In the complex world of insurance, one question frequently arises: Can insurance companies be trusted to pay fair market value for damaged property? This query touches on a critical aspect of financial security and consumer trust, impacting millions of policyholders who rely on these companies to uphold their end of the bargain in times of need. As natural disasters, accidents, and unforeseen events continue to disrupt lives, the assurance that an insurance provider will offer a fair and just compensation becomes paramount. This article delves into the mechanisms by which insurance companies assess property value, examines the factors influencing their payout decisions, and evaluates the checks and balances in place to ensure equitable treatment for policyholders. By dissecting industry practices and regulatory frameworks, we aim to equip you with the knowledge to navigate insurance claims effectively, and to understand whether trust in these entities is well-placed or if skepticism is warranted.

Understanding Fair Market Value in Property Insurance

When it comes to property insurance, understanding the nuances of fair market value (FMV) is crucial for policyholders. Fair market value refers to the price a property would sell for on the open market, assuming a willing buyer and seller. Insurance companies often assess FMV by considering various factors, such as:

- Current market conditions

- Location and desirability of the property

- Age and condition of the property

- Comparable sales in the area

While insurers strive to provide accurate valuations, discrepancies can arise. It is essential for policyholders to be proactive by gathering their own evidence of value and understanding their policy terms. This includes knowing the difference between FMV and replacement cost, as some policies cover the latter, potentially resulting in higher payouts. By being informed and prepared, policyholders can ensure they receive a fair settlement that truly reflects their property’s worth.

Evaluating Insurance Company Practices in Claims Settlement

When assessing the conduct of insurance companies in settling claims, it is crucial to scrutinize several key practices to ensure they align with the promise of providing fair market value for damaged property. Transparency in the claims process is paramount; policyholders should have clear insights into how valuations are determined. Many insurers use sophisticated algorithms and third-party assessments, which must be communicated clearly to avoid any misunderstanding. Communication plays a vital role here—policyholders should be informed at every stage of the process, from initial assessment to final settlement offer.

Policyholders should be aware of the following considerations to protect their interests:

- Documentation: Ensure all property values and damages are thoroughly documented with photos, receipts, and appraisals.

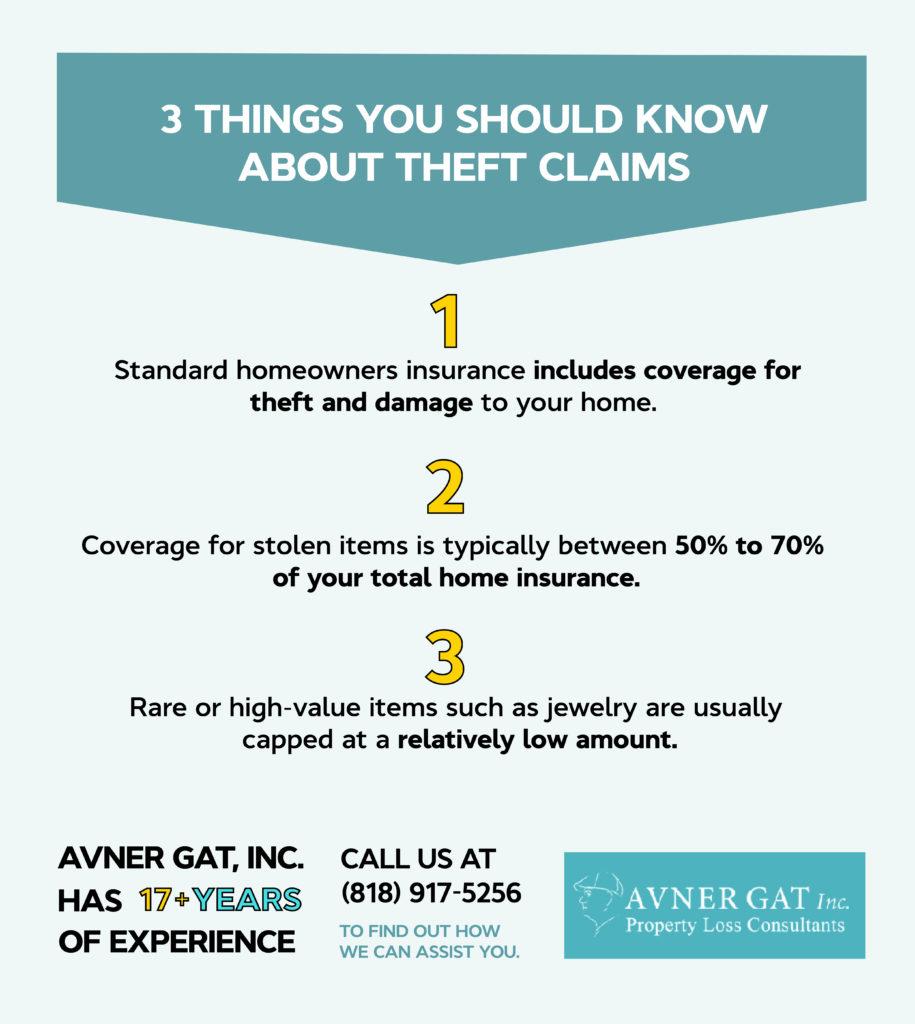

- Understand Your Policy: Familiarize yourself with the specifics of your coverage, including any exclusions or limits that may affect your claim.

- Seek Professional Help: Consider hiring an independent appraiser or public adjuster to provide a second opinion on your claim’s value.

By keeping these factors in mind, policyholders can better navigate the claims settlement process and advocate for a fair valuation of their property.

Strategies for Ensuring Fair Compensation for Damaged Property

When dealing with insurance claims, it’s crucial to adopt a proactive approach to secure fair compensation for your damaged property. Start by meticulously documenting the damage with photographs and detailed descriptions immediately after the incident. This will serve as solid evidence when negotiating with the insurance company. Furthermore, obtaining multiple repair estimates from reputable contractors can help you establish a baseline for the necessary compensation. Never settle for the first offer from your insurer without conducting your own research on the property’s current market value and the costs involved in restoring it to its original state.

Engage with a professional public adjuster or legal advisor who can advocate on your behalf if negotiations stall. These experts have the experience and knowledge to navigate complex insurance policies and ensure that your rights are upheld. Additionally, familiarize yourself with the terms of your policy to understand what is covered and what is not, which can prevent unexpected denials. Remember to keep detailed records of all communications with your insurer, including emails and phone calls, to build a robust case for your claim. Key strategies include:

- Documenting damage thoroughly

- Securing multiple repair estimates

- Consulting with professionals for guidance

- Understanding your policy in depth

- Maintaining detailed communication logs

Implementing these strategies can significantly enhance your chances of receiving a fair settlement that truly reflects the market value of your damaged property.

Expert Recommendations for Navigating Property Insurance Claims

When navigating the often-complex world of property insurance claims, leveraging expert insights can significantly enhance your outcomes. Experienced adjusters and legal professionals recommend the following strategies to ensure you receive fair market value for your damaged property:

- Document Everything: Keep meticulous records of all communications with the insurance company, including emails, phone calls, and written correspondence. Detailed documentation of the property condition before and after the damage is crucial.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your insurance policy. Knowing the specific coverage and exclusions can help you effectively argue your case.

- Engage Professional Help: Consider hiring a public adjuster or legal advisor who specializes in property claims to negotiate on your behalf. Their expertise can be invaluable in securing a fair settlement.

- Get Multiple Estimates: Obtain quotes from several reputable contractors to establish a clear market value for the repairs or replacement. This can serve as solid evidence during negotiations.

By following these expert recommendations, policyholders can better position themselves to receive the compensation they rightfully deserve, rather than relying solely on the insurance company’s initial offer.