As the golden years approach, the horizon often gleams with the promise of leisure and reflection, yet beneath the tranquil surface lies the quiet, uncharted territory of future care needs. In this landscape, where health can be as unpredictable as the weather, long-term care insurance emerges as a steadfast ally for aging adults. This vital safeguard is not just a policy, but a commitment to dignity, independence, and peace of mind. It transforms the daunting unpredictability of tomorrow into a well-charted journey, ensuring that life’s latter chapters are not defined by uncertainty, but enriched by choice and security. As we delve into the importance of long-term care insurance, envision a future where your loved ones are empowered, your legacy is preserved, and your story unfolds on your own terms.

Securing Peace of Mind Understanding the Vital Role of Long Term Care Insurance

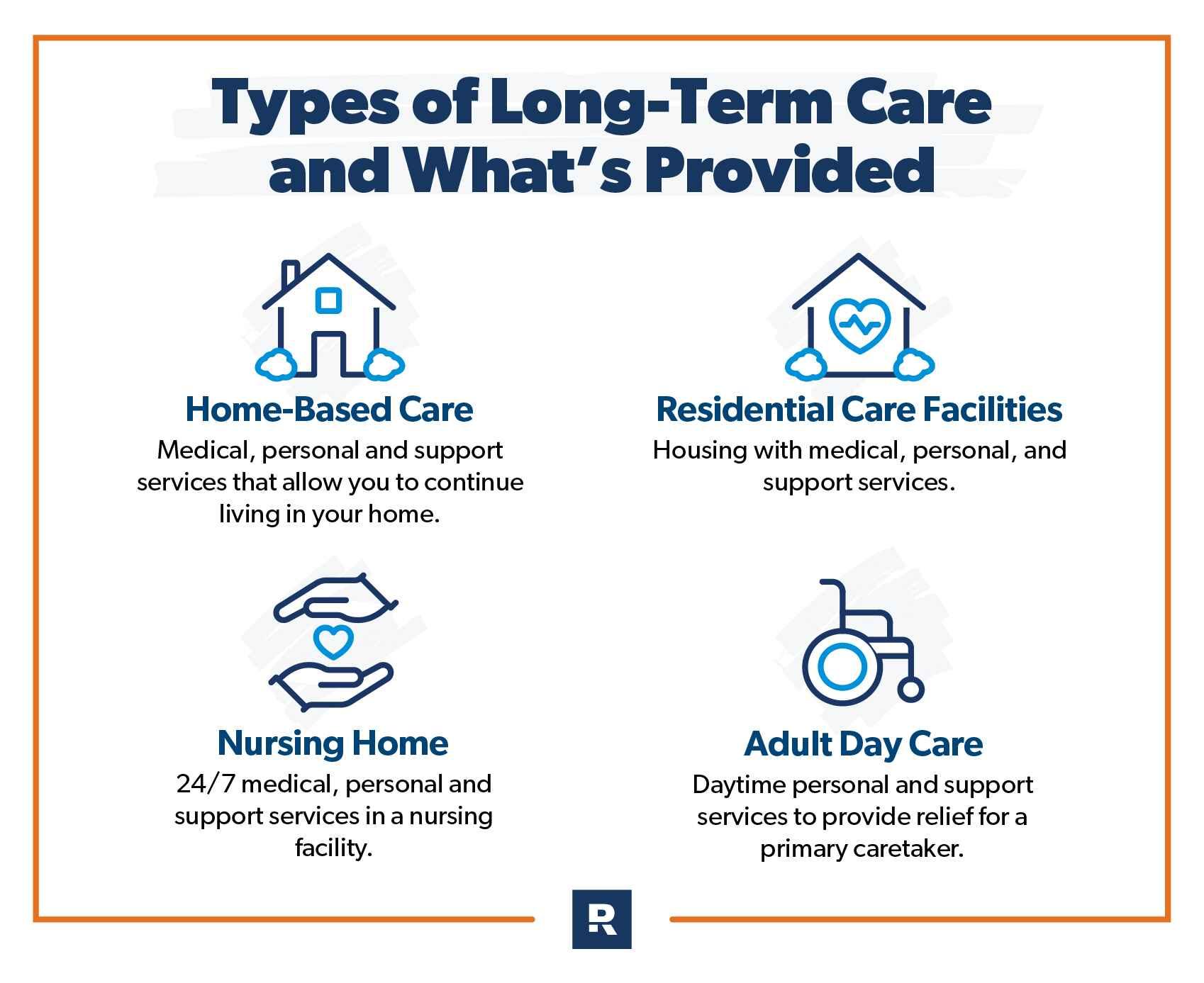

As we gracefully age, preparing for the unforeseen becomes an essential part of our journey. One of the key elements in this preparation is embracing long term care insurance. This invaluable tool is not just about securing financial stability; it’s about ensuring a future where quality care is accessible when it’s needed most. For aging adults, this type of insurance provides a safety net that covers a wide array of services, which can include:

- Assisted living facilities

- In-home health care

- Nursing home care

- Adult daycare services

By investing in long term care insurance, families can avoid the emotional and financial strain that often accompanies unexpected health challenges. It offers peace of mind, knowing that the resources will be available to maintain dignity and independence, no matter what life throws your way. This proactive approach not only benefits the individual but also alleviates the potential burden on loved ones, allowing them to focus on what truly matters—cherishing time together.

Safeguarding Financial Stability How Insurance Protects Your Assets in Later Years

As we age, the unpredictability of future healthcare needs becomes a pressing concern. Long-term care insurance emerges as a vital shield, ensuring that your hard-earned assets are protected against the rising costs of care in later years. With this coverage, you can focus on enjoying your golden years without the looming anxiety of financial instability. Here’s how it safeguards your wealth:

- Protection from High Costs: Covers expenses that can deplete savings, such as nursing home stays, assisted living, or in-home care.

- Asset Preservation: Ensures your estate remains intact for heirs, preventing the need to liquidate assets to pay for care.

- Flexibility and Choice: Provides you with the autonomy to choose the type of care you prefer, whether in the comfort of your home or at a specialized facility.

- Peace of Mind: Offers a safety net that alleviates the stress on both you and your family, knowing that financial resources are secured.

By incorporating long-term care insurance into your financial planning, you’re not just investing in a policy—you’re investing in peace of mind and a stable future.

Tailored Coverage Exploring Options to Meet Individual Needs and Preferences

When considering long-term care insurance, it’s crucial to recognize the diverse needs and preferences of aging adults. Tailoring coverage means examining the different facets of care that individuals may require and ensuring that their specific situations are addressed. Options such as in-home care, assisted living, or skilled nursing facilities can be included in policies, offering a personalized approach to coverage. This flexibility allows policyholders to feel confident that they will receive the care they prefer, in the setting they choose, without compromising on quality or comfort.

- In-home care: Offers the comfort of familiar surroundings while receiving professional assistance.

- Assisted living: Provides a balance of independence and support in a community setting.

- Skilled nursing facilities: Delivers comprehensive care for those with more intensive health needs.

By exploring these tailored options, individuals can find a plan that aligns with their lifestyle, financial situation, and personal values, ensuring peace of mind for both themselves and their loved ones.

Planning for the Future Strategic Steps to Ensure Comprehensive Long Term Care

As we look ahead to the golden years, crafting a robust strategy for long-term care becomes imperative. Aging adults face a myriad of challenges, from escalating healthcare costs to the potential need for specialized medical attention. Strategic planning in this context is not just about securing financial stability; it’s about ensuring peace of mind and dignity in later years. To achieve this, consider implementing the following strategic steps:

- Evaluate Current and Future Needs: Understanding potential healthcare needs and associated costs can help in tailoring an insurance plan that offers comprehensive coverage.

- Research and Compare Policies: Delve into various insurance providers, comparing benefits, premiums, and the range of services covered to find the best fit.

- Consult with Financial Advisors: Engaging professionals who specialize in eldercare can provide invaluable insights into crafting a personalized care strategy.

- Incorporate Family in Decision Making: Including family members in the planning process ensures alignment on care preferences and potential support roles.

By adopting a proactive approach, aging adults can effectively mitigate the uncertainties of the future, ensuring that their twilight years are not just a time of retrospection but also a period of continued fulfillment and security.