When it comes to life insurance, individuals often find themselves navigating a maze of options and decisions. One common dilemma is whether to convert a term life insurance policy to a whole life policy. This decision can have significant implications for one’s financial planning and long-term security. Term life insurance, known for its affordability and simplicity, provides coverage for a specific period, making it an attractive choice for those seeking temporary protection. In contrast, whole life insurance offers lifelong coverage coupled with a cash value component, appealing to those interested in building a financial asset over time. This article explores the key factors to consider when deciding whether to convert term life insurance to whole life, weighing the benefits and drawbacks of each option to help you make an informed choice that aligns with your financial goals and needs.

Understanding the Differences Between Term and Whole Life Insurance

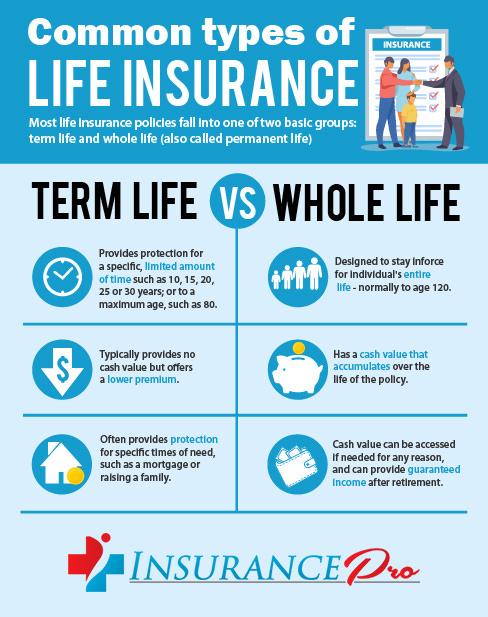

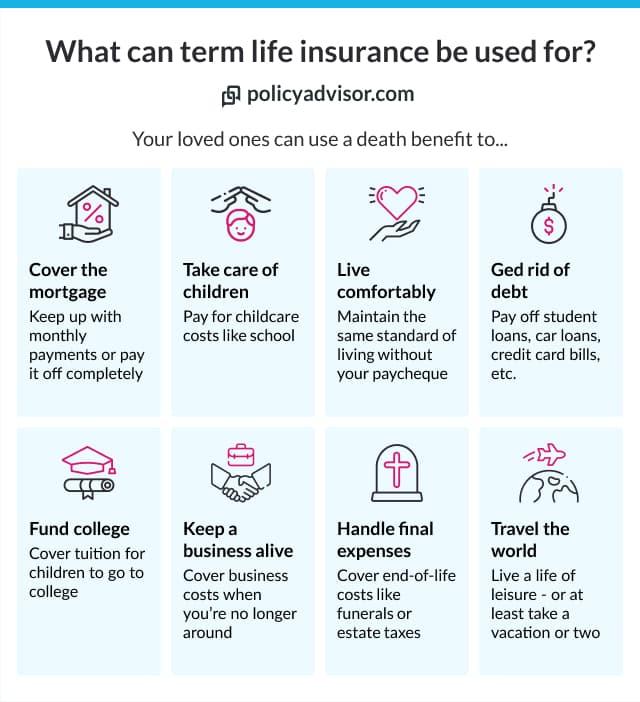

When considering life insurance, it’s crucial to understand the key distinctions between term life insurance and whole life insurance to make an informed decision. Term life insurance is designed to provide coverage for a specified period, typically ranging from 10 to 30 years. It’s often favored for its affordability and simplicity, making it an attractive option for those seeking temporary coverage to protect financial obligations like a mortgage or children’s education. Once the term ends, the policyholder can choose to renew, convert to whole life, or let the policy lapse.

In contrast, whole life insurance offers permanent coverage, lasting for the insured’s entire life as long as premiums are paid. This type of policy not only provides a death benefit but also builds cash value over time, which can be borrowed against or withdrawn. Key benefits include:

- Lifetime coverage

- Fixed premiums

- Potential for cash value accumulation

However, whole life insurance generally comes with higher premiums than term life insurance, reflecting its additional benefits and lifelong coverage.

Evaluating the Financial Implications of Conversion

When contemplating the shift from term life insurance to whole life, it is crucial to delve into the financial implications of such a decision. Whole life insurance typically comes with higher premiums, but these costs can be balanced by the policy’s potential benefits, such as cash value accumulation and lifetime coverage. Here are some key financial aspects to consider:

- Premium Costs: Whole life policies usually demand a significantly higher premium compared to term life. It’s important to assess whether your current budget can accommodate these increased expenses.

- Cash Value: One of the appealing features of whole life insurance is its cash value component, which can grow over time. This aspect can serve as an investment tool, potentially offering loans or withdrawals during your lifetime.

- Long-Term Financial Planning: Whole life insurance can be an integral part of estate planning, providing financial security for heirs and covering estate taxes. Consider how these benefits align with your long-term financial goals.

- Policy Loans and Withdrawals: The cash value in a whole life policy can be accessed through loans or withdrawals, offering a potential financial resource. However, these transactions may reduce the death benefit and incur interest.

Carefully weighing these factors will help determine if the transition aligns with your financial strategy, ensuring that the decision supports both your current and future financial well-being.

Analyzing the Long-Term Benefits of Whole Life Insurance

When considering a transition from term to whole life insurance, it’s essential to delve into the enduring advantages that the latter offers. Whole life insurance provides lifelong coverage, ensuring that your beneficiaries receive a death benefit no matter when you pass away, as long as premiums are paid. This contrasts with term insurance, which only offers protection for a specified period. Moreover, whole life policies come with a cash value component that grows over time, allowing policyholders to borrow against it or even surrender the policy for cash in the future.

Here are some key benefits of whole life insurance:

- Guaranteed Coverage: Unlike term insurance, whole life ensures coverage for your entire life.

- Cash Value Accumulation: Over time, the policy builds a cash value that can be accessed or borrowed against.

- Fixed Premiums: Premiums remain constant throughout the life of the policy, providing financial predictability.

- Potential Dividends: Some whole life policies offer dividends, which can be used to reduce premiums or increase the policy’s cash value.

Evaluating these aspects can provide a comprehensive understanding of how whole life insurance can serve as a long-term financial tool, blending security with potential financial growth.

Expert Recommendations on When to Consider Conversion

Deciding when to convert your term life insurance policy to a whole life policy can be pivotal in ensuring long-term financial security. Experts often recommend considering this conversion when certain life circumstances or financial goals align. Here are a few key indicators:

- Stability in Finances: If you’ve reached a point of financial stability and can afford the higher premiums associated with whole life insurance, conversion might be beneficial.

- Desire for Lifelong Coverage: When your need for coverage extends beyond the term policy’s expiration, whole life insurance offers the peace of mind of lifelong protection.

- Interest in Building Cash Value: Whole life policies accumulate cash value over time, which can be accessed for loans or future expenses. If this aligns with your financial strategy, consider converting.

- Tax Considerations: Converting to whole life insurance might offer tax advantages, particularly if you are in a higher tax bracket. Consulting with a tax advisor can provide clarity on this aspect.

Ultimately, the decision to convert should be based on a thorough assessment of your long-term financial goals, current financial situation, and the needs of your dependents. Engaging with a financial advisor can provide personalized guidance tailored to your specific circumstances.