In today’s financial landscape, student loans have become a significant burden for many individuals, often influencing major life decisions and long-term financial planning. Amidst rising education costs and the ongoing dialogue about student debt relief, individuals are increasingly exploring unconventional avenues to alleviate this financial pressure. One such option that has garnered attention is life insurance. Traditionally associated with providing financial security to beneficiaries after one’s passing, life insurance policies are now being examined for their potential role in managing student loan debt. This article delves into the intersection of life insurance and student loans, exploring how these seemingly disparate financial instruments might work together to provide relief for borrowers. Through an examination of policy types, beneficiary structures, and strategic financial planning, we aim to illuminate whether life insurance can indeed serve as a viable tool in the quest to mitigate student loan obligations.

Understanding the Basics of Life Insurance and Student Loans

At first glance, life insurance and student loans may seem like two distinct financial concepts. However, understanding their intersection can provide clarity and potential solutions for debt management. Life insurance is primarily designed to offer financial protection to your loved ones in the event of your passing. Student loans, on the other hand, are financial obligations that many individuals carry for years. When combined, a well-structured life insurance policy can serve as a strategic tool to alleviate the burden of student debt. Here’s how:

- Death Benefit: A life insurance policy pays out a death benefit to your beneficiaries, which can be used to settle outstanding student loans, ensuring that your family is not left with this financial burden.

- Cosigner Protection: If someone has cosigned your student loans, a life insurance policy can protect them from being held responsible for the debt if you were to pass away unexpectedly.

- Peace of Mind: Knowing that your financial obligations will not be transferred to your family members can provide a sense of security and peace of mind.

While life insurance is not a direct method for paying off student loans, it offers a safety net that can prevent financial strain on your loved ones. Evaluating your life insurance options in the context of your student loans can be a prudent step towards comprehensive financial planning.

Exploring How Life Insurance Can Be Utilized for Student Debt Repayment

Life insurance is often perceived primarily as a tool for providing financial security to loved ones after one’s passing. However, it can also be a strategic resource for managing student debt. Permanent life insurance policies, such as whole or universal life insurance, accumulate a cash value over time. This cash value can be borrowed against, potentially providing a source of funds to help repay student loans. While borrowing against your policy can be a viable option, it is important to consider the implications, such as interest on the loan and the potential impact on the death benefit.

Here are some considerations when thinking about utilizing life insurance for student debt repayment:

- Loan Interest: Loans against a life insurance policy usually have lower interest rates compared to student loans, which might make them an attractive option.

- Policy Impact: Reducing the policy’s cash value can affect the overall policy performance and the amount passed on to beneficiaries.

- Repayment Flexibility: Unlike traditional loans, there is no fixed repayment schedule, providing more flexibility in managing repayments.

- Tax Considerations: The borrowed amount is generally not taxable, but failure to repay can lead to tax consequences if the policy lapses.

Before leveraging life insurance in this way, it is crucial to evaluate both the short-term benefits and long-term impacts, possibly with the guidance of a financial advisor.

Evaluating the Benefits and Limitations of Using Life Insurance for Student Loans

When considering life insurance as a tool to manage student loans, it’s important to weigh both its potential advantages and its constraints. Life insurance policies, particularly permanent life insurance, offer the benefit of accumulating cash value over time. This cash value can be borrowed against to help cover student loan payments, providing a flexible financial resource. Additionally, in the unfortunate event of the policyholder’s death, the death benefit could be used to settle any remaining student loan debt, thus relieving family members of this financial burden.

However, there are notable limitations to this approach. Premium costs for permanent life insurance can be significantly higher than those for term life insurance, potentially making it an expensive strategy for managing student loans. Moreover, borrowing against the policy’s cash value may reduce the death benefit and could lead to policy lapse if not managed carefully. It’s crucial to assess whether the potential benefits outweigh the costs and complexities involved, and to consider alternative strategies that might offer more direct or cost-effective solutions to managing student loan debt.

Practical Tips for Incorporating Life Insurance into Your Student Loan Strategy

Integrating life insurance into your student loan repayment plan can be a strategic move, particularly if you have cosigned loans or private student loans. Here are some practical tips to consider:

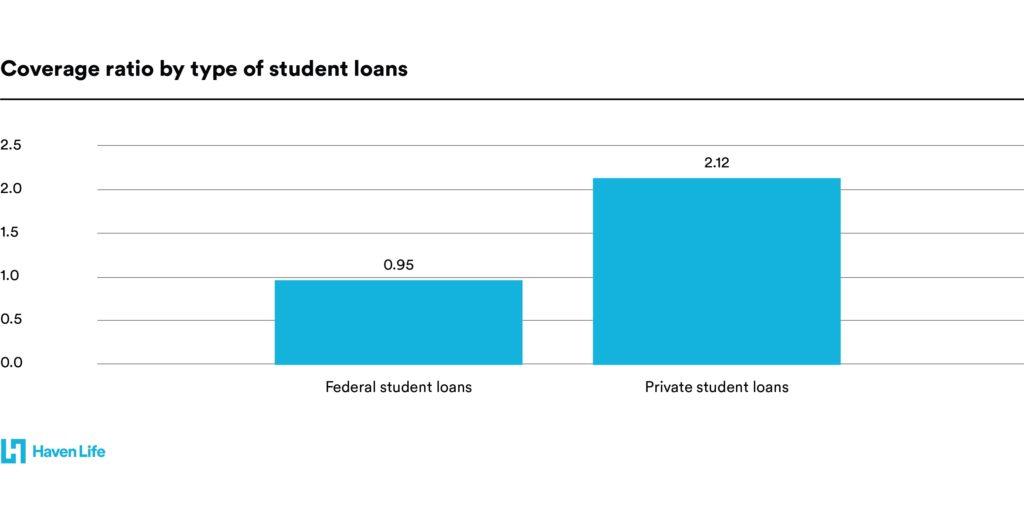

- Assess Your Loan Type: Determine whether your loans are federal or private. Federal loans are typically discharged upon the borrower’s death, but private loans might not be. In such cases, life insurance can offer a financial safety net for your cosigners or family.

- Calculate Coverage Needs: Consider the total amount of your student loans and any other debts you may have. Ensure your life insurance policy covers at least this amount, so that your loved ones are not burdened with unexpected financial obligations.

- Choose the Right Policy: Opt for a term life insurance policy that aligns with the repayment period of your loans. This approach can be cost-effective and ensure coverage during the years when your loans are active.

- Regularly Review Your Plan: As you pay down your loans, periodically reassess your insurance needs. Adjust your coverage to reflect any changes in your financial situation or debt obligations.

By thoughtfully integrating life insurance into your strategy, you can protect your family’s financial future while managing your student debt responsibly.