In today’s complex financial landscape, choosing the right life insurance policy can be a daunting task, especially when considering the potential for whole life insurance as an investment”>return on investment (ROI). While life insurance is primarily designed to provide financial protection to beneficiaries, many modern policies also offer investment components that can enhance the policyholder’s wealth over time. This dual function has made such policies increasingly popular among individuals seeking both security and financial growth. This article delves into the intricacies of life insurance policies that offer the best ROI options, providing a comprehensive analysis of their features, benefits, and potential drawbacks. By examining various policy structures and investment strategies, we aim to equip readers with the knowledge necessary to make informed decisions tailored to their financial goals and risk tolerance.

Evaluating Life Insurance Policies for Optimal Investment Returns

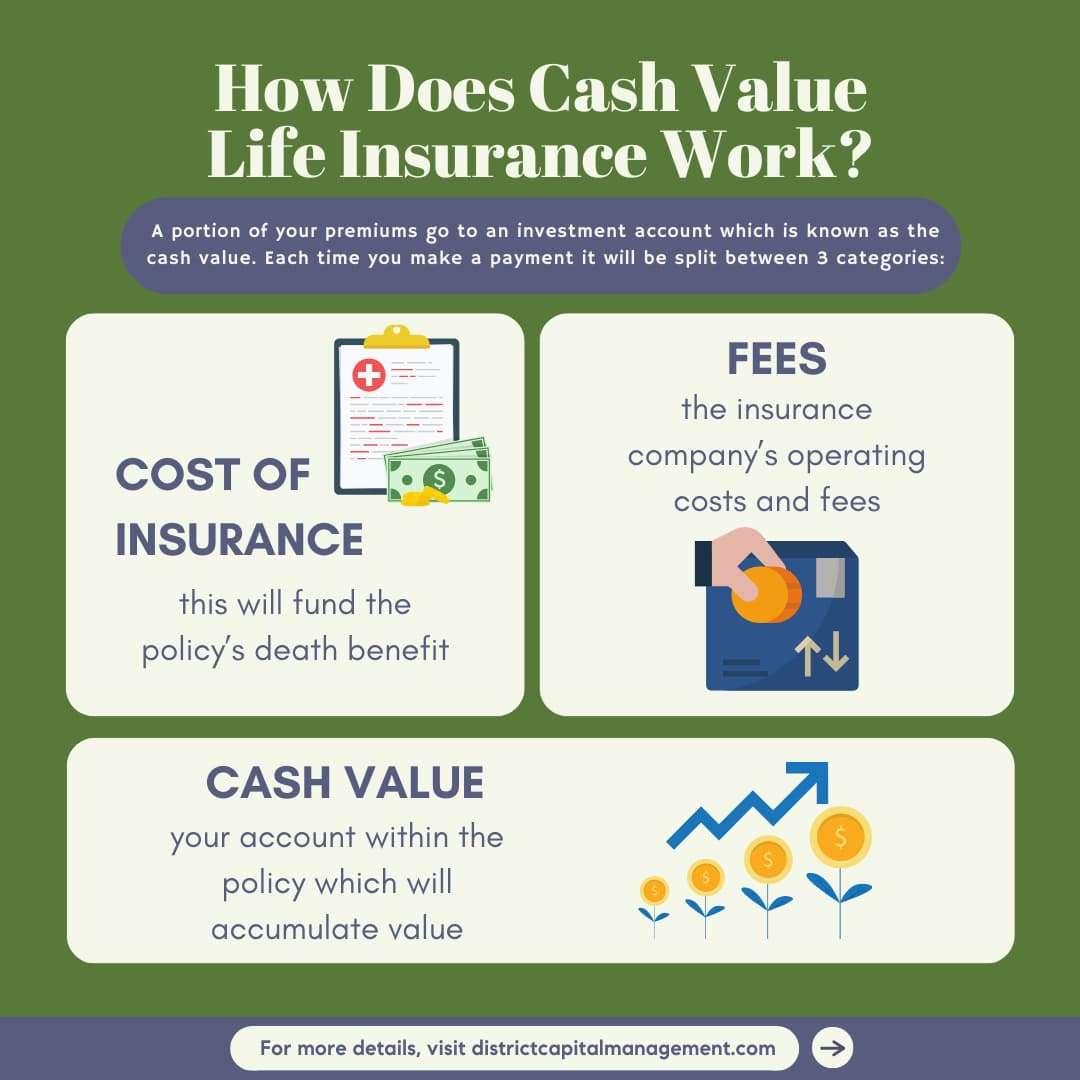

When assessing life insurance policies for their investment potential, several factors come into play that can significantly impact the return on investment. Policy type is a crucial consideration, as different types offer varying levels of risk and reward. For instance, whole life insurance policies often include a savings component, providing a steady cash value accumulation. On the other hand, universal life insurance policies offer more flexibility, allowing policyholders to adjust premiums and death benefits, which can lead to higher returns if managed wisely.

Another key factor is the investment options embedded within the policy. Look for policies that provide a diverse range of investment opportunities, such as:

- Equity investments, which can offer higher returns but come with greater risk.

- Fixed income investments, which typically provide more stable returns.

- Index-linked options, allowing your investment to track market indices for potentially balanced growth.

It’s essential to evaluate the performance history of these options and consider any associated fees, as these can erode returns over time. Analyzing these aspects thoroughly can help you identify life insurance policies that align with your investment goals while balancing risk and return.

Key Features of High-Performing Life Insurance Investment Options

When evaluating life insurance policies with superior investment returns, several critical features stand out. First and foremost, flexibility in premium payments and investment choices allows policyholders to tailor their strategies to align with financial goals and risk tolerance. This adaptability can be crucial for optimizing returns over time. Additionally, policies that offer a wide array of investment options, such as equities, bonds, and mutual funds, provide a diversified portfolio that can mitigate risks while maximizing potential growth.

- Guaranteed Minimum Returns: Look for policies that offer a safety net through guaranteed minimum returns, ensuring some level of return even in volatile markets.

- Transparency: High-performing policies maintain clear and transparent communication regarding fees, investment performance, and policy adjustments.

- Tax Efficiency: Policies that offer tax-deferred growth or tax-free withdrawals can enhance overall returns by reducing the tax burden on investment gains.

- Rider Options: Additional features like critical illness or waiver of premium riders can provide extra security without significantly impacting investment returns.

By focusing on these key features, policyholders can better navigate the complex landscape of life insurance investments and make informed decisions that align with their long-term financial objectives.

Comparative Analysis of Leading Life Insurance Return Potentials

When evaluating the return potentials of various life insurance policies, it’s essential to focus on the balance between risk and reward. The most lucrative options often come with investment components, allowing policyholders to accumulate wealth over time. Here are some standout choices:

- Variable Life Insurance (VLI): This policy offers investment flexibility, with returns linked to the performance of selected sub-accounts, similar to mutual funds. While it provides higher growth potential, it also carries market risk.

- Indexed Universal Life (IUL): IUL policies credit interest based on a stock market index’s performance, offering a blend of security and growth. They often include caps and floors, ensuring some level of protection against market downturns.

- Participating Whole Life Insurance: These policies distribute dividends to policyholders, which can be reinvested to increase the policy’s cash value or used to reduce premiums. The return potential largely depends on the insurer’s performance and profit-sharing policy.

Each of these options presents unique opportunities and challenges. Potential investors should consider their financial goals, risk tolerance, and the specific features of each policy type to make an informed decision.

Expert Recommendations for Maximizing Life Insurance Investment Gains

Investing in life insurance policies can be a strategic way to secure financial growth alongside protection. To ensure you’re maximizing your returns, consider following expert insights into policy selection and management. Diversification within your life insurance portfolio can significantly enhance your investment gains. Opt for policies that offer a mix of fixed, indexed, and variable returns, as this combination can balance risk while capitalizing on market opportunities. Additionally, keep an eye on interest rate trends; adjusting your investment strategy in response to these can optimize your returns over time.

- Policy Flexibility: Choose plans that allow for changes in premium payments or investment allocations without penalties. This adaptability can be crucial during economic fluctuations.

- Tax Advantages: Leverage the tax-deferred growth benefits of certain policies. This can be a significant factor in increasing your overall return.

- Professional Guidance: Regular consultations with a financial advisor can provide personalized strategies that align with your financial goals and risk tolerance.