Life insurance is often perceived as a financial safety net for loved ones in the event of an untimely death. However, its role extends beyond providing basic financial support to beneficiaries. One of the lesser-known yet crucial functions of life insurance is its ability to safeguard one of your most significant assets: your home. As homeowners navigate the complexities of mortgage commitments, life insurance emerges as a strategic tool to ensure that their property remains secure, even under unforeseen circumstances. This article explores the intersection of life insurance and mortgage protection, elucidating how life insurance policies can prevent financial strain and potential foreclosure, thereby offering peace of mind and stability to homeowners and their families. Through a detailed examination of the mechanisms and benefits of life insurance in relation to mortgage protection, we aim to provide readers with a comprehensive understanding of how this financial instrument can serve as a vital component of a robust homeownership strategy.

Understanding the Basics of Mortgage Protection Insurance

Mortgage protection insurance is a specialized form of life insurance designed to pay off your mortgage in the event of your untimely death. Unlike traditional life insurance, which can be used for a variety of expenses, this type of policy specifically targets your outstanding mortgage balance, ensuring that your family can stay in their home without financial strain. Understanding its core features can help you decide if it’s the right choice for your financial planning.

- Coverage Specificity: This insurance focuses solely on covering the remaining mortgage debt.

- Term-based Policies: Typically, these policies align with the length of your mortgage term.

- Decreasing Benefit: As you pay down your mortgage, the payout amount decreases over time.

Choosing mortgage protection insurance can provide peace of mind, knowing that your loved ones will not face the threat of losing their home. By examining the terms and benefits, you can make an informed decision that aligns with your long-term financial goals.

The Role of Life Insurance in Safeguarding Your Home Investment

In the unpredictable journey of life, having a plan to secure your home investment is crucial. Life insurance plays a pivotal role in ensuring that your mortgage is covered in the event of unforeseen circumstances. By having a policy in place, you create a financial safety net that protects your loved ones from the burden of mortgage debt. This means that, in the unfortunate event of your passing, the insurance payout can be used to pay off the outstanding balance on your mortgage, safeguarding your home from potential foreclosure.

Consider the following benefits of integrating life insurance into your financial strategy:

- Peace of Mind: Knowing that your family will not face the stress of losing their home provides invaluable comfort.

- Financial Stability: Life insurance ensures that your family retains ownership of the home, preserving their living standards and emotional well-being.

- Flexibility: Policies can be tailored to meet the specific needs of your mortgage and family situation, offering personalized protection.

- Legacy Preservation: It enables you to leave a lasting legacy, ensuring that your investment in the home benefits future generations.

By incorporating life insurance into your mortgage protection plan, you not only secure your home but also provide a solid foundation for your family’s future.

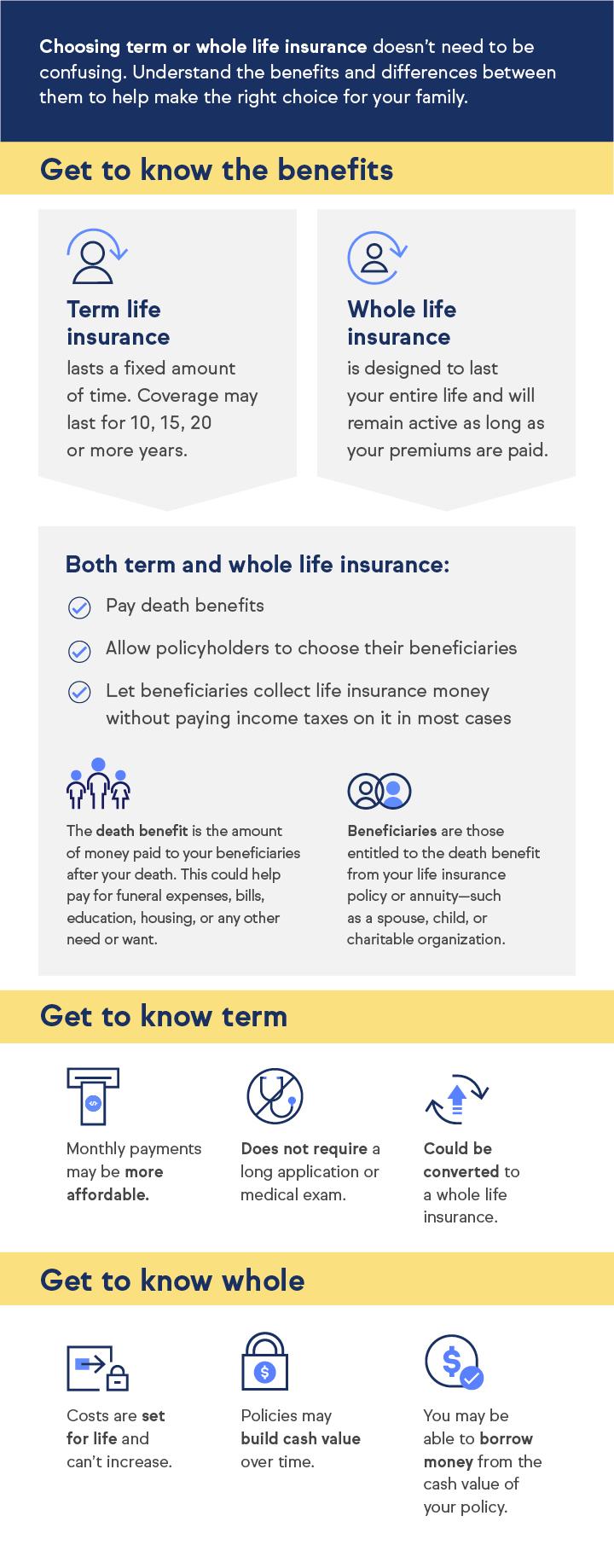

Comparing Life Insurance Policies for Mortgage Coverage

When evaluating life insurance options to safeguard your mortgage, it’s essential to consider the various policy types available. Term life insurance is a popular choice for many homeowners, offering coverage for a specific period—typically aligning with the duration of your mortgage. This type of policy provides a straightforward death benefit without any cash value, making it a cost-effective option for those seeking to ensure their mortgage is paid off in the event of their passing. On the other hand, whole life insurance offers lifelong coverage with the added benefit of a cash value component, which can be accessed or borrowed against, though it generally comes with higher premiums.

To make an informed decision, consider the following factors:

- Duration of Coverage: Align the policy term with your mortgage period.

- Cost: Evaluate premium affordability over the long term.

- Flexibility: Determine if you need options like converting term policies to permanent ones.

- Cash Value Component: Decide if you need a policy with savings or investment features.

By carefully weighing these elements, homeowners can select a life insurance policy that best suits their financial goals and provides peace of mind for their loved ones.

Key Considerations When Choosing a Life Insurance Policy for Mortgage Protection

When it comes to safeguarding your home and ensuring financial stability, selecting the right life insurance policy for mortgage protection is crucial. Understanding your coverage needs is the first step. Evaluate the outstanding balance on your mortgage and consider any additional debts or financial responsibilities that might arise in the future. It’s important to choose a policy that aligns with your specific financial situation and long-term goals.

- Policy Type: Decide between a term life insurance policy, which typically offers lower premiums for a set period, and a whole life insurance policy, which provides lifelong coverage with an investment component.

- Premium Affordability: Assess your budget to ensure that the premiums are manageable over the life of the policy without compromising your current financial stability.

- Flexibility and Features: Look for policies that offer flexibility, such as conversion options or riders that can be tailored to your needs, providing additional benefits like critical illness coverage.

Additionally, consider the reputation and reliability of the insurance provider. Research their claim settlement ratio and customer service reviews to ensure they have a history of honoring claims and providing support when needed. By carefully weighing these factors, you can select a life insurance policy that effectively protects your mortgage and secures your home for the future.