Life is a journey marked by a series of transformations, each stage bringing new challenges, dreams, and responsibilities. Just as a master tailor crafts a bespoke suit to fit the contours of a client’s frame, so too must we tailor our insurance coverage to snugly fit the unique needs of each phase of our lives. From the carefree days of youth to the settled wisdom of retirement, the right insurance can serve as a steadfast companion, offering protection and peace of mind. In this article, we will unravel the threads of insurance intricacies, guiding you through the art of customizing coverage to suit your evolving lifestyle. With confidence and clarity, we will explore how to ensure that your insurance not only safeguards your present but also secures your future, no matter where life’s path may lead.

Navigating the Early Years Crafting Essential Coverage for Young Adults

For young adults stepping into the world of independence, selecting the right insurance coverage is a pivotal step in securing their financial future. Crafting a plan that evolves with life’s stages can be a daunting task, yet with the right approach, it can be both empowering and strategic. Understanding the unique needs of this age group is key. From health and auto insurance to renters and even early-life investment policies, these essentials lay a foundation for a stable future.

Key considerations for young adults include:

- Health Insurance: Transitioning off parental plans or exploring marketplace options.

- Auto Insurance: Finding cost-effective policies for first-time car owners.

- Renters Insurance: Protecting personal belongings and understanding liability.

- Long-term Investments: Starting early with life insurance or retirement accounts.

By aligning coverage with their evolving lifestyle, young adults can confidently navigate the early years with a safety net tailored just for them.

Family Focused Strategies Ensuring Comprehensive Protection for Growing Families

When it comes to safeguarding your family’s future, it’s essential to customize insurance plans that align with the evolving needs of each life stage. Young couples might prioritize term life insurance to ensure financial security in the event of an unexpected loss, while new parents may focus on health insurance that offers comprehensive coverage for pediatric care and maternity benefits. As children grow, incorporating education insurance can provide a financial cushion for future academic pursuits.

For families with teenagers, consider plans that extend coverage to include driver’s insurance, acknowledging the new risks that come with young drivers. As you transition into the empty nest phase, it might be wise to shift focus towards long-term care insurance and retirement planning, ensuring that both you and your partner can enjoy peace of mind in later years. At each stage, consider these factors:

- Coverage Needs: Evaluate the specific needs of your family at each life stage.

- Budget Considerations: Balance between necessary coverage and financial constraints.

- Future Planning: Anticipate future changes in family dynamics and plan accordingly.

By addressing these considerations, you can craft a robust insurance strategy that evolves with your family, offering a safety net tailored to your unique journey.

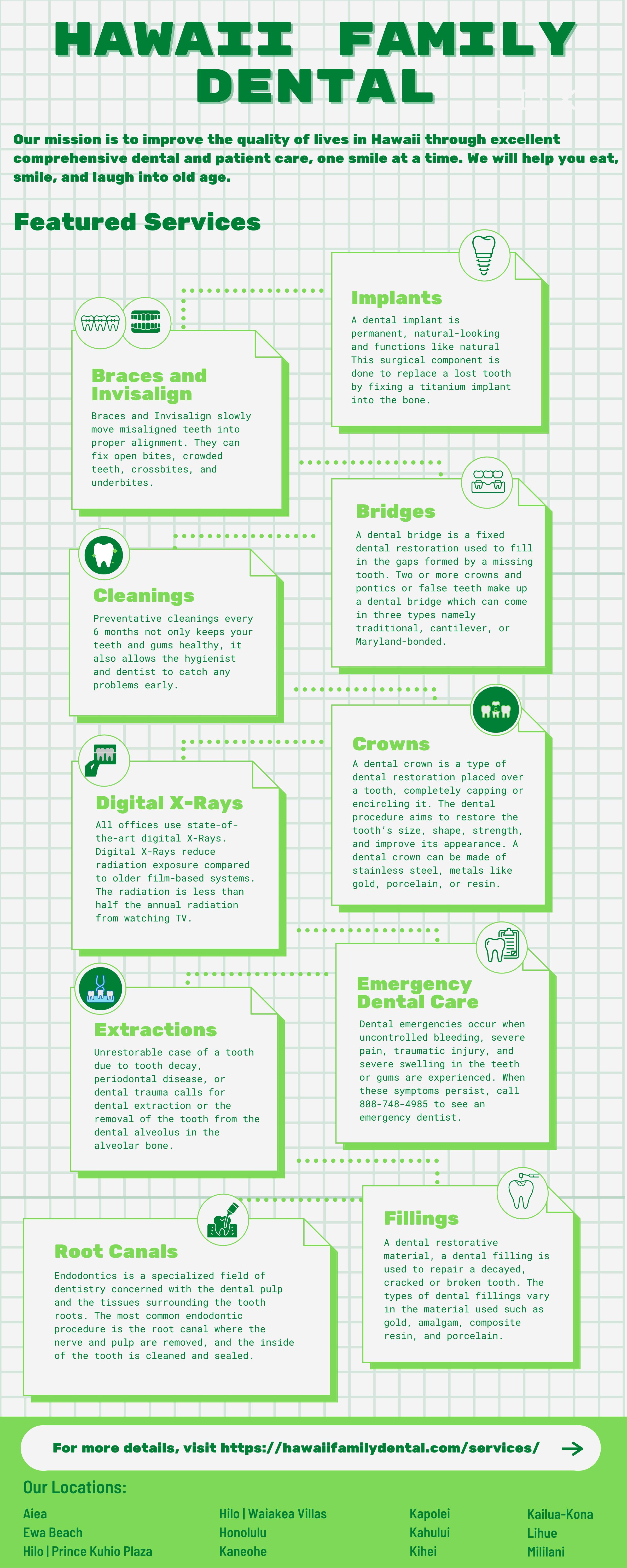

Golden Years Planning Designing Tailored Insurance Solutions for Retirement

When planning for the golden years, designing a bespoke insurance solution is crucial to ensure financial stability and peace of mind. As retirement approaches, it’s essential to reassess your insurance needs, taking into account lifestyle changes and evolving priorities. Customizing insurance coverage involves evaluating several factors, such as health status, financial goals, and potential risks. Here are some considerations to help tailor your insurance coverage effectively:

- Health and Long-term Care: Consider policies that cover medical expenses and long-term care, as healthcare needs often increase with age.

- Life Insurance Adjustments: Review life insurance policies to ensure they align with current financial obligations and legacy plans.

- Income Protection: Explore annuities or other income-generating insurance products to provide a steady cash flow throughout retirement.

- Asset Protection: Evaluate options for safeguarding assets against unforeseen events, including liability insurance and coverage for estate planning.

By proactively adjusting your insurance portfolio, you can create a robust financial foundation that supports your desired lifestyle and offers security in your retirement years.

Adapting to Change Revisiting and Refining Coverage for Life’s Unexpected Turns

In a world that’s constantly evolving, it’s crucial to ensure your insurance coverage evolves with you. Life is a tapestry of experiences, and each stage demands its own kind of protection. Revisiting your insurance policies periodically ensures that you’re not caught off guard by life’s unpredictable twists. Whether you’re welcoming a new child, buying a home, or planning for retirement, each milestone presents unique risks and opportunities.

Consider the following strategies to refine your coverage:

- Evaluate and adjust regularly: Schedule annual reviews to assess your current needs and ensure your coverage aligns with your life stage.

- Seek professional advice: Consulting with an insurance expert can provide insights tailored to your personal circumstances and future plans.

- Stay informed: Keep abreast of new insurance products and regulations that could impact your coverage options.

Embracing change isn’t just about keeping up; it’s about strategically positioning yourself to thrive amidst life’s surprises.