In the complex tapestry of financial planning, life insurance often emerges as a pivotal thread, weaving security and peace of mind into the future of countless families. While it may not possess the tangible allure of a new home or the immediate gratification of a lavish vacation, life insurance stands as a profound testament to foresight and care. This financial tool, often misunderstood or overlooked, holds the potential to safeguard your loved ones against unforeseen circumstances, ensuring that their financial well-being remains intact even in your absence. In this article, we delve into the reasons why life insurance is not merely a policy but a lasting gift for your family’s future, exploring its role in providing stability, support, and a legacy that endures beyond a lifetime.

Understanding the Role of Life Insurance in Financial Security

Life insurance serves as a crucial pillar in the foundation of a family’s financial security. It offers a safety net that ensures your loved ones are protected from the unpredictable challenges that life may present. The primary purpose of life insurance is to provide financial support in the event of the policyholder’s death, but its role extends beyond that. Here are a few key aspects of how life insurance contributes to financial stability:

- Income Replacement: Life insurance helps replace lost income, ensuring that your family can maintain their standard of living even when you’re no longer around.

- Debt Coverage: It can cover outstanding debts, such as a mortgage or personal loans, preventing your family from facing financial burdens.

- Educational Expenses: Policies can be tailored to support your children’s education, safeguarding their future opportunities.

- Estate Planning: Life insurance can be an effective tool in estate planning, helping to cover taxes and administrative costs, and ensuring a smooth transfer of assets.

By investing in life insurance, you are providing a comprehensive financial strategy that protects your family’s future, offering peace of mind and security in uncertain times.

How Life Insurance Supports Long-Term Family Stability

In the unpredictable journey of life, securing the future of your loved ones is paramount. Life insurance offers a safety net that extends beyond immediate financial needs, supporting long-term family stability. This stability manifests in various ways:

- Financial Security: Life insurance provides a lump sum payment to beneficiaries, ensuring that your family’s financial obligations are met even in your absence. This financial cushion can cover expenses such as mortgage payments, education costs, and daily living expenses.

- Debt Management: Outstanding debts can become a significant burden for families. With life insurance, these debts can be settled, preventing your family from experiencing financial strain and preserving their creditworthiness.

- Peace of Mind: Knowing that your family is protected allows them to focus on their future without the anxiety of financial insecurity. This peace of mind fosters a stable environment where your loved ones can thrive and pursue their goals.

By investing in life insurance, you are not just providing for your family’s immediate needs, but also paving the way for a secure and stable future.

Choosing the Right Life Insurance Policy for Your Familys Needs

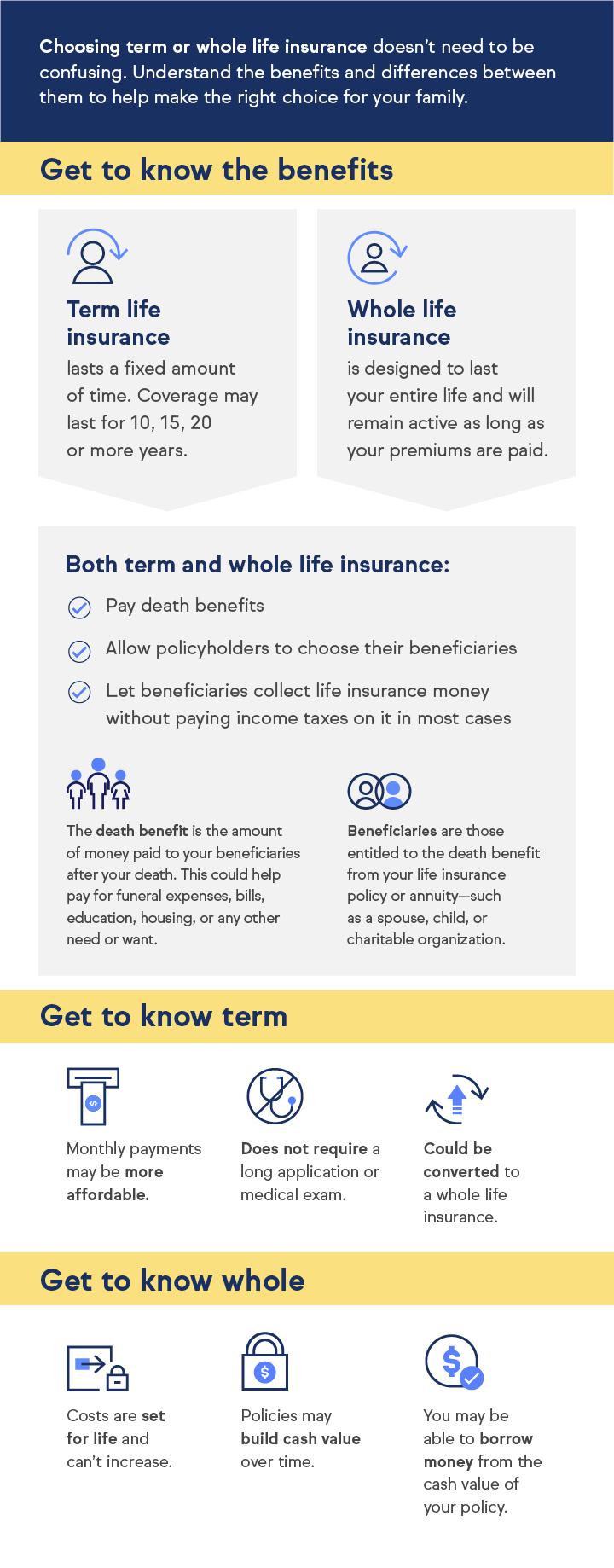

When considering the best life insurance policy for your family, it is crucial to assess both your current financial situation and future aspirations. Different types of policies offer varying benefits, so understanding these can guide you in making an informed decision. Term life insurance is often chosen for its affordability and simplicity, providing coverage for a specified period. On the other hand, whole life insurance is more comprehensive, offering lifelong protection and the potential for cash value accumulation. This can be particularly advantageous if you seek a policy that acts as both an insurance and investment tool.

- Evaluate Your Financial Goals: Consider what you aim to achieve financially, such as paying off a mortgage, funding education, or ensuring a steady income for your family.

- Understand Policy Types: Get acquainted with the differences between term, whole, and universal life insurance to see which aligns best with your needs.

- Assess Your Budget: Determine how much you can comfortably allocate towards premiums without compromising other financial obligations.

- Consult a Professional: Seek advice from a licensed insurance agent or financial planner to explore tailored options that fit your unique situation.

Maximizing the Benefits of Life Insurance for Future Generations

Life insurance is not just a safety net for immediate financial needs; it is also a strategic tool for creating a lasting legacy for future generations. By carefully selecting a policy that aligns with your long-term goals, you can ensure that your family is equipped with financial resources to cover educational expenses, medical emergencies, and even entrepreneurial ventures. Here are some ways to maximize the benefits:

- Flexible Policy Options: Choose a policy that offers adaptability over time. Many insurers provide options to adjust coverage as your family’s needs evolve, ensuring that the benefits remain relevant.

- Tax Advantages: Life insurance payouts are typically tax-free, which can be a substantial benefit. This ensures that your beneficiaries receive the full amount without the burden of additional tax liabilities.

- Investment Component: Some life insurance policies include an investment component that can grow over time. This allows your policy to potentially increase in value, providing more substantial support for your heirs.

By viewing life insurance as a multifaceted tool rather than a mere financial safety net, you empower your family to thrive long after you’re gone. It is an investment in their future, offering both security and opportunity.