In a world where every penny counts, mastering the art of stretching your dollar has never been more essential. Whether it’s ensuring your car, home, or health, the quest for comprehensive coverage at a wallet-friendly price is a journey many embark on, yet few navigate successfully. Welcome to your guide on unlocking the secrets of savvy savings without sacrificing peace of mind. In this article, we’ll unveil the strategies and insider tips to help you get the most coverage for the least amount of money, turning the daunting task of insurance shopping into an empowering experience. So grab a cup of coffee, settle in, and let’s explore how you can protect what matters most without breaking the bank.

Maximizing Your Budget with Smart Coverage Choices

Making smart choices about your coverage is crucial when you’re looking to stretch your budget. One way to ensure you’re not overspending is to evaluate your actual needs versus what’s being offered. Begin by assessing what aspects of coverage are essential for your lifestyle. Do you need comprehensive health insurance, or would a high-deductible plan suffice given your current health status? Similarly, for car insurance, consider if collision coverage is necessary if you’re driving an older vehicle.

- Bundle Your Policies: Many providers offer discounts if you combine different types of insurance, like home and auto, under one umbrella.

- Opt for Higher Deductibles: This can significantly lower your premium costs, though it’s important to ensure you can cover the deductible if needed.

- Take Advantage of Discounts: Look for discounts based on safe driving records, security systems in your home, or even good grades if you’re a student.

- Regularly Review Your Coverage: Life changes such as marriage, having children, or buying a new home can affect your insurance needs. Adjust your policies accordingly to avoid paying for unnecessary coverage.

By prioritizing what’s most important and understanding the options available, you can enjoy peace of mind without breaking the bank.

Unlocking Hidden Discounts and Benefits

In the pursuit of maximizing coverage while minimizing expenses, it’s crucial to explore the often-overlooked discounts and benefits available. Start by reviewing your current policies and subscriptions to identify any potential savings. Many insurance providers offer bundling discounts when you combine multiple policies, such as home and auto insurance. Similarly, loyalty discounts can be a hidden gem for those who have been with the same provider for several years.

- Consider leveraging affiliation discounts through memberships in professional organizations or alumni associations.

- Investigate seasonal promotions that might align with your renewal dates, providing additional savings opportunities.

- Check if you’re eligible for usage-based discounts, which reward low-risk behavior, like safe driving.

Remember, it’s not just about the savings—it’s about making informed decisions. Regularly reviewing and comparing your coverage options ensures that you’re not missing out on any valuable benefits. Always stay proactive and inquisitive, and you’ll be well on your way to unlocking the full potential of your coverage.

Navigating the Fine Print for Extra Savings

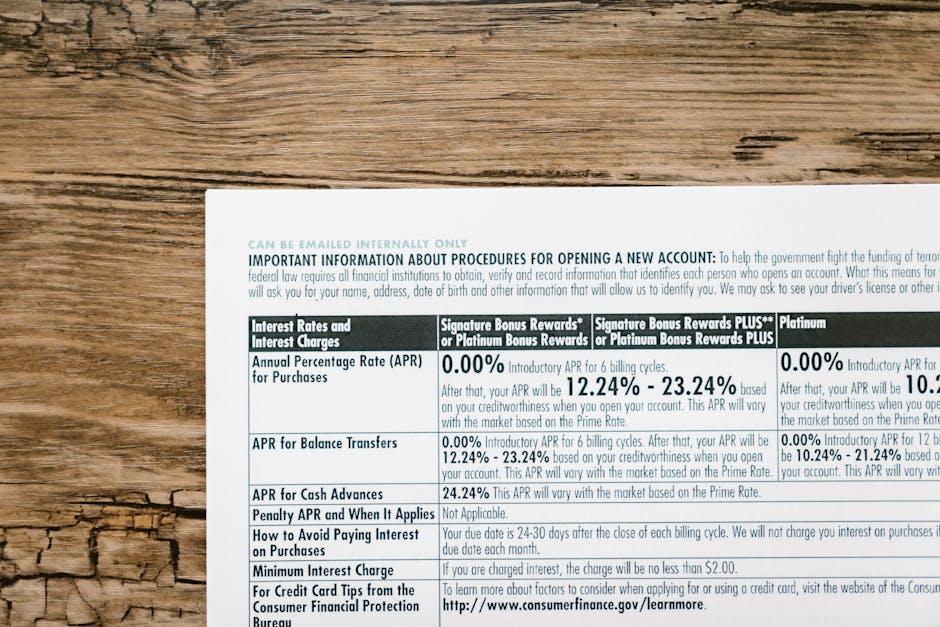

Unlocking extra savings often requires a deep dive into the terms and conditions that many overlook. By taking the time to understand the fine print, you can discover hidden opportunities to maximize your coverage without breaking the bank. Here are some key points to keep in mind:

- Discounts and Bundles: Many providers offer discounts for bundling services or for early payment. Make sure to ask about any promotional offers that may not be advertised.

- Exclusions and Limitations: It’s essential to be aware of what is not covered in your plan. Identifying these gaps can help you decide if additional coverage is necessary or if another plan might offer better value.

- Renewal Terms: Often, the best rates are reserved for new customers. Be proactive in negotiating your renewal terms to ensure you continue to receive competitive pricing.

Understanding these elements can empower you to negotiate more effectively and ensure you’re not leaving money on the table. So grab that magnifying glass and dive into the details—your wallet will thank you!

Expert Tips for Tailoring Affordable Coverage

Finding the perfect balance between cost and coverage doesn’t have to be daunting. Here are some proven strategies to help you tailor your policy without breaking the bank:

- Bundle Your Policies: Combining multiple policies, such as home and auto, can often lead to significant discounts. Many insurers offer incentives for bundling, making it a smart way to save.

- Increase Your Deductible: Opting for a higher deductible can lower your premium significantly. Just ensure you have the funds available to cover it in case of a claim.

- Shop Around Annually: Insurance rates can vary widely between providers. Taking the time to compare quotes each year ensures you’re getting the best deal available.

- Leverage Discounts: From good driver discounts to reduced rates for security features, make sure to ask about any available discounts that you might qualify for.

By implementing these strategies, you can effectively maximize your coverage while minimizing costs, ensuring peace of mind and financial security.

The Way Forward

In the ever-evolving dance of dollars and sense, mastering the art of maximizing coverage without breaking the bank is akin to discovering a hidden treasure map. As you venture forth with these newfound strategies in your toolkit, remember that every savvy decision you make is a step toward financial empowerment. Whether it’s stretching your insurance dollars further or cleverly navigating the world of benefits, you’re now equipped to turn the tide in your favor. So, go forth and conquer your coverage conundrums with confidence and flair, knowing that your wallet and peace of mind are in perfect harmony. Here’s to a future where you get the most bang for your buck, and perhaps, even a little extra to spare for life’s other adventures. Cheers to smart spending and even smarter saving!