In the cozy sanctuary of your home, peace of mind is as valuable as the roof over your head. Yet, while we all cherish the comfort of our personal havens, the financial burden of home insurance premiums can sometimes dampen that sense of tranquility. What if there was a way to safeguard your cherished space while lightening the load on your wallet? Enter the world of home security systems—a savvy solution that not only fortifies your castle but also charms your insurance provider into offering you a more favorable rate. In this article, we’ll explore how investing in a security system can do more than just protect your home; it can be your ticket to reduced insurance premiums, allowing you to enjoy the dual benefits of safety and savings. So, grab a cup of tea, settle into your favorite chair, and let’s uncover how you can turn your home into a fortress of both security and financial wisdom.

Securing Savings with Smart Security

Incorporating a comprehensive security system into your home can be a game-changer when it comes to slashing those hefty insurance premiums. Many insurance providers offer discounts to homeowners who take proactive measures to protect their property. Here’s how a security system can help you save:

- Deterrence of Potential Threats: With visible security cameras and alarms, the chances of burglary or vandalism decrease significantly. This reduced risk often translates into lower premiums.

- Real-Time Monitoring: Systems that offer 24/7 monitoring can alert authorities immediately in case of emergencies, minimizing damage and risk, which insurers love.

- Fire and Smoke Detection: Advanced systems often come with integrated smoke and carbon monoxide detectors, adding another layer of protection that can result in additional discounts.

- Smart Home Integration: Features like smart locks and lighting can further enhance your home’s security, showing insurers that you’re committed to safeguarding your property.

By investing in a robust security system, not only are you enhancing your home’s safety, but you’re also making a strategic move towards financial savings. It’s a win-win for peace of mind and your wallet!

Unlocking Discounts: How Your Security System Pays Off

Did you know that your security system can do more than just protect your home? It can also be your ticket to reduced home insurance premiums! Insurance companies love a secure home because it means fewer claims, and they’re willing to pass those savings onto you. Here’s how you can leverage your security system for financial benefits:

- Install Monitored Alarms: Insurance providers often offer discounts for homes equipped with monitored alarm systems. These systems alert authorities in case of a break-in, reducing the risk of significant loss.

- Integrate Fire and Smoke Detectors: Adding fire and smoke detectors to your security system can further lower your premiums. Early detection systems minimize damage, which insurers appreciate.

- Consider Smart Home Features: Smart systems that allow remote monitoring and control can add an extra layer of security. These features can demonstrate your proactive approach to safeguarding your home, making you eligible for additional discounts.

- Document Everything: Keep a record of all installed security devices and provide this to your insurance company. Detailed documentation can make it easier to qualify for discounts.

By enhancing your home’s security, you not only protect your loved ones and valuables but also potentially save money on your insurance premiums. It’s a win-win situation!

From Cameras to Alarms: Choosing the Right Setup for Maximum Premium Reduction

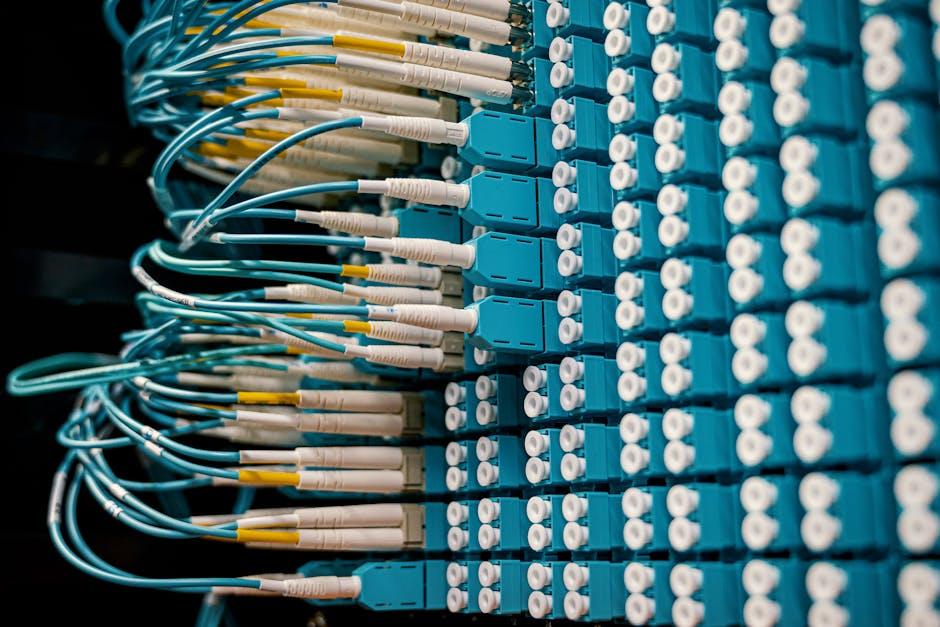

When it comes to enhancing your home security and cutting down those insurance costs, selecting the right combination of devices is key. Security cameras are a popular choice, offering not only peace of mind but also a tangible deterrent to potential intruders. Opt for cameras with high resolution, night vision, and remote access capabilities for maximum effectiveness. Pairing cameras with smart locks and video doorbells can create a formidable first line of defense, providing both surveillance and control over who enters your home.

Beyond cameras, consider integrating alarm systems that are monitored 24/7. These systems often lead to greater premium reductions, as they offer immediate response to potential threats. Look for features like motion detectors, glass break sensors, and smart smoke detectors. Together, these components create a robust security ecosystem that not only safeguards your home but also impresses your insurance provider with its comprehensive coverage. Remember, the goal is to balance technology with practicality, ensuring every device serves a purpose and contributes to a safer home environment.

Expert Tips to Optimize Your Security System for Insurance Benefits

Enhancing your home security system not only safeguards your property but can also lead to reduced insurance premiums. To maximize these benefits, consider implementing the following expert tips:

- Integrate Smart Technology: Incorporate smart locks, cameras, and alarms that can be controlled via mobile apps. Insurance providers often offer discounts for homes with advanced, connected security systems.

- Install a Monitored Alarm System: Systems monitored by a professional service can lead to substantial premium reductions. Ensure your provider is recognized by your insurance company for maximum benefit.

- Regular Maintenance and Upgrades: Keep your system up-to-date with regular checks and upgrades. A well-maintained system is more reliable and may be rewarded with lower insurance costs.

By strategically enhancing your security setup, you can enjoy peace of mind while also saving on your insurance bills.

To Wrap It Up

transforming your home into a fortress of safety not only offers peace of mind but also provides a tangible reward in the form of reduced insurance premiums. By investing in a robust security system, you’re not just safeguarding your family and cherished belongings; you’re also demonstrating to your insurer that you’re committed to risk prevention. This proactive approach can lead to significant savings over time, making it a win-win situation.

As you embark on this journey towards a more secure and financially savvy household, remember that every little measure counts. Whether it’s installing smart locks, setting up surveillance cameras, or simply ensuring your alarm system is up-to-date, these steps can make a world of difference. So, go ahead and embrace the dual benefits of heightened security and lower premiums. After all, a secure home is not just a safe haven; it’s also a smart investment. Stay safe, stay savvy, and let your home be the sanctuary it’s meant to be.