In the ever-expanding realm of travel, adventurers are increasingly venturing into remote and challenging destinations, where the thrill of exploration meets the unpredictable nature of the great outdoors. As these journeys grow in complexity and risk, so too does the necessity for comprehensive travel insurance tailored to the unique needs of the intrepid traveler. This article delves into the myriad options available for those seeking coverage that not only protects against the common mishaps of travel but also addresses the specific demands of adventure-related activities. By examining the key features, benefits, and limitations of various travel insurance providers, we aim to identify which company offers the most robust and reliable coverage for adventurers. Through an analytical lens, we will evaluate how well these companies cater to the essential aspects of adventure travel, such as emergency medical support, evacuation services, and coverage for extreme sports, ensuring that thrill-seekers can embark on their journeys with confidence and peace of mind.

Comparative Analysis of Top Travel Insurance Providers for Adventure Enthusiasts

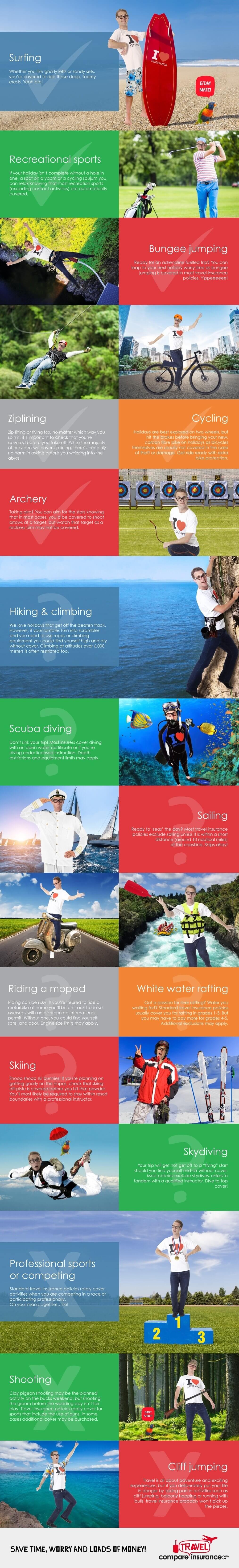

When it comes to securing peace of mind for adventure travel, selecting the right insurance provider can be a daunting task. World Nomads, Allianz Global Assistance, and AXA Assistance USA stand out as prominent contenders, each offering unique benefits tailored to the needs of thrill-seekers. World Nomads is renowned for its extensive coverage options that include activities like scuba diving, bungee jumping, and even rock climbing. Their flexible policy structure allows for coverage extension even while on the road, making it an ideal choice for spontaneous adventurers.

- World Nomads: Offers a wide range of adventure sports coverage, ideal for extreme activities.

- Allianz Global Assistance: Known for comprehensive trip protection and strong customer support, although its adventure sports coverage may be less extensive.

- AXA Assistance USA: Provides solid medical coverage and emergency assistance, with some policies covering a variety of adventure sports.

On the other hand, Allianz Global Assistance provides robust trip protection and medical coverage, though their policies may require additional riders for extreme sports. AXA Assistance USA, with its competitive pricing, offers substantial medical coverage and emergency support, though it may not cover as many extreme sports without customization. Each of these providers brings something distinct to the table, making the choice dependent on the specific activities planned and the level of risk adventurers are willing to undertake.

Evaluating Coverage Options: What Adventurers Should Look for in Travel Insurance

When selecting travel insurance tailored for the daring adventurer, it is crucial to focus on several key aspects that ensure comprehensive protection. Medical coverage is paramount, especially for activities like trekking, scuba diving, or rock climbing, where the risk of injury is higher. Policies should include emergency medical expenses, evacuation, and repatriation. Equally important is the coverage for lost or damaged equipment, which is vital for adventurers who travel with specialized gear.

- Adventure Activity Coverage: Ensure the policy covers a wide range of activities and clearly defines what is included.

- Cancellation and Interruption: Look for policies that offer protection against trip cancellations or interruptions due to unforeseen circumstances.

- 24/7 Assistance Services: Access to round-the-clock support can be invaluable, especially in remote locations.

- Personal Liability: Consider policies that cover damages or injuries you might accidentally cause to others during your travels.

By prioritizing these elements, adventurers can embark on their journeys with peace of mind, knowing they are well-prepared for any eventuality.

Understanding Risk Factors: How Travel Insurance Companies Assess Adventure Activities

Adventure activities, with their inherent thrills and potential hazards, are scrutinized by travel insurance companies through a multifaceted lens. These companies employ a range of criteria to evaluate the risks associated with such activities. Key factors typically include:

- Activity Type: The nature of the adventure, whether it’s skydiving, scuba diving, or mountain climbing, influences risk assessment. Each activity carries unique risks, requiring tailored coverage options.

- Location: Geographic location plays a critical role. Insurers often consider the remoteness of the destination, accessibility to medical facilities, and local safety conditions.

- Participant Experience: The adventurer’s level of expertise and prior experience can impact the perceived risk. Novice participants might face higher premiums compared to seasoned enthusiasts.

- Safety Measures: The presence of safety protocols and certified guides can mitigate risk factors, potentially reducing insurance costs.

By analyzing these elements, insurance companies aim to offer tailored policies that balance comprehensive coverage with cost-effectiveness, ensuring adventurers are well-protected without overpaying.

Expert Recommendations: Best Travel Insurance Plans for Thrill Seekers

For those who crave adventure and seek thrills in their travels, selecting the right travel insurance is paramount. The best insurance plans for adventurers should offer comprehensive coverage tailored to high-risk activities such as skydiving, scuba diving, and mountain climbing. When evaluating options, consider plans that provide extensive medical coverage, emergency evacuation, and trip cancellation due to unforeseen circumstances. Look for companies that have a track record of efficient claims processing and 24/7 assistance to ensure peace of mind wherever your adventures take you.

- World Nomads: Known for their flexible policies that cover a wide range of adventure sports, World Nomads is a popular choice for thrill-seekers.

- Allianz Global Assistance: Offers customizable plans with add-ons for extreme sports, ensuring you’re covered for your specific adventure needs.

- AXA Assistance USA: Provides robust coverage with high limits for medical emergencies and evacuation, making it ideal for those venturing into remote locations.

Final Thoughts

selecting the best travel insurance company for adventurers requires careful consideration of several critical factors. These include the scope of coverage, the range of activities insured, customer service reliability, and the cost of premiums. Each company offers unique advantages tailored to different types of adventure travelers, from those seeking high-altitude trekking coverage to those needing protection for extreme water sports. While some insurers provide comprehensive packages with extensive global networks, others excel in offering customizable plans that cater to specific needs. Ultimately, the best choice depends on individual preferences, the nature of the adventures planned, and personal risk tolerance. By thoroughly evaluating these elements, adventurers can make informed decisions that ensure both safety and peace of mind during their explorations.