Flood damage can be an overwhelming and distressing experience, leaving homeowners grappling with the aftermath of rising waters and the uncertainty of restoration. Filing an insurance claim in such circumstances is a crucial step toward recovery, yet it is a process fraught with complexity and potential pitfalls. Understanding the intricacies of your insurance policy, the documentation required, and the strategic approach to communication with your insurer can significantly impact the outcome of your claim. This article serves as an authoritative guide to navigating the flood damage claim process, providing you with essential insights and actionable advice to ensure that you are well-prepared and well-informed. Whether you’re dealing with the immediate aftermath of a flood or preparing for potential future incidents, these guidelines will empower you to advocate effectively for your rights and secure the compensation necessary to rebuild and recover.

Understanding Your Policy Coverage and Limitations

When dealing with the aftermath of a flood, understanding the nuances of your insurance policy can be a game-changer. It’s essential to be aware of what your policy covers and what it doesn’t. Flood insurance policies typically cover direct physical loss caused by a flood, which may include structural damage to your home, electrical and plumbing systems, and appliances. However, there are often limitations and exclusions you need to be mindful of. Most policies do not cover damage to landscaping, currency, precious metals, or improvements made by tenants.

- Structural Coverage: Includes the building and its foundation, electrical and plumbing systems, and central air systems.

- Personal Property Coverage: May cover clothing, furniture, and electronics but often excludes items stored in basements.

- Policy Limitations: Be aware of maximum limits on claims, which might not cover the full extent of damage.

- Exclusions: Generally, external property like fences, pools, and landscaping are not covered.

It’s crucial to review your policy documents thoroughly and consult with your insurance provider to clarify any ambiguities. Knowing the extent of your coverage will not only help in managing expectations but also in streamlining the claim process.

Documenting Flood Damage Effectively for Claims

When it comes to filing an insurance claim for flood damage, thorough documentation is crucial. Start by taking detailed photographs of all affected areas, including structural damage, furniture, and personal belongings. Capture multiple angles and close-ups to ensure clarity. Create a comprehensive inventory of damaged items, noting details such as make, model, and estimated value. If possible, locate original receipts or purchase records to support your claim. Additionally, keep a record of any repair estimates or cleanup costs incurred.

- Photograph all damage extensively.

- Document each item with descriptions and values.

- Retain receipts and estimates for repairs.

- Record conversations with your insurer.

Maintain a log of all communications with your insurance company, including the date, time, and names of representatives spoken to. This will help track the progress of your claim and provide a reference if any disputes arise. By meticulously documenting every aspect of the flood damage and related expenses, you significantly enhance the likelihood of a smooth and successful insurance claim process.

Navigating the Claims Process with Your Insurer

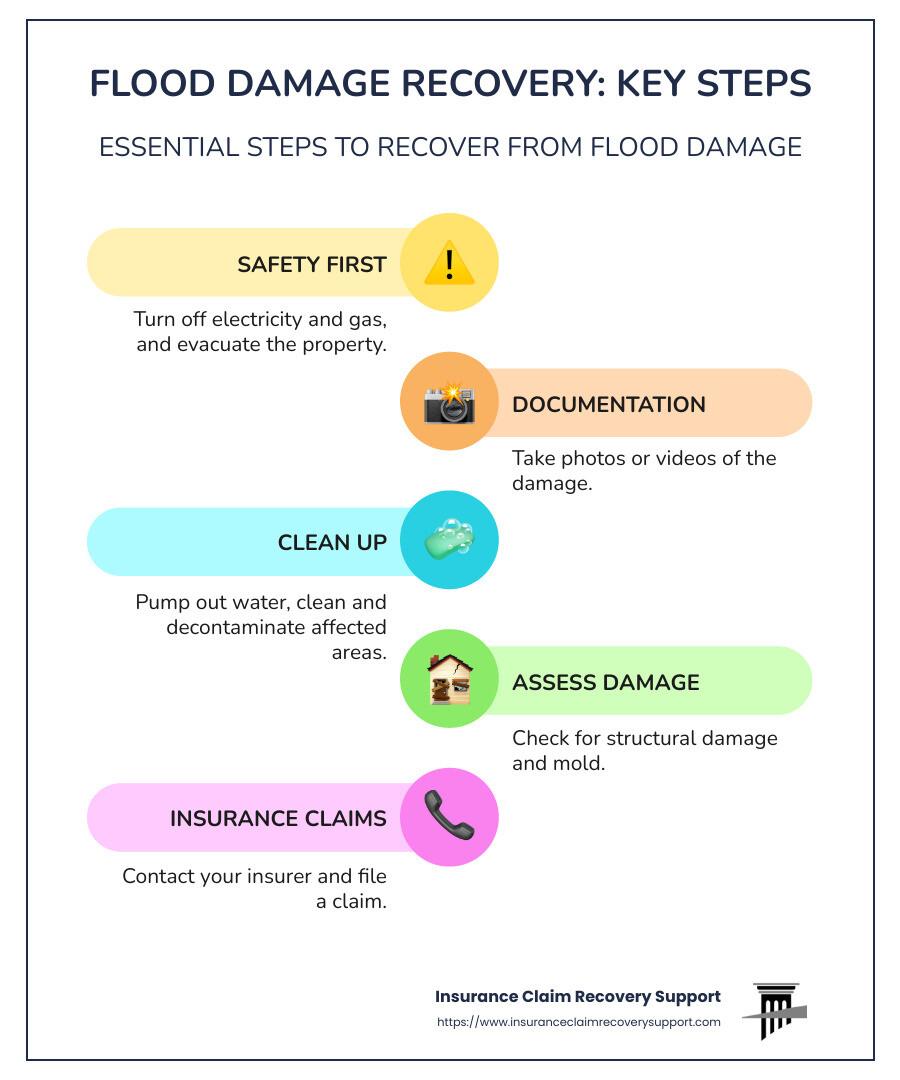

When facing flood damage, the first step is to meticulously document the damage. Capture clear, comprehensive photos and videos of the affected areas, focusing on structural damage, furniture, and personal belongings. This visual evidence is crucial for your claim. Ensure you include timestamps and, if possible, geotags for added credibility. Additionally, make a list of all damaged items, noting their purchase dates and approximate values. This inventory will serve as a vital reference during discussions with your insurer.

Once you’ve documented the damage, promptly review your insurance policy to understand what is covered under your flood damage provisions. Key elements to examine include:

- Deductibles: Know how much you are responsible for paying out of pocket before your coverage kicks in.

- Exclusions: Be aware of any exclusions that may affect your claim, such as specific types of water damage not covered.

- Coverage limits: Determine the maximum amount your policy will pay for flood-related damages.

Contact your insurance company immediately to initiate the claims process. Be prepared to provide your documentation and any additional information they may require. It’s essential to keep a detailed log of all communications with your insurer, noting the dates, times, and nature of each interaction. This record will be invaluable if disputes arise.

Essential Tips for Communicating with Insurance Adjusters

Communicating effectively with insurance adjusters is crucial to ensure a fair assessment of your flood damage claim. Here are some key tips to guide you through the process:

- Be Prepared: Gather all necessary documentation before your conversation. This includes photographs of the damage, a detailed inventory of affected items, and any receipts or estimates for repairs.

- Stay Organized: Keep a log of all interactions with your adjuster, including dates, times, and summaries of discussions. This record will be invaluable if disputes arise.

- Be Clear and Concise: When explaining the damage, be specific about what occurred and the extent of the impact. Avoid unnecessary details that might confuse the situation.

- Ask Questions: If you don’t understand something the adjuster says, ask for clarification. Knowing the terms of your policy and the claims process is essential for advocating effectively for your needs.

- Remain Professional: Emotions can run high after experiencing flood damage, but it’s important to maintain a calm and respectful demeanor during all communications.