Moving to a new city is like starting a fresh chapter in the storybook of life, filled with exciting adventures, unfamiliar streets, and endless possibilities. As you pack up your life and prepare to embrace the unknown, it’s easy to overlook one crucial aspect: your insurance. Just like finding the perfect neighborhood coffee shop or the quickest route to work, securing the right insurance is essential for a smooth transition. But fear not! Navigating the world of premiums and policies doesn’t have to be daunting. In this guide, we’ll embark on a journey to uncover savvy tips and tricks that will not only safeguard your new adventure but also keep your wallet happy. So grab a cup of coffee, settle in, and let’s explore how to save on insurance when moving to a new city, turning this new chapter into a masterpiece of peace of mind and financial savvy.

Discover Hidden Discounts in Your New Neighborhood

Moving to a new city is exciting, but it can also bring about unexpected expenses, especially when it comes to insurance. Luckily, your new neighborhood might have some hidden gems to help you save. Here are a few tips to uncover those secret savings:

- Local Discounts: Many insurance companies offer special rates based on local partnerships or regional factors. Check with local agents who may have exclusive offers not available online.

- Community Groups: Joining neighborhood associations or community groups can sometimes lead to insider tips on the best deals and discounts available for residents.

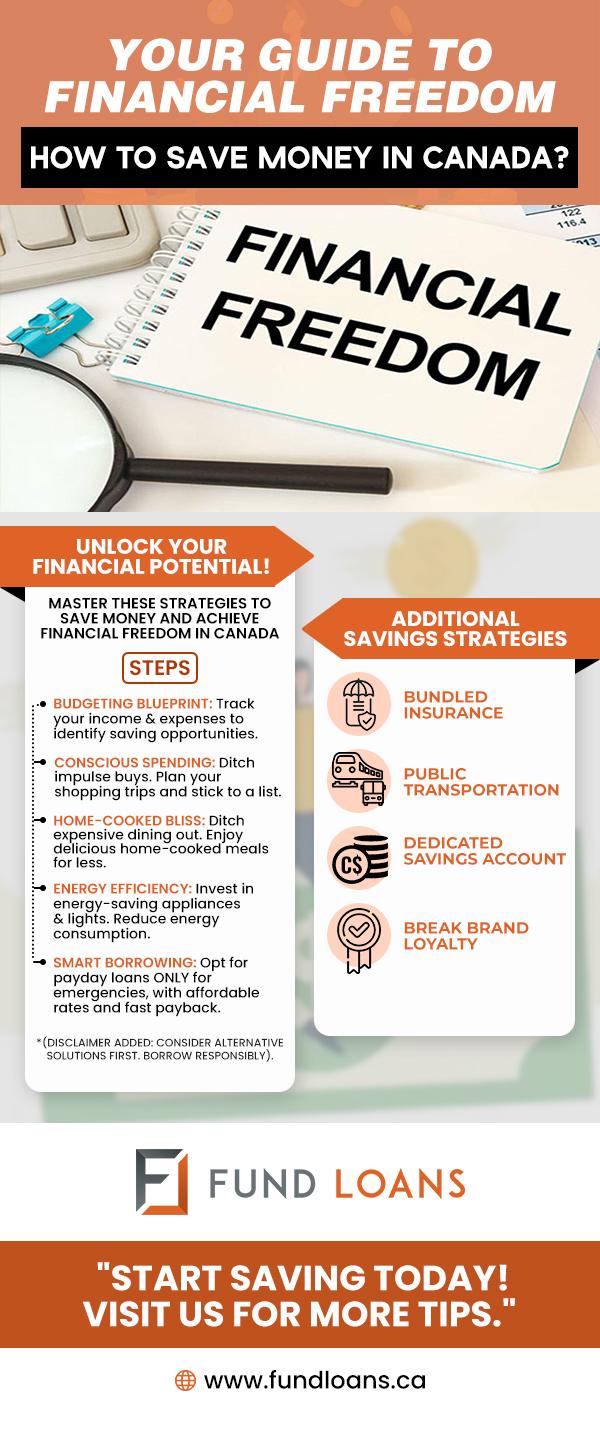

- Bundle and Save: If you’re moving, it’s a great time to reevaluate your insurance needs. Bundling your home, auto, and other insurances with a single provider can lead to significant discounts.

By tapping into these resources, you can ease the financial transition of your move and enjoy your new city without breaking the bank.

Unlock the Secrets of Tailored Insurance Plans

Moving to a new city can be an exhilarating adventure, but it often comes with its own set of challenges, especially when it comes to insurance. Tailoring your insurance plan to fit your new lifestyle is not just about finding the right coverage; it’s about uncovering hidden opportunities to save. Consider the following strategies:

- Evaluate Local Risks: Different cities have different risk factors. For instance, if you’re moving to a coastal city, you might need to focus on flood insurance. On the other hand, a city known for its high traffic might require a more comprehensive auto policy.

- Bundle Your Policies: Many insurers offer discounts when you bundle multiple types of insurance, such as home and auto. This can lead to significant savings and streamline your policy management.

- Leverage Local Discounts: Some insurance providers offer special rates for local residents. Research companies that cater specifically to your new city, as they might provide competitive pricing or exclusive discounts.

By customizing your insurance plan based on your new environment and needs, you can protect yourself effectively while also keeping costs down. Remember, the key is to be proactive and explore all available options!

Master the Art of Bundling for Bigger Savings

When you’re settling into a new city, the thrill of a fresh start can be accompanied by a whirlwind of tasks. One savvy move is to explore the potential savings through insurance bundling. By combining different types of insurance policies, you can unlock significant discounts that make your transition smoother and more cost-effective. Here’s how you can master this strategy:

- Assess Your Needs: Start by listing the types of insurance you require, such as auto, home, or renters insurance. Understanding your needs will help you tailor a bundle that offers maximum benefits.

- Shop Around: Don’t settle for the first offer you receive. Reach out to multiple insurance providers to compare bundle packages and negotiate the best deal.

- Leverage Loyalty: If you’ve been with an insurer for a while, inquire about loyalty discounts when bundling. Companies often reward long-term customers with attractive savings.

- Review Regularly: Life changes, and so do your insurance needs. Periodically reviewing your bundled policies ensures you’re always getting the best deal tailored to your current situation.

By strategically bundling your insurance policies, you can enjoy not only financial savings but also the convenience of managing your insurance needs under one roof. It’s all about making your move to a new city as seamless and budget-friendly as possible.

Navigate Local Regulations Like a Pro

Understanding the intricacies of local insurance regulations can seem daunting, but with a little savvy, you can turn this challenge into an opportunity for savings. Each city has its own set of rules and requirements that can affect your insurance rates. It’s essential to do your homework and get familiar with these specifics to ensure you’re not overpaying. Start by researching the minimum insurance requirements in your new city. Often, local laws dictate the types and amounts of coverage you must carry, which can vary significantly from your previous location.

Next, consider the factors that influence insurance premiums in your new area. Some cities may offer discounts for safe driving records, while others might provide breaks for vehicles with advanced safety features. Here are a few strategies to consider:

- Bundle policies: Combining auto and home insurance can often result in discounts.

- Adjust coverage levels: Review your policy to ensure you’re not paying for unnecessary coverage.

- Shop around: Different insurers may offer better rates based on local competition.

- Inquire about local discounts: Some insurers provide discounts for members of certain local organizations or for completing defensive driving courses.

By taking the time to understand and navigate local regulations effectively, you’ll be in a strong position to optimize your insurance costs, leaving you with more resources to enjoy your new city.

Insights and Conclusions

As you embark on this exciting journey to a new city, remember that saving on insurance is not just about cutting costs—it’s about crafting a safety net that fits your new life like a glove. By doing your homework, comparing quotes, and tapping into local resources, you can navigate the insurance landscape with confidence and ease. So, pack up your sense of adventure along with these savvy tips, and let your new chapter unfold with peace of mind and a little extra cash in your pocket. Here’s to new beginnings, new adventures, and a future where you’re both protected and prepared. Safe travels!