In the ever-spinning carousel of life’s expenses, insurance often takes center stage, twirling with a price tag that can leave us dizzy. But what if there were a way to slow down the ride and make it a bit more wallet-friendly? Enter the savvy strategy of annual payments—a delightful financial dance that can lead to significant savings on your insurance costs. Imagine transforming the daunting task of managing premiums into a graceful waltz, where you take the lead and guide your budget with confidence. In this article, we’ll explore how opting for annual payments can be your ticket to a more affordable insurance experience. So, grab your financial dancing shoes, and let’s step into a world where savings and peace of mind are just a twirl away.

Mastering the Art of Annual Payments for Big Savings

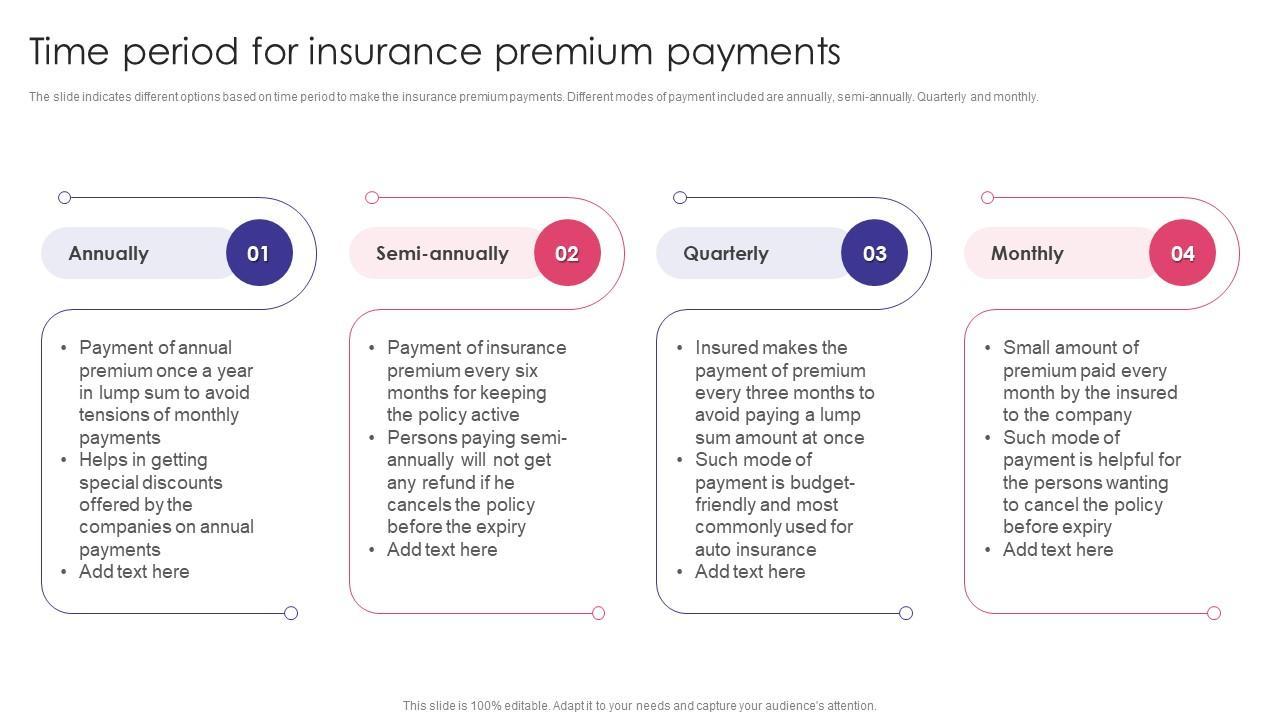

Opting for annual payments instead of monthly installments can significantly lower your insurance expenses. Insurers often provide discounts for customers who choose to pay their premium in one lump sum. This not only helps them manage administrative costs but also ensures they have your commitment for the year. As a result, you enjoy reduced rates and the peace of mind that comes with knowing your coverage is secured for the next 12 months.

- Avoid monthly processing fees that can add up over time.

- Leverage loyalty discounts offered for upfront payments.

- Simplify budgeting by eliminating monthly payment reminders.

- Prevent lapses in coverage due to missed payments.

Consider the annual payment option as an investment in your financial health. With strategic planning, this approach can lead to substantial savings, allowing you to allocate your funds towards other priorities. Remember, every penny saved contributes to a more secure financial future!

Unlock Hidden Discounts with Yearly Insurance Payments

Paying for your insurance policy annually instead of monthly can lead to significant savings. When you opt for a yearly payment plan, many insurance companies offer exclusive discounts that aren’t available with monthly installments. These hidden discounts can lower your overall premium, making it a cost-effective choice for those looking to save on insurance expenses.

Here’s how you can make the most of annual payments:

- Discounted Rates: Insurers often provide reduced rates for annual payments, rewarding your commitment with lower premiums.

- Fee Waivers: Avoid monthly administrative fees that can add up over time by choosing a one-time payment.

- Bonus Incentives: Some companies offer additional perks like loyalty rewards or cashback for clients who pay upfront.

Switching to an annual payment plan not only simplifies your budgeting but also unlocks these valuable discounts, ensuring you get the best deal on your insurance policy.

Strategize Your Payment Plan to Maximize Cost Efficiency

When it comes to cutting down on your insurance expenses, choosing the right payment plan can make a significant difference. Annual payments often come with discounts that monthly payments don’t offer. By opting for this strategy, you not only streamline your payment process but also potentially unlock savings that could be put to better use elsewhere in your budget.

Consider these benefits of annual payments:

- Discount Opportunities: Many insurance companies offer discounts to customers who pay their premium in full at the start of the year.

- Reduced Administrative Fees: Monthly payments can sometimes include additional administrative fees, which are typically waived with a single annual payment.

- Simplified Budgeting: Handling one large payment can simplify your financial planning, allowing you to focus on other financial goals throughout the year.

By making a one-time annual payment, you can eliminate the need to remember multiple due dates, reducing the risk of late fees. Plus, you’ll have peace of mind knowing your insurance is paid up for the entire year, allowing you to concentrate on other important matters.

Expert Tips for Slashing Insurance Costs Through Annual Payments

Switching to an annual payment plan for your insurance can be a savvy move for budget-conscious consumers. By opting to pay your premium once a year, you can often take advantage of discounts that monthly payers miss out on. Here are some expert tips to make the most of this strategy:

- Negotiate for Discounts: Don’t hesitate to ask your insurer for a discount when you choose to pay annually. Many companies offer reduced rates as a reward for upfront payments, so it’s worth inquiring.

- Set Aside Funds: To avoid a financial crunch when the payment is due, consider setting up a dedicated savings account. Regularly deposit a portion of your income, ensuring you have enough to cover the lump sum when it’s time to renew.

- Review Coverage Annually: Use the payment cycle as a reminder to reassess your coverage needs. Adjusting your policy to reflect any changes in your circumstances can prevent overpaying for unnecessary coverage.

By employing these strategies, you can enjoy the dual benefits of lower insurance costs and simplified financial planning. Paying annually not only saves you money but also frees you from the hassle of monthly payments, giving you more peace of mind.

The Conclusion

As we wrap up our journey through the world of annual payments and insurance savings, it’s clear that a little foresight can lead to substantial rewards. By embracing the strategy of paying your insurance premiums annually, you’re not just cutting costs—you’re taking control of your financial future with confidence and savvy. Remember, every dollar saved is a dollar earned, and those savings can add up to something significant over time.

We hope this guide has illuminated the path to smarter financial decisions and empowered you to make choices that align with your goals. So, the next time your insurance bill arrives, consider taking the annual plunge. Your wallet will thank you, and you’ll be one step closer to financial peace of mind. Until next time, keep saving, keep thriving, and keep looking forward to a future filled with possibilities!