In today’s fast-paced world, where travel has become an integral part of both personal and professional lives, ensuring adequate protection against unforeseen circumstances is paramount. Travel insurance serves as a safety net, offering financial security and peace of mind during your journeys. However, with a plethora of providers flooding the market, selecting the right travel insurance can be a daunting task. This article aims to dissect the complex landscape of travel insurance providers, offering a structured approach to evaluating and choosing the one that aligns best with your unique needs. By examining key factors such as coverage options, pricing, customer service, and claim processes, we aim to equip you with the knowledge needed to make an informed decision. Whether you are a frequent flyer or an occasional vacationer, understanding how to choose the right travel insurance provider is essential to safeguarding your travel experiences.

Evaluating Coverage Options and Policy Terms

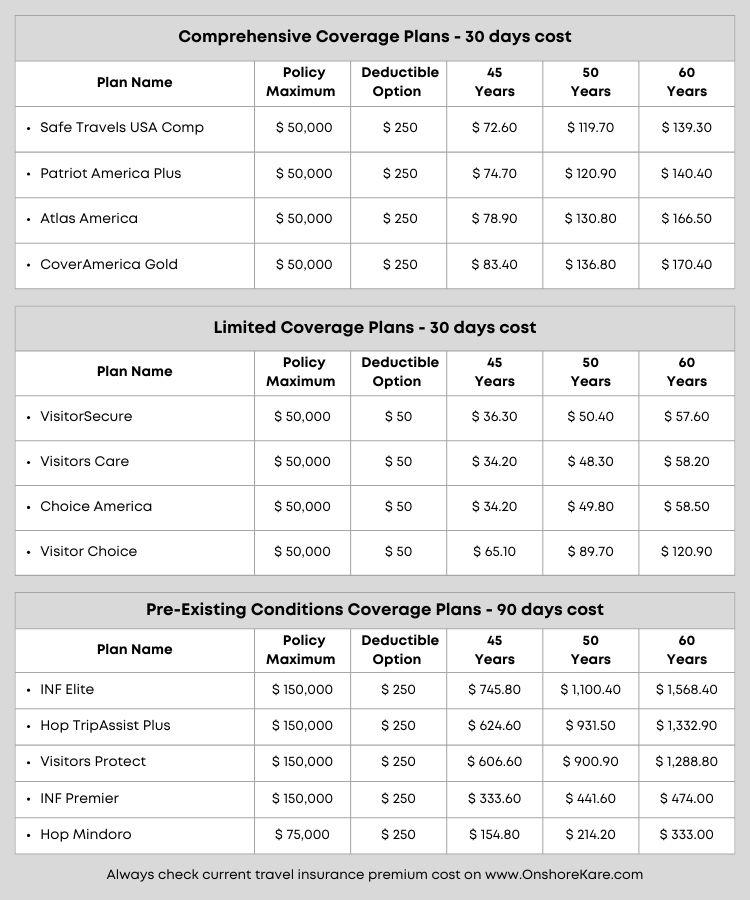

When selecting a travel insurance provider, it’s crucial to thoroughly assess both the coverage options and the policy terms to ensure they align with your specific travel needs. Begin by identifying the essential components of coverage, such as medical emergencies, trip cancellations, lost luggage, and emergency evacuations. Each travel plan offers varying levels of protection, so it’s important to compare these components across different providers. Consider whether the policy includes coverage for pre-existing conditions, as this can significantly impact your decision if you have ongoing health concerns.

- Medical emergencies: Does the policy cover hospital stays, doctor visits, and prescription medications?

- Trip cancellations: Are you reimbursed for non-refundable expenses if you need to cancel for covered reasons?

- Lost luggage: What compensation is available for lost, stolen, or damaged personal belongings?

- Emergency evacuations: Are there provisions for transportation in the event of a natural disaster or political unrest?

Next, scrutinize the policy terms, such as deductibles, exclusions, and the claims process. Look for any hidden exclusions that might nullify your coverage under certain conditions, such as engaging in high-risk activities or traveling to specific regions. Understanding the claims process is also vital; some insurers may have more streamlined procedures than others, affecting how quickly and efficiently you receive assistance. By evaluating these aspects, you can make a more informed decision that ensures peace of mind during your travels.

Understanding Costs and Exclusions

When evaluating travel insurance providers, a critical step is to delve into the costs and exclusions associated with each policy. Understanding the premium you will pay is essential, but it’s equally important to comprehend what your policy covers and what it doesn’t. Look for detailed information about coverage limits, deductibles, and any potential additional fees. This insight will allow you to weigh the cost against the benefits, ensuring that you get the best value for your money.

Exclusions can significantly impact your coverage, so it’s crucial to identify any situations or events that your insurance won’t cover. Common exclusions might include:

- Pre-existing medical conditions

- Adventure sports and activities

- Travel to high-risk destinations

- Acts of terrorism or natural disasters

By understanding these exclusions, you can avoid unexpected surprises during your travels. It’s advisable to compare different providers and policies to ensure that the plan you choose aligns with your travel habits and potential risks.

Assessing Provider Reputation and Customer Service

When evaluating a travel insurance provider, understanding their reputation and the quality of their customer service is crucial. A well-regarded provider typically offers reliable coverage and responds effectively in times of need. To gauge reputation, consider the following:

- Online Reviews: Browse forums, social media, and review sites for feedback from past customers.

- Industry Ratings: Check ratings from recognized bodies like the Better Business Bureau or insurance industry watchdogs.

- Years in Business: Longevity can be a sign of stability and trustworthiness.

Equally important is the provider’s customer service. A provider should offer:

- 24/7 Support: Ensure they provide round-the-clock assistance, especially for emergencies.

- Clear Communication: Look for transparent policies and readily available information.

- Responsive Service: Test their responsiveness by contacting their support with queries before purchasing.

Balancing these factors can help you select a provider that not only meets your coverage needs but also supports you effectively throughout your travels.

Utilizing Comparison Tools and Expert Reviews

When searching for the perfect travel insurance provider, leveraging comparison tools and expert reviews can significantly streamline the decision-making process. These resources allow you to efficiently evaluate various options based on key factors such as coverage limits, exclusions, and premium costs. Comparison tools often provide side-by-side analyses, enabling you to identify discrepancies and advantages among providers. This can be particularly useful for pinpointing those insurers who offer customizable plans that align with your unique travel needs.

In addition to comparison tools, turning to expert reviews can provide deeper insights into the customer service quality, claim processing efficiency, and overall reliability of insurance providers. Look for reviews that focus on:

- Customer satisfaction: How do past customers rate their experiences?

- Claim handling: Are claims processed smoothly and fairly?

- Financial stability: Is the provider financially sound and capable of covering claims?

By combining these resources, you can form a comprehensive view that aids in selecting a travel insurance provider that not only meets your financial and coverage needs but also delivers peace of mind during your travels.