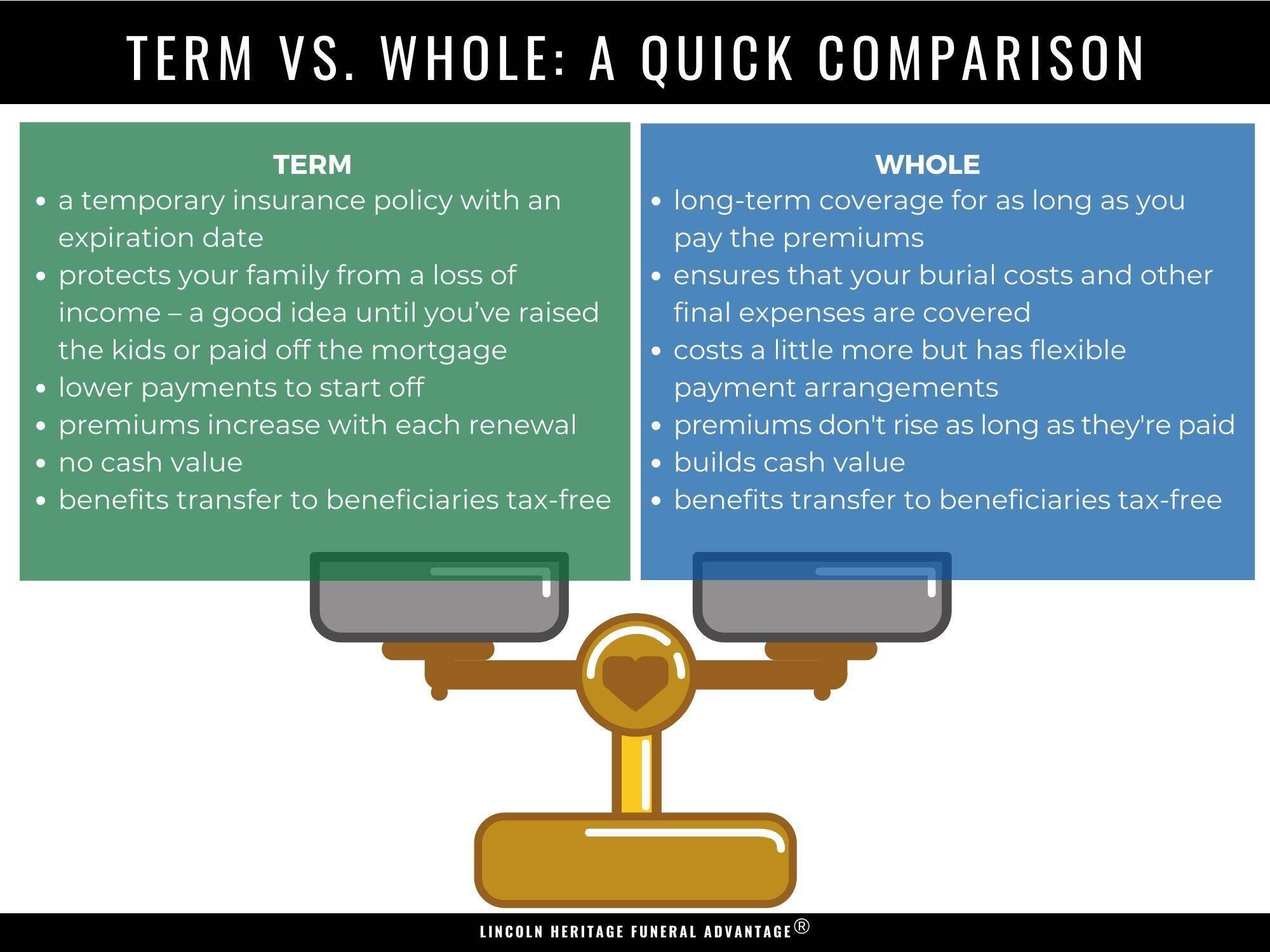

However, there are also notable downsides to consider. Whole life insurance policies typically come with higher premiums compared to term life insurance, making them less accessible for individuals on a tight budget. Furthermore, the rate of return on the investment component is often lower than what could potentially be achieved through other investment vehicles, such as stocks or mutual funds. It’s crucial to weigh these factors and consider whether the stability and benefits of whole life insurance align with your financial goals and risk tolerance.

Evaluating the Financial Benefits of Whole Life Insurance

Whole life insurance, a form of permanent life insurance, offers more than just a death benefit; it also provides a cash value component that can be leveraged for financial growth. When , one must consider its potential as a steady, low-risk investment. The policy’s cash value grows at a guaranteed rate, and over time, this can accumulate into a substantial amount. Moreover, the cash value is tax-deferred, meaning you won’t pay taxes on its growth until you withdraw the money, allowing for potentially more robust compounding.

- Guaranteed Returns: Unlike other investments that are subject to market volatility, whole life insurance offers a guaranteed rate of return, providing a reliable component in a diversified financial portfolio.

- Tax Advantages: The tax-deferred growth of the cash value can be a significant advantage, especially for those in higher tax brackets looking for long-term wealth accumulation strategies.

- Loan Options: Policyholders can borrow against the cash value, providing a flexible option for accessing funds without the need to liquidate other investments.

Potential Drawbacks of Investing in Whole Life Insurance

While whole life insurance can be a stable addition to an investment portfolio, it is important to consider its potential downsides. High premiums are one of the most significant drawbacks, as they can be considerably more expensive than term life insurance policies. This cost might not be justifiable for individuals who are primarily looking for a robust investment vehicle rather than life coverage. Additionally, the return on investment might not meet expectations, as the cash value accumulation can be slow and often yields lower returns compared to other investment options such as stocks or mutual funds.

- Limited flexibility: Once a whole life policy is in place, the terms are often rigid, making it difficult to adjust premiums or coverage without incurring penalties.

- Complexity: Understanding the intricate details of whole life insurance policies can be challenging, often requiring professional advice to navigate the numerous clauses and fees.

- Opportunity cost: Funds tied up in a whole life insurance policy could potentially generate higher returns if invested elsewhere, such as in a diversified stock portfolio.

Expert Recommendations for Whole Life Insurance Policyholders

When considering whole life insurance as an investment, it is crucial to follow expert recommendations to ensure that your financial strategy aligns with your long-term goals. Financial advisors often suggest evaluating the policy’s cash value growth potential and comparing it with other investment opportunities. Key benefits include:

- Guaranteed Death Benefit: Provides a fixed payout to beneficiaries, ensuring financial security.

- Cash Value Accumulation: Builds up over time, offering a potential source of funds for future needs.

- Tax Advantages: Cash value grows tax-deferred, and policy loans are typically tax-free.

On the flip side, experts caution against the potential drawbacks, which might impact your financial health. Challenges to consider are:

- Higher Premiums: Whole life policies often come with higher costs compared to term life insurance.

- Limited Investment Flexibility: The growth of cash value may be slower compared to other investments.

- Complexity: Understanding policy details and managing them effectively can be challenging.