In the ever-evolving landscape of entrepreneurship, small business owners are often preoccupied with growth strategies, financial management, and operational efficiency. However, a crucial aspect that sometimes takes a backseat is the protection of both personal and business interests through life insurance. Navigating the myriad of life insurance coverage options available can be daunting, yet it is essential for safeguarding the future of the business and ensuring the financial security of loved ones. This article delves into the various life insurance options tailored for small business owners, exploring their features, benefits, and potential impact on business continuity. By understanding these options, entrepreneurs can make informed decisions that align with their long-term goals and provide peace of mind in the face of unforeseen circumstances.

Understanding the Importance of Life Insurance for Small Business Owners

For small business owners, securing a robust life insurance policy is not just about personal protection; it extends to safeguarding the business itself. The right coverage can provide financial stability, ensuring that your business continues to thrive even in your absence. Here are some key life insurance options to consider:

- Term Life Insurance: Offers coverage for a specific period, providing a cost-effective solution for business owners seeking temporary protection. This option is ideal for covering business loans or short-term financial obligations.

- Whole Life Insurance: This policy provides lifelong coverage with a savings component that can accumulate cash value over time. It’s a good choice for those who want a policy that also serves as a long-term investment.

- Key Person Insurance: Designed to protect the business against the financial loss that might occur from the death of a key employee or owner. The business is typically the beneficiary, using the payout to cover operational costs or to hire a replacement.

- Buy-Sell Agreement Funding: Life insurance can fund a buy-sell agreement, ensuring a smooth transition of ownership in the event of a partner’s death, thereby protecting the business’s continuity.

Selecting the appropriate life insurance policy requires careful consideration of your business’s unique needs and long-term goals. It’s crucial to evaluate the potential risks and financial responsibilities to ensure that both your personal and professional interests are adequately protected.

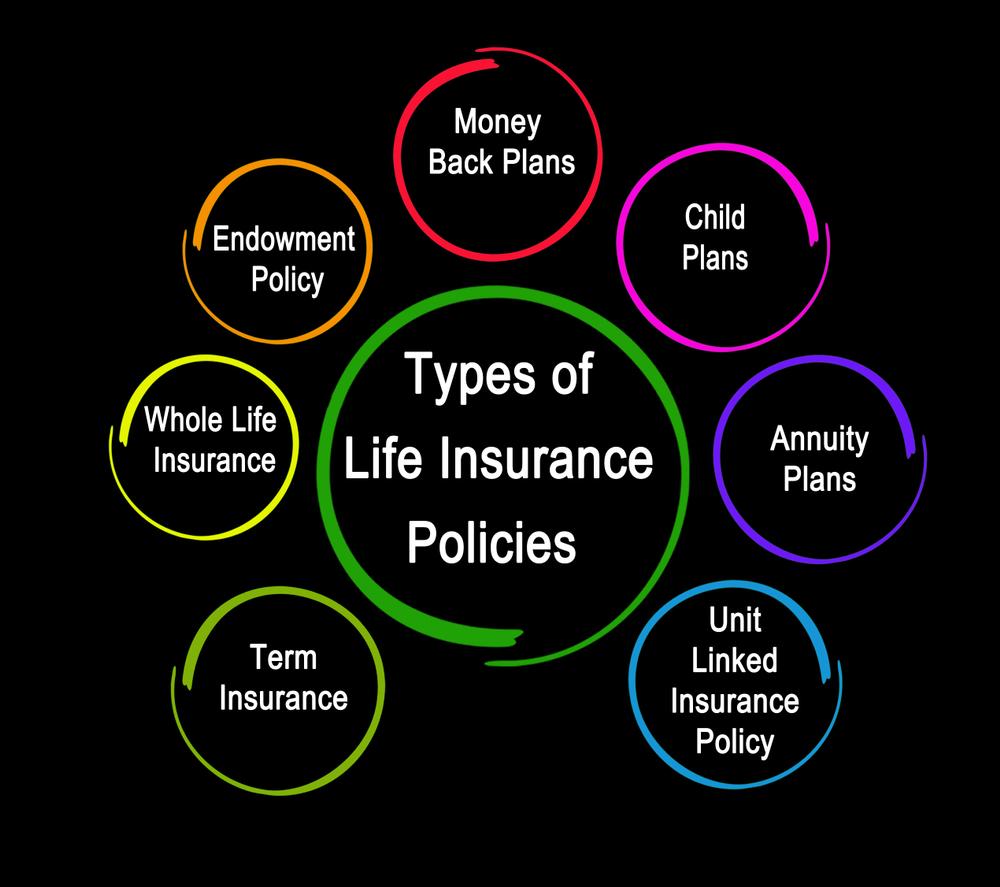

Exploring Different Types of Life Insurance Policies Available

Small business owners have a variety of life insurance policies to consider, each tailored to meet specific needs and goals. Term life insurance is a popular choice for those seeking coverage for a specified period, such as 10, 20, or 30 years. This option is generally more affordable and can provide peace of mind by ensuring financial protection during crucial business growth stages. Alternatively, whole life insurance offers lifelong coverage and includes a savings component that builds cash value over time, making it a dual-purpose solution for both protection and investment.

For those looking for flexibility, universal life insurance provides adjustable premiums and death benefits, allowing business owners to modify their coverage as their financial situation evolves. Additionally, variable life insurance offers the potential for investment growth through various sub-accounts, though it comes with higher risk. Consider exploring the benefits of key person insurance as well, which safeguards your business against the unexpected loss of a crucial team member. With these diverse options, small business owners can tailor their life insurance policies to best fit their unique circumstances and ensure their enterprise’s stability.

Key Considerations for Selecting the Right Coverage

When choosing life insurance coverage, small business owners must evaluate several critical factors to ensure they make an informed decision. Financial objectives are a primary consideration; understanding the purpose of the policy, whether it’s to protect the business, family, or both, will guide the selection process. Assess the amount of coverage necessary to meet these objectives, taking into account outstanding business loans, potential loss of income, and future growth plans. Additionally, the choice between term and permanent insurance can significantly impact the business. Term policies provide coverage for a specific period, making them a cost-effective option for temporary needs, whereas permanent policies offer lifelong protection and can serve as an investment vehicle.

Consider the implications of key person insurance if your business heavily relies on certain individuals. This coverage can safeguard against the financial impact of losing a pivotal team member. Evaluating the potential tax benefits and implications is also crucial; different types of policies may offer tax advantages, which could influence your choice. Furthermore, it’s essential to compare premium rates and policy terms from various providers, ensuring that the coverage is not only adequate but also financially sustainable for your business. Lastly, consult with a knowledgeable insurance advisor who understands the unique needs of small business owners to guide you through the complexities of selecting the right life insurance coverage.

Expert Recommendations for Optimizing Life Insurance Benefits

When selecting life insurance for your small business, it’s crucial to consider strategies that maximize your coverage’s value. Diversifying policy types is a key recommendation. By combining term life insurance with permanent policies like whole or universal life, you can balance short-term needs with long-term security. Term life offers cost-effective coverage during critical business growth phases, while permanent insurance can provide a stable asset that grows over time. Additionally, permanent policies can serve as a financial tool, offering the potential to borrow against the policy’s cash value if your business encounters unexpected financial hurdles.

Experts also suggest focusing on customizing coverage to match your business’s unique needs. Consider factors such as the age and health of key personnel, potential business liabilities, and your personal estate planning goals. It’s beneficial to work with an insurance advisor who understands small business dynamics and can tailor policies accordingly. Some specific recommendations include:

- Implementing a buy-sell agreement funded by life insurance to ensure business continuity.

- Exploring key person insurance to protect against the loss of critical staff members.

- Evaluating the benefits of executive bonus plans to attract and retain top talent.