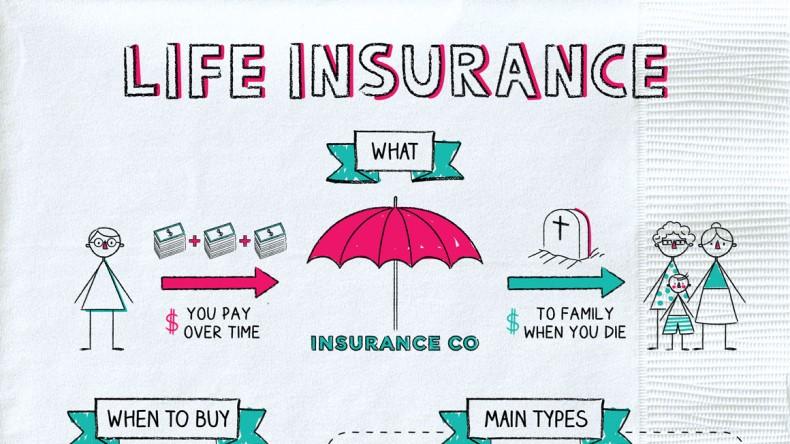

As individuals navigate the complex landscape of financial planning, the pursuit of an early retirement often emerges as a compelling goal. While traditional strategies such as savings accounts, investments, and retirement funds are commonly considered, life insurance is frequently overlooked as a potential tool in achieving this aspiration. This article seeks to explore the role that life insurance can play in facilitating an early retirement, examining the various types of policies available, their benefits, and the strategic ways they can be integrated into a comprehensive retirement plan. By understanding the nuances of life insurance and its potential advantages, individuals can make informed decisions that align with their financial objectives and retirement aspirations.

Understanding the Role of Life Insurance in Retirement Planning

Life insurance can be an invaluable tool in retirement planning, offering more than just a safety net for beneficiaries. It can serve as a strategic asset that enhances financial security and provides flexibility. One of the primary benefits is the cash value component found in permanent life insurance policies, such as whole life or universal life insurance. This cash value accumulates over time, often on a tax-deferred basis, allowing policyholders to borrow against it or even withdraw funds to supplement retirement income. This feature can be particularly beneficial for those looking to retire early, as it offers a liquid asset that can be accessed without the penalties typically associated with early retirement account withdrawals.

Additionally, life insurance can help manage risks associated with outliving your savings. It can provide a steady income stream for surviving spouses, ensuring that the household’s financial needs are met even if one partner passes away prematurely. Moreover, some policies come with riders that offer long-term care benefits, which can be crucial in covering unexpected healthcare costs during retirement. These advantages make life insurance a versatile component of a comprehensive retirement plan, offering peace of mind and financial flexibility.

Evaluating Different Types of Life Insurance Policies for Early Retirement

Choosing the right life insurance policy can be a pivotal decision when planning for early retirement. Different types of life insurance policies offer varied benefits, each catering to unique financial goals and risk appetites. Term life insurance provides coverage for a specified period and is often the most affordable option, making it ideal for those looking to secure their family’s financial future while accumulating savings for early retirement. However, it lacks a cash value component, meaning once the term expires, the policyholder has no residual benefits.

On the other hand, whole life insurance and universal life insurance policies include an investment component, potentially allowing policyholders to build a cash reserve over time. These policies can be more expensive but offer the advantage of cash value accumulation, which can be accessed or borrowed against to supplement retirement savings. Some key factors to consider when evaluating these policies include:

- Premium costs and affordability

- Cash value growth potential

- Flexibility in premium payments and death benefits

- Potential tax advantages

By understanding these elements, individuals can align their life insurance choices with their early retirement goals, ensuring both protection and financial growth.

Strategies for Integrating Life Insurance into Your Retirement Portfolio

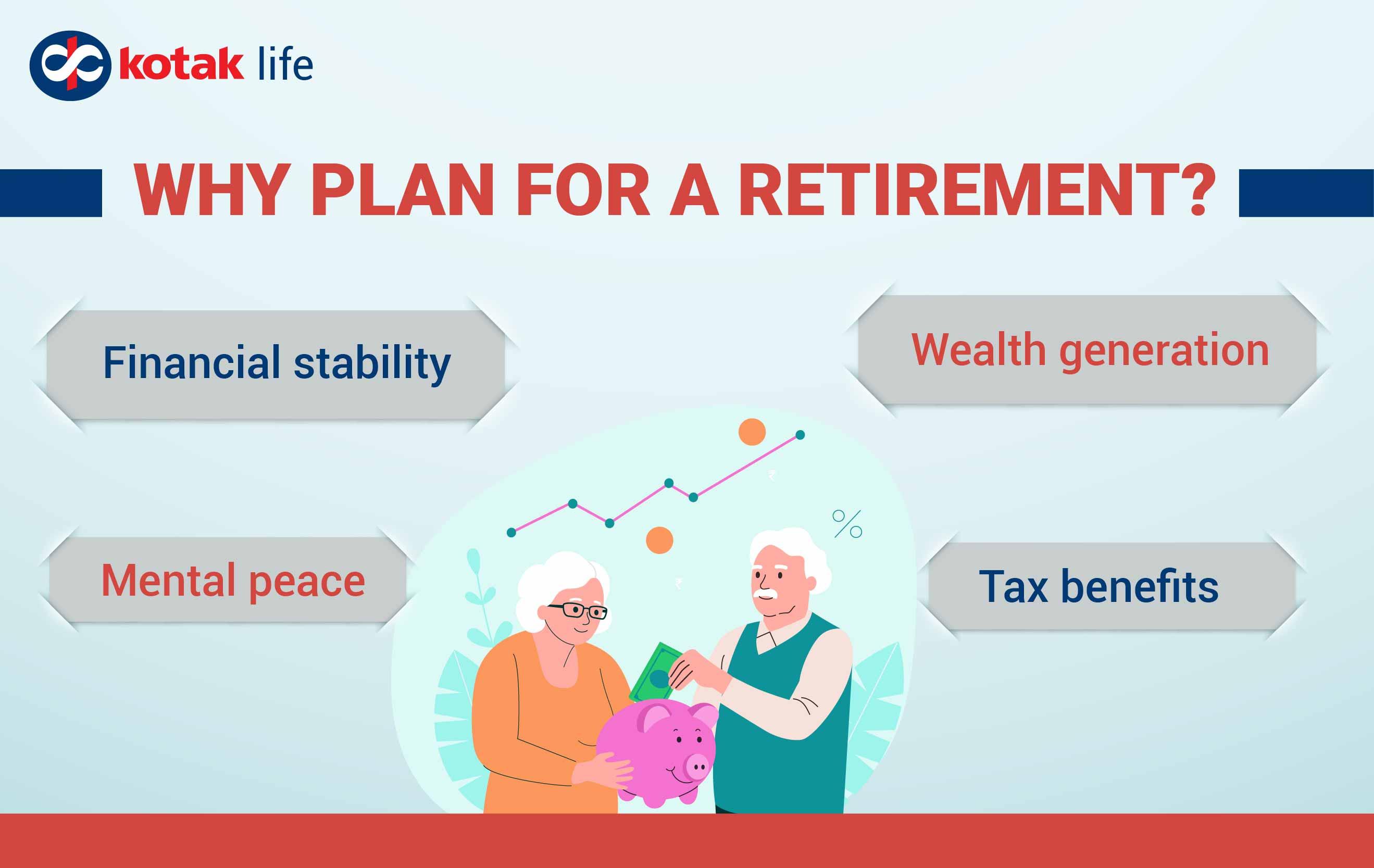

Life insurance can be a versatile component of your retirement strategy, offering more than just a death benefit. One effective approach is to utilize a permanent life insurance policy with a cash value component. This allows policyholders to accumulate savings over time, which can be accessed through loans or withdrawals. Such cash value growth is often tax-deferred, providing a financial cushion that can be strategically tapped into during retirement. This flexibility can be particularly beneficial in managing tax liabilities and bridging income gaps.

Moreover, life insurance can serve as a legacy planning tool. While traditional retirement accounts like 401(k)s and IRAs focus on accumulating wealth for personal use, life insurance can ensure that your beneficiaries receive a substantial financial benefit. This can be particularly useful if your retirement strategy includes leaving an inheritance or supporting dependents financially. By integrating life insurance into your retirement portfolio, you can diversify your financial plan with an eye towards both immediate needs and long-term legacy goals.

- Consider policies with cash value growth potential.

- Utilize policy loans for tax-efficient income.

- Plan for legacy benefits to support heirs.

Potential Pitfalls and Considerations When Using Life Insurance for Early Retirement

While utilizing life insurance as a strategy for early retirement might seem appealing, there are several crucial considerations and potential pitfalls to keep in mind. Cash value life insurance policies, such as whole or universal life, can accumulate savings over time. However, these policies often come with high fees and expenses, which can erode the cash value growth. Additionally, the investment returns within these policies might not be as robust as other investment vehicles, limiting your retirement savings potential.

It’s also essential to consider the impact of withdrawals on the policy’s death benefit. Taking out loans or withdrawals from your policy can reduce the payout your beneficiaries receive, potentially affecting your long-term financial plans. Moreover, if the policy lapses due to insufficient funds after withdrawals, you might face significant tax consequences. Lastly, life insurance policies require ongoing premium payments, which can become a burden if your financial situation changes unexpectedly. Always evaluate the potential risks and consult with a financial advisor to ensure this strategy aligns with your overall retirement goals.