In the bustling world of insurance, where policies and premiums swirl around like leaves in the wind, many of us find ourselves standing at the crossroads of coverage choices. It’s a place where practicality meets caution, and the lure of saving a few extra dollars on premiums beckons us to take a leap of faith. But is it wise to skip comprehensive coverage in favor of a lighter wallet? Picture this: you’re driving down a scenic road, the sun is shining, and everything seems perfect—until the unexpected happens. Suddenly, the question of whether to forego comprehensive coverage becomes more than just a financial decision; it’s a tale of risk, reward, and the peace of mind that comes with knowing you’re fully protected. Join us as we explore the intriguing world of insurance choices, where every decision shapes the story of our financial security.

Understanding Comprehensive Coverage: What Are You Really Giving Up

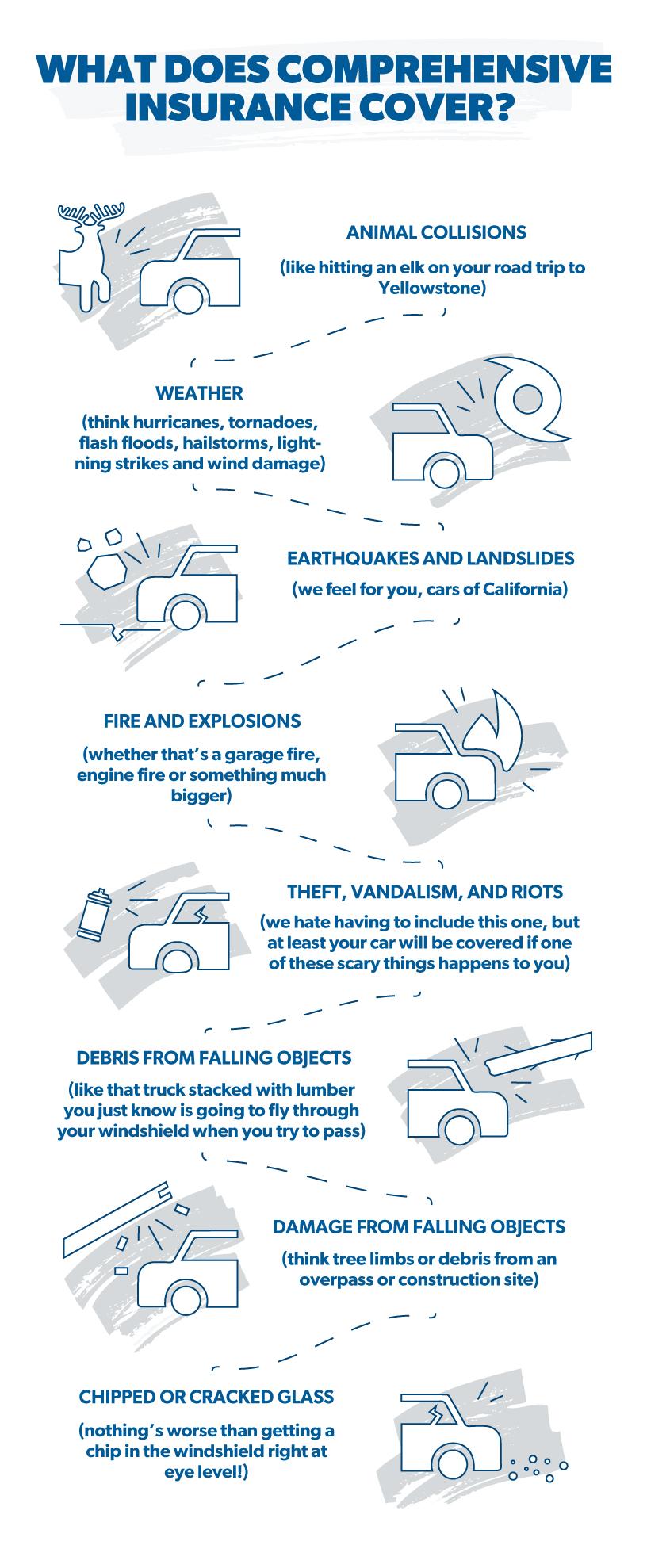

When you opt out of comprehensive coverage, you’re essentially choosing to forego protection against a myriad of non-collision related mishaps. While it might seem like a smart way to cut down on monthly expenses, it’s important to understand the potential risks and consequences. Comprehensive coverage offers a safety net against damages caused by events beyond your control, such as:

- Theft or vandalism

- Natural disasters like hurricanes or earthquakes

- Fire or explosions

- Falling objects, including trees or debris

- Animal collisions

Without this coverage, any of these incidents could result in significant out-of-pocket expenses. Imagine a hailstorm leaving your car with a pockmarked exterior, or a sudden deer crossing your path on a dark road. The cost of repairs or replacement could easily outweigh the savings on your premium. Additionally, if your vehicle is stolen or declared a total loss, you’d be left to cover the full cost of replacement. Understanding what you’re giving up can help you make a more informed decision about whether skipping comprehensive coverage truly aligns with your financial strategy and risk tolerance.

The Hidden Costs of Skipping Comprehensive Coverage

When considering ways to reduce your insurance expenses, opting out of comprehensive coverage might seem like an easy decision. However, what many don’t realize are the hidden costs that can arise from this choice. Without comprehensive coverage, you’re left vulnerable to non-collision incidents such as theft, vandalism, or natural disasters. These are events that can happen unexpectedly and lead to significant out-of-pocket expenses.

Imagine your car being damaged by a hailstorm or a falling tree branch—without the right coverage, these repairs can quickly escalate in cost. Additionally, skipping comprehensive coverage could mean losing out on rental car reimbursements when your vehicle is being repaired, or having to pay for a new windshield after a rogue stone cracks it on the highway. Consider these potential expenses:

- Theft: Replacing a stolen vehicle without insurance can be financially devastating.

- Vandalism: Repairing graffiti or broken windows can be unexpectedly costly.

- Weather Damage: From floods to hail, nature’s unpredictability can lead to expensive repairs.

Ultimately, while the upfront savings might be tempting, the unforeseen expenses of bypassing comprehensive coverage can far outweigh any initial benefits. It’s essential to weigh these potential costs against the savings to make a truly informed decision.

Navigating the Balance: When Skipping Might Make Sense

In the intricate dance of insurance choices, there are moments when skipping comprehensive coverage might actually make sense. This decision isn’t about cutting corners, but rather about understanding your unique situation and aligning your choices accordingly. Consider these scenarios:

- If you drive an older vehicle that has significantly depreciated in value, the cost of comprehensive coverage could outweigh the potential payout in the event of a claim.

- Living in a low-risk area: If your locale has a low incidence of theft, vandalism, or natural disasters, the necessity for comprehensive coverage might diminish.

- Emergency fund: Having a robust emergency fund in place could give you the financial cushion to cover unexpected repairs or replacements, reducing the need for comprehensive insurance.

Each of these factors plays a role in the delicate balance of risk management. It’s about crafting a policy that not only fits your financial landscape but also gives you peace of mind. By evaluating these elements, you can navigate the balance with confidence and make a choice that’s both savvy and secure.

Expert Tips for Making an Informed Decision

When considering whether to forgo comprehensive coverage, it’s essential to weigh the pros and cons thoughtfully. Start by evaluating your specific circumstances and risk tolerance. Ask yourself:

- Do I have enough savings to cover potential repairs or replacement costs?

- Is my vehicle financed, and does my lender require comprehensive coverage?

- How likely is it that I might face non-collision incidents like theft, vandalism, or natural disasters?

Additionally, consulting with a trusted insurance advisor can offer valuable insights. They can help you understand the nuances of different policies and what they mean for your particular situation. Remember, while saving on premiums can be tempting, the peace of mind provided by comprehensive coverage might be worth the extra cost. Always consider the long-term implications over short-term savings.