In the complex landscape of financial planning, life insurance stands as a critical pillar, offering policyholders peace of mind and financial security for their beneficiaries. Yet, a recurring concern among policyholders and beneficiaries alike is the opacity surrounding the payout process. As life insurance companies grapple with evolving consumer expectations and regulatory landscapes, the question arises: should they offer more transparency on payout times? This article delves into the intricacies of this issue, examining the potential benefits and drawbacks of increased transparency. By analyzing industry practices, consumer perspectives, and regulatory considerations, we aim to provide a balanced view on whether greater clarity in payout timelines could enhance trust and satisfaction, or if it might inadvertently lead to unintended consequences.

Current State of Transparency in Life Insurance Payouts

The transparency of life insurance payouts remains a contentious issue within the industry, primarily due to varied processing times and lack of clear communication. Policyholders and beneficiaries often face uncertainty regarding when they will receive their payouts, which can lead to financial stress during already difficult times. While some companies have taken steps to improve their transparency by providing estimated timelines and regular updates, many still fall short in offering detailed information that could help set realistic expectations.

- Communication: Many companies provide vague timelines without specifics, leaving beneficiaries uncertain about when funds will be disbursed.

- Policy Complexity: The complexity of policy terms often contributes to delays, with many beneficiaries unaware of the necessary documentation required to expedite the process.

- Regulatory Requirements: Varying regulatory requirements across regions can also impact the speed and transparency of payouts.

For life insurance companies to build trust and credibility, addressing these issues is crucial. By adopting more transparent practices, such as offering detailed breakdowns of processing stages and potential delays, companies can better support beneficiaries during critical times.

Analyzing the Impact of Delayed Payouts on Policyholders

In the realm of life insurance, the timely disbursement of payouts is a cornerstone of trust between companies and policyholders. When payouts are delayed, the financial stability and emotional well-being of beneficiaries can be significantly impacted. Financial stress can escalate as families rely on these funds to cover funeral expenses, debts, or everyday living costs. Moreover, delayed payouts can lead to a loss of confidence in the insurance provider, potentially driving policyholders to seek alternatives or abandon their policies altogether.

The implications of such delays are multifaceted. Policyholders may experience:

- Increased anxiety over financial security during a period of mourning.

- Compounded legal or financial complications if they are unable to access the funds when most needed.

- Strained relationships with the insurance company, affecting long-term customer loyalty.

Understanding these effects is crucial for life insurance companies aiming to maintain credibility and customer satisfaction. Transparency in payout processes, therefore, not only benefits the policyholders but also strengthens the insurer’s market position.

Challenges Faced by Insurers in Providing Timely Information

Insurers encounter several hurdles when it comes to delivering information swiftly. One of the most significant challenges is the complexity of claims processing. The intricacies involved in assessing and verifying claims can lead to delays, as multiple departments may need to collaborate to ensure accuracy. Moreover, insurers must adhere to stringent regulatory requirements that can further slow down the process. These regulations, while essential for maintaining industry standards, often necessitate additional documentation and reviews, adding layers of bureaucracy.

Additionally, technology limitations can impede the rapid dissemination of information. Many insurance companies rely on legacy systems that are not equipped to handle the modern demands for real-time data sharing. This can result in bottlenecks, as outdated systems struggle to integrate with newer platforms or manage increased data loads. Furthermore, the need to balance data security with accessibility means that insurers must carefully manage how and when information is shared. These factors combined create a challenging environment for providing timely updates, ultimately impacting customer satisfaction.

- Complex claims processing

- Regulatory compliance

- Legacy technology systems

- Data security concerns

Strategies for Enhancing Clarity and Trust in Life Insurance Payouts

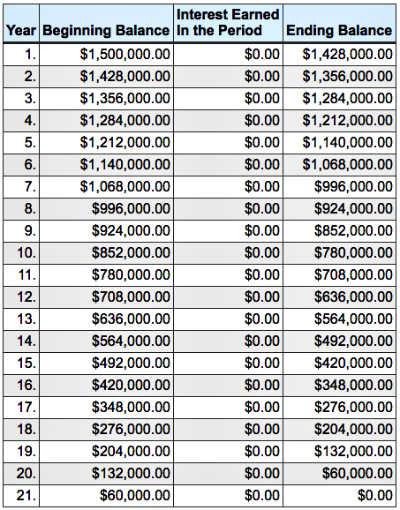

To ensure beneficiaries fully understand and trust the process, life insurance companies should implement several strategies. Firstly, they can provide a detailed timeline of the payout process. This timeline should include clear steps from claim submission to disbursement, with estimated durations for each phase. By doing so, policyholders and beneficiaries can have realistic expectations, reducing anxiety and uncertainty. Secondly, insurers should consider offering a dedicated support team that can answer queries related to payout processes, ensuring that beneficiaries have access to personalized assistance when needed.

Moreover, enhancing digital transparency can significantly improve clarity and trust. Insurers could leverage online portals where beneficiaries can track the status of their claims in real-time. Such platforms should be user-friendly and accessible, providing updates on any required documentation or potential delays. Additionally, life insurance companies can publish anonymized payout statistics, showcasing their average processing times and success rates. This data-driven approach can foster greater confidence among policyholders and their families, reassuring them of the insurer’s reliability and efficiency.

- Provide a detailed payout process timeline.

- Offer a dedicated support team for inquiries.

- Implement real-time claim tracking via online portals.

- Publish anonymized payout statistics for transparency.