Picture this: you’re sipping your morning coffee, scrolling through your endless to-do list, when suddenly your eyes land on the line item that always seems to loom larger than life—your insurance premium. Like clockwork, it appears month after month, unyielding and unwavering. But what if there was a way to bring it down to size, to tame that towering figure? Enter the art of negotiation. Yes, you read that right—negotiation! Contrary to popular belief, insurance premiums aren’t set in stone, and with a little charm, strategy, and know-how, you might just be able to sweet-talk your way to a lower rate. In this article, we’ll explore the ins and outs of negotiating with your insurance provider, offering you the tools and tips to transform your financial landscape. So, grab another cup of coffee, settle in, and let’s embark on this money-saving adventure together!

Unlocking the Art of Negotiation: Lower Your Insurance Premiums

Imagine being able to save money each month without having to sacrifice the quality of your insurance coverage. It’s not just a fantasy; it’s a reality you can achieve by honing your negotiation skills. To start, it’s crucial to research thoroughly. Know the average premium rates in your area, and understand the specifics of your policy. Armed with this knowledge, you can confidently approach your provider and discuss your options. Ask for discounts or special promotions that might be available to loyal customers or those who bundle policies.

Another key strategy is to highlight your loyalty and low-risk status. If you’ve been with your insurer for several years, or if you have a clean claims history, these are strong points in your favor. Providers value customers who pose less risk and may be willing to lower premiums as a result. Consider asking about these possibilities:

- Multi-policy discounts

- Safe driver discounts

- Reduced rates for home security features

- Discounts for paying annually instead of monthly

Remember, the art of negotiation isn’t just about asking for lower rates; it’s about presenting your case in a way that highlights mutual benefits. With the right approach, you can transform your insurance discussions into rewarding experiences.

Secrets to Success: Building Rapport with Your Insurance Provider

Unlocking the key to better insurance rates often lies in the subtle art of rapport-building with your provider. Establishing a friendly and professional relationship can open doors to more personalized service and potential savings. Consider these effective strategies to enhance your connection:

- Open Communication: Keep an open line of communication with your provider. Regularly update them about any changes in your life that could affect your policy, such as buying a new car or moving to a safer neighborhood.

- Show Loyalty: If you’ve been a long-time customer, don’t hesitate to mention it. Providers often value loyalty and may be more willing to offer discounts to retain you as a customer.

- Be Informed: Research your policy and the market. Knowing what you’re paying for and what competitors offer can give you leverage in negotiations.

Building a rapport isn’t just about small talk; it’s about creating a mutual understanding and trust that can lead to beneficial adjustments in your premiums. Embrace this approach, and you might find that negotiating with your insurance provider becomes a less daunting task and more of a collaborative conversation.

Smart Strategies: Timing Your Negotiation for Maximum Impact

Mastering the art of negotiation with your insurance provider is akin to crafting the perfect soufflé — timing is everything. Knowing when to initiate a discussion can significantly tip the scales in your favor. Annual policy renewal periods are prime opportunities to renegotiate your premiums. During this time, providers are keen on customer retention and might be more amenable to offering discounts or adjustments. Similarly, reaching out at the end of a fiscal quarter might yield positive results, as companies often aim to hit sales targets and could be more flexible.

Additionally, personal life changes can be a catalyst for renegotiation. Have you recently quit smoking or installed a home security system? Such changes can positively impact your risk profile, providing leverage to lower your premiums. Also, consider the current market conditions. If competitors are offering better rates, use this as a bargaining chip to negotiate a more favorable deal with your existing provider. Remember, the key to successful negotiation lies not just in what you ask, but when you ask it.

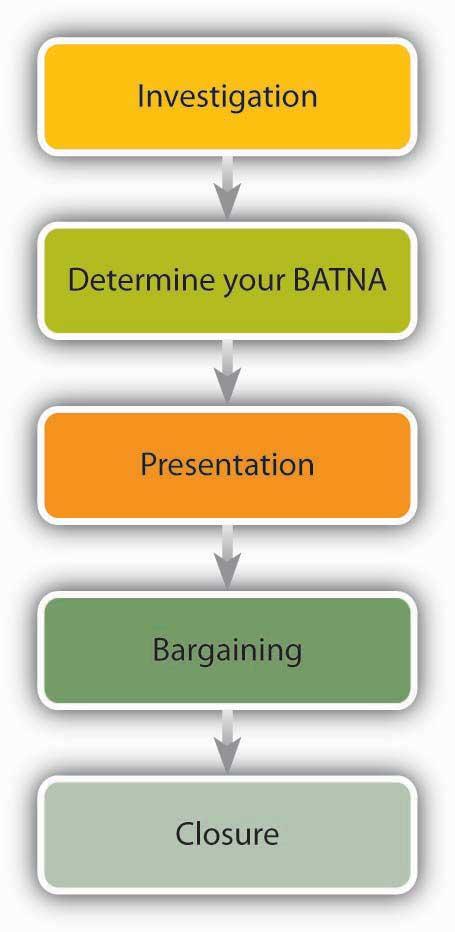

From Research to Results: Mastering the Negotiation Process

When it comes to negotiating insurance premiums, a little research can go a long way in helping you achieve better results. Start by gathering information about your current policy and comparing it with similar options from other providers. This will give you a solid foundation to discuss potential adjustments with your insurer. Consider these steps to strengthen your negotiation position:

- Understand Your Policy: Know the ins and outs of your current insurance plan. This knowledge empowers you to ask the right questions and propose feasible adjustments.

- Highlight Your Loyalty: If you’ve been a long-term customer, emphasize your loyalty. Insurers often value customer retention and may offer discounts or perks to keep you on board.

- Leverage Competitive Quotes: Having quotes from competitors can provide leverage. Present these quotes to your current provider and see if they can match or beat them.

- Discuss Bundling Options: Ask about bundling different types of insurance, such as home and auto, for additional savings.

Remember, the goal is to have a constructive conversation with your provider. Approach the negotiation with a positive attitude and be open to compromise. With the right strategy, you might just find yourself paying less for the coverage you need.