In a world where the unexpected lurks around every corner, insurance is our trusty shield, offering peace of mind and protection from life’s curveballs. But as comforting as it is, that monthly premium can sometimes feel like a formidable foe, stealthily nibbling away at our hard-earned cash. Fear not, for there is a way to tame this financial beast without sacrificing the safety net it provides. Welcome to the world of savvy savings, where small, thoughtful changes can lead to significant reductions in your insurance costs. Join us on this journey as we explore practical tips and clever strategies to lighten the load on your wallet, all while keeping your coverage robust and reliable. It’s time to turn the tables and let your insurance work for you—saving money has never felt so rewarding!

Boost Your Savings with Smart Policy Tweaks

Discovering ways to lower your insurance expenses doesn’t have to be a daunting task. With a few clever adjustments, you can find yourself saving more each month. Start by evaluating your coverage needs—it’s easy to overlook what you really require. Are you paying for extras that you don’t need? If your car is older, for example, you might consider dropping comprehensive coverage. You could also raise your deductible slightly, which can reduce your premium significantly.

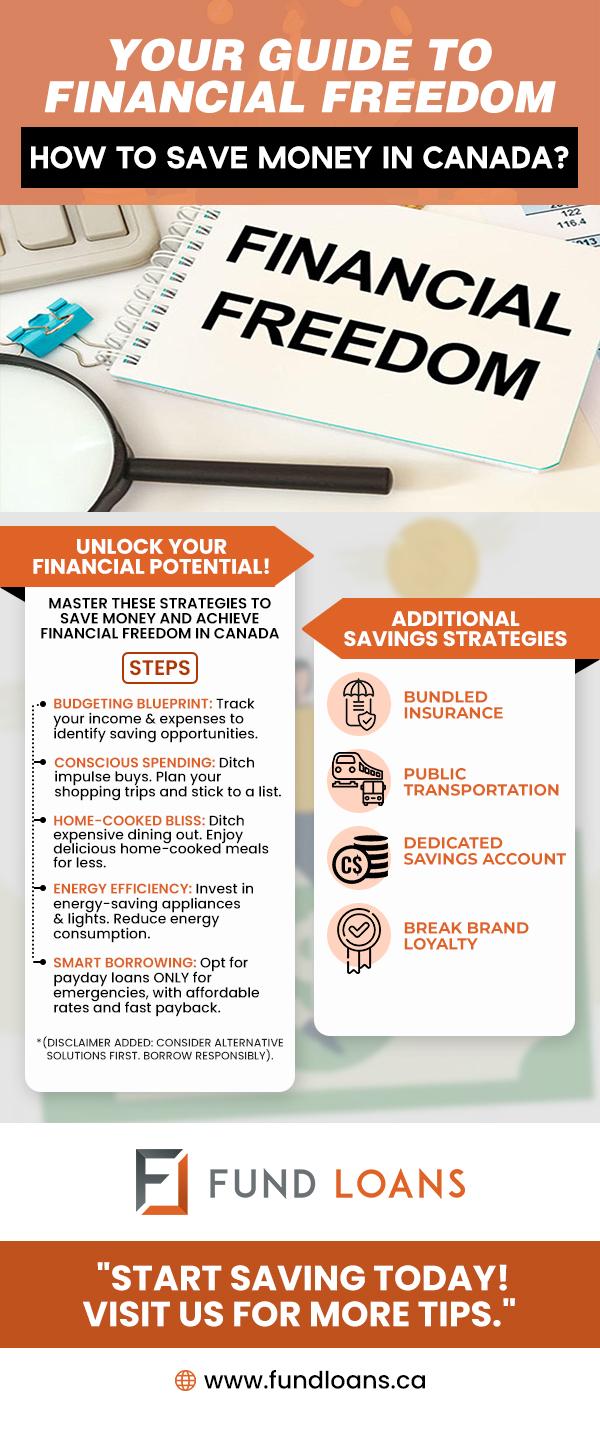

- Bundle your policies: Combining home and auto insurance can lead to substantial discounts.

- Pay annually: If you can swing it, paying your premium annually rather than monthly often leads to savings.

- Ask about discounts: Insurance companies offer various discounts—safe driver, good student, or even loyalty discounts. It’s worth asking about these.

- Review and update regularly: As your life changes, so should your insurance policy. Regular reviews ensure you’re not over-insured or underinsured.

By incorporating these smart tweaks into your insurance strategy, you can enjoy more financial freedom without compromising on coverage.

Uncover Hidden Discounts and Perks

Exploring the intricacies of your insurance policy can often reveal a treasure trove of discounts and perks that are easily overlooked. Many insurance companies offer a variety of incentives for seemingly minor adjustments or actions. For instance, bundling multiple policies such as home and auto insurance can lead to significant savings. Additionally, installing safety features in your car or home, like anti-theft devices or smoke detectors, may qualify you for reduced premiums.

- Consider raising your deductible to lower your monthly payments.

- Check if your insurer offers discounts for paperless billing or automatic payments.

- Maintain a good credit score to potentially access better rates.

- Ask about loyalty discounts if you’ve been with your insurer for several years.

Engage with your insurance agent to review your policy regularly. They can guide you through the available options and help you tailor your coverage to maximize savings while ensuring you have the protection you need. Remember, a little investigation can go a long way in reducing your insurance expenses.

Optimize Your Deductibles for Maximum Benefit

When it comes to slashing your insurance costs, tweaking your deductibles can be a game-changer. By strategically adjusting your deductibles, you could enjoy lower monthly premiums without compromising your coverage. Here are some savvy tips to help you make the most of your deductibles:

- Assess Your Risk Tolerance: Are you comfortable with a higher out-of-pocket expense in case of a claim? If so, opting for a higher deductible can significantly reduce your premiums. This approach is ideal if you have a solid emergency fund to cover unexpected costs.

- Review Your Policy Regularly: Life changes, and so should your insurance policy. Reevaluate your deductibles annually to ensure they align with your current financial situation and risk exposure. A little tweak here and there could lead to substantial savings.

- Bundle Policies for Discounts: Many insurers offer discounts when you bundle multiple policies. Consider combining your auto and home insurance under one provider to take advantage of lower deductibles and premiums.

By fine-tuning your deductibles, you can create a personalized insurance plan that fits your budget and lifestyle, keeping your coverage robust while your costs remain manageable.

Harness the Power of Bundling for Bigger Savings

Unlock a world of savings by combining multiple insurance policies under one provider. This strategic move can lead to significant discounts, as insurers often reward customers who choose to consolidate their policies. Think of it as a loyalty bonus for your commitment. Bundling can include pairing your home and auto insurance or adding additional coverage like life or renters insurance. By doing so, you not only streamline your bills but also enhance your bargaining power for better rates.

- Convenience: Manage all your policies in one place, making it easier to track payments and renewals.

- Discounts: Enjoy reduced premiums that come with bundling, which can lead to substantial yearly savings.

- Enhanced Coverage Options: Some insurers offer exclusive benefits or add-ons to bundled policyholders.

Remember, the key is to review your policies periodically and communicate with your insurer about any potential bundling benefits. This small change can be a game-changer for your budget, offering peace of mind and financial flexibility.