In the complex landscape of financial planning, life insurance stands as a crucial component, offering protection and peace of mind for individuals and their families. However, not all life insurance policies are created equal, particularly when it comes to flexibility. As consumers navigate the myriad options available, the ability to tailor a policy to meet evolving needs becomes increasingly important. This article delves into the realm of life insurance, focusing on the policies that provide the most adaptable terms. By examining key features such as premium adjustments, coverage alterations, and policy conversion options, we aim to provide a comprehensive analysis that empowers consumers to make informed decisions about their life insurance needs. Through a methodical exploration of the market’s offerings, this piece seeks to illuminate which life insurance policies stand out for their versatility and adaptability in a world where change is the only constant.

Understanding Flexibility in Life Insurance Policies

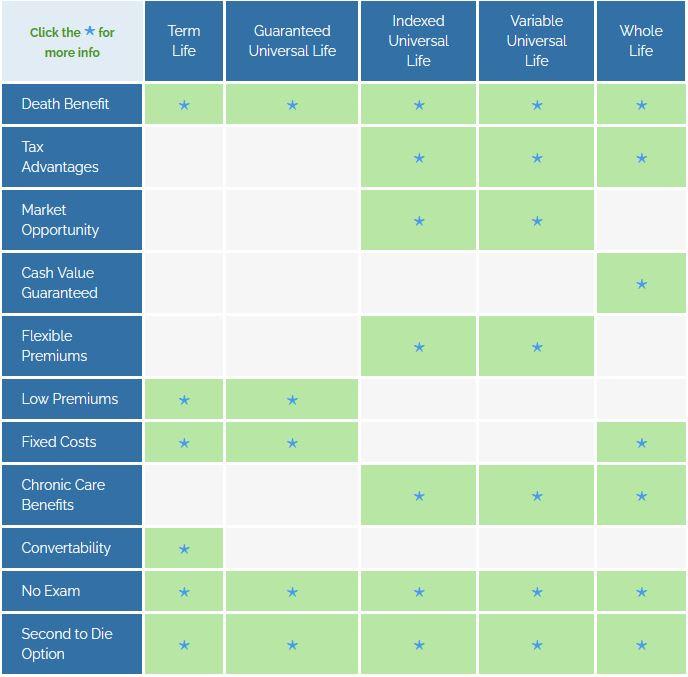

When it comes to life insurance, flexibility can mean the difference between a policy that fits your life perfectly and one that feels restrictive. Universal Life Insurance (ULI) stands out as one of the most adaptable options. This type of policy allows for adjustable premiums and death benefits, giving policyholders the ability to modify their plan in response to changing financial circumstances. Additionally, ULI policies often come with a savings component, where cash value can accumulate over time, offering potential for future loans or withdrawals.

Variable Life Insurance is another option that provides flexibility, particularly for those interested in investment opportunities. With this policy, the cash value can be allocated to a variety of investment options, such as stocks and bonds. The potential for higher returns is balanced by the risk of losing value, but for financially savvy individuals, this can be a compelling choice. Key features of flexible life insurance policies often include:

- Adjustable premium payments

- Variable death benefits

- Investment-linked cash value growth

- Options for policy loans or withdrawals

Understanding these elements can help you select a life insurance policy that not only meets your current needs but also adapts as your life evolves.

Key Features of Flexible Life Insurance Plans

Flexible life insurance plans are designed to adapt to the changing needs of policyholders, offering a range of customizable options that stand out in the insurance market. One of the most significant features is the adjustable premium payments, which allow policyholders to increase or decrease their payments based on their financial situation. This flexibility ensures that the policy remains affordable and sustainable over the long term.

Additionally, these plans often come with modifiable coverage amounts, enabling individuals to adjust their coverage as their life circumstances change, such as getting married, having children, or purchasing a home. Another noteworthy feature is the policy loan option, where policyholders can borrow against the cash value of their policy, providing a source of emergency funds without the need to cancel their coverage. Furthermore, some plans offer convertible term policies, allowing the transition from term to permanent insurance without additional medical exams. These features, collectively, make flexible life insurance plans a versatile choice for those seeking tailored protection.

Comparing Top Providers for Customizable Coverage

In the competitive landscape of life insurance, finding a policy with adaptable terms can be crucial for meeting diverse personal and financial needs. Several top providers have emerged as leaders in offering customizable coverage, allowing policyholders to tailor their plans to better fit their lifestyles and future goals. Among these, Provider A stands out with its wide range of riders, enabling clients to add benefits such as critical illness coverage or waiver of premium options. Meanwhile, Provider B offers a unique approach with its flexible term lengths and the ability to adjust coverage amounts without penalty, providing a dynamic solution for those anticipating life changes.

When evaluating these providers, consider the following features:

- Rider Options: Look for providers that offer a variety of riders to enhance base policies, like accidental death or disability income riders.

- Policy Adjustments: Check if you can alter your coverage amount or term length as your needs evolve, without incurring additional costs.

- Conversion Flexibility: Some policies allow conversion from term to whole life insurance, offering permanent coverage as an option.

Ultimately, the most flexible life insurance policy will align with your long-term plans while providing the adaptability needed to navigate life’s uncertainties.

Expert Recommendations for Tailored Life Insurance Options

When considering life insurance policies with the most adaptable terms, it’s crucial to assess the features that cater to individual needs. Universal life insurance and variable life insurance often stand out due to their inherent flexibility. These policies allow for adjustments in premium payments and death benefits, which can be particularly advantageous for those with fluctuating financial situations. Additionally, the investment component in variable life insurance offers policyholders the potential for growth, though it comes with associated risks.

- Premium Flexibility: Some policies allow you to increase or decrease premium payments based on your financial status.

- Adjustable Death Benefits: You can modify the death benefit amount as your needs change over time.

- Cash Value Component: Certain policies accumulate cash value that can be accessed or borrowed against if necessary.

While these options provide flexibility, it’s essential to weigh them against your long-term goals and risk tolerance. Consulting with a financial advisor can help tailor these policies to better fit your personal circumstances.

The Conclusion

the landscape of life insurance policies is vast and varied, with flexibility being a crucial factor for many policyholders. As we have explored, certain types of life insurance, such as universal life and variable universal life policies, tend to offer more adaptable terms compared to traditional whole or term life insurance. These flexible options can accommodate changes in premium payments, death benefits, and investment components, allowing policyholders to tailor their coverage to better suit their evolving financial needs and life circumstances. However, this flexibility often comes with increased complexity and potential risks that require careful consideration and thorough understanding. Ultimately, the most suitable policy will depend on an individual’s specific financial goals, risk tolerance, and long-term planning needs. It is advisable for potential policyholders to consult with financial advisors or insurance professionals to ensure they select a policy that aligns with their personal and financial objectives. As the insurance market continues to evolve, staying informed about the available options will empower consumers to make decisions that best support their financial security and peace of mind.