In a world where every dollar counts, finding ways to trim expenses without sacrificing quality is akin to discovering hidden treasure. Family insurance premiums often feel like an unavoidable storm cloud, casting a shadow over our financial sunshine. But what if we told you there’s a way to clear those skies and let the sun shine on your savings? Welcome to the art of combining insurance policies—a savvy strategy that can reduce your family’s premiums and put a smile on your face. In this guide, we’ll embark on a journey through the maze of insurance options, revealing tips and tricks that can help you bundle your way to a more affordable future. So grab a cup of coffee, settle into your favorite chair, and let’s explore the world of policy combinations with a friendly, guiding hand.

Unlocking Savings with Smart Policy Bundling

When it comes to slashing those family insurance premiums, bundling is your secret weapon. By combining multiple insurance policies, such as home, auto, and life, with the same provider, you can unlock a world of savings. This approach not only simplifies your life with a single point of contact but often rewards you with substantial discounts. Imagine having one go-to person for all your insurance needs, and as a bonus, a lighter bill at the end of the month. Now, that’s a win-win situation!

- Convenience: Manage all your policies under one roof, reducing the paperwork and hassle.

- Discounts: Providers often offer discounts for bundled policies, making it a cost-effective choice.

- Comprehensive Coverage: Ensure all aspects of your family’s life are protected seamlessly.

While the initial task of gathering quotes and assessing the best combination might seem daunting, the long-term benefits are well worth it. Take the time to shop around and speak with various providers to understand their bundling options. A little effort today could lead to substantial savings tomorrow!

Family First: Tailoring Coverage to Your Needs

Combining insurance policies can be a savvy way to cut down on family premiums without sacrificing coverage. By bundling multiple types of insurance under one provider, families can often take advantage of discounts and loyalty perks. This approach not only simplifies managing your policies but also makes it easier to identify any gaps in coverage. Here are some options to consider:

- Home and Auto Insurance: Many insurers offer discounts for bundling home and auto policies. This can lead to significant savings, especially for families with multiple vehicles.

- Health and Life Insurance: Some companies provide incentives for customers who combine their health and life insurance policies, potentially lowering premiums and offering more comprehensive coverage.

- Multi-Vehicle Policies: If your family owns more than one vehicle, insuring them under a single policy could reduce costs. Check for family discounts or multi-car discounts.

Additionally, it’s worth exploring whether your employer offers any group insurance plans, which can be an effective way to lower premiums. By strategically combining policies, you can keep your family’s insurance costs in check while ensuring that everyone remains protected.

Decoding Discounts: Strategies for Maximizing Benefits

When it comes to family insurance, understanding how to leverage different policies can make a world of difference in your premium payments. Bundling policies is one of the most effective strategies. By combining multiple insurance needs—such as auto, home, and health insurance—under one provider, you often qualify for significant discounts. Insurance companies appreciate loyalty and reward it by reducing your overall costs. Moreover, it simplifies your life by consolidating billing and customer service to a single point of contact.

Another powerful approach is to capitalize on group insurance plans offered through employers or professional associations. These plans often provide lower rates due to the collective bargaining power of the group. If both parents work, comparing the benefits and premiums of each employer’s offerings can lead to unexpected savings. Consider these additional strategies:

- Increase deductibles to lower premium costs, while ensuring you have enough savings to cover the deductible if needed.

- Utilize wellness programs that offer incentives and discounts for maintaining a healthy lifestyle.

- Review and adjust coverage regularly to ensure you’re not paying for unnecessary extras.

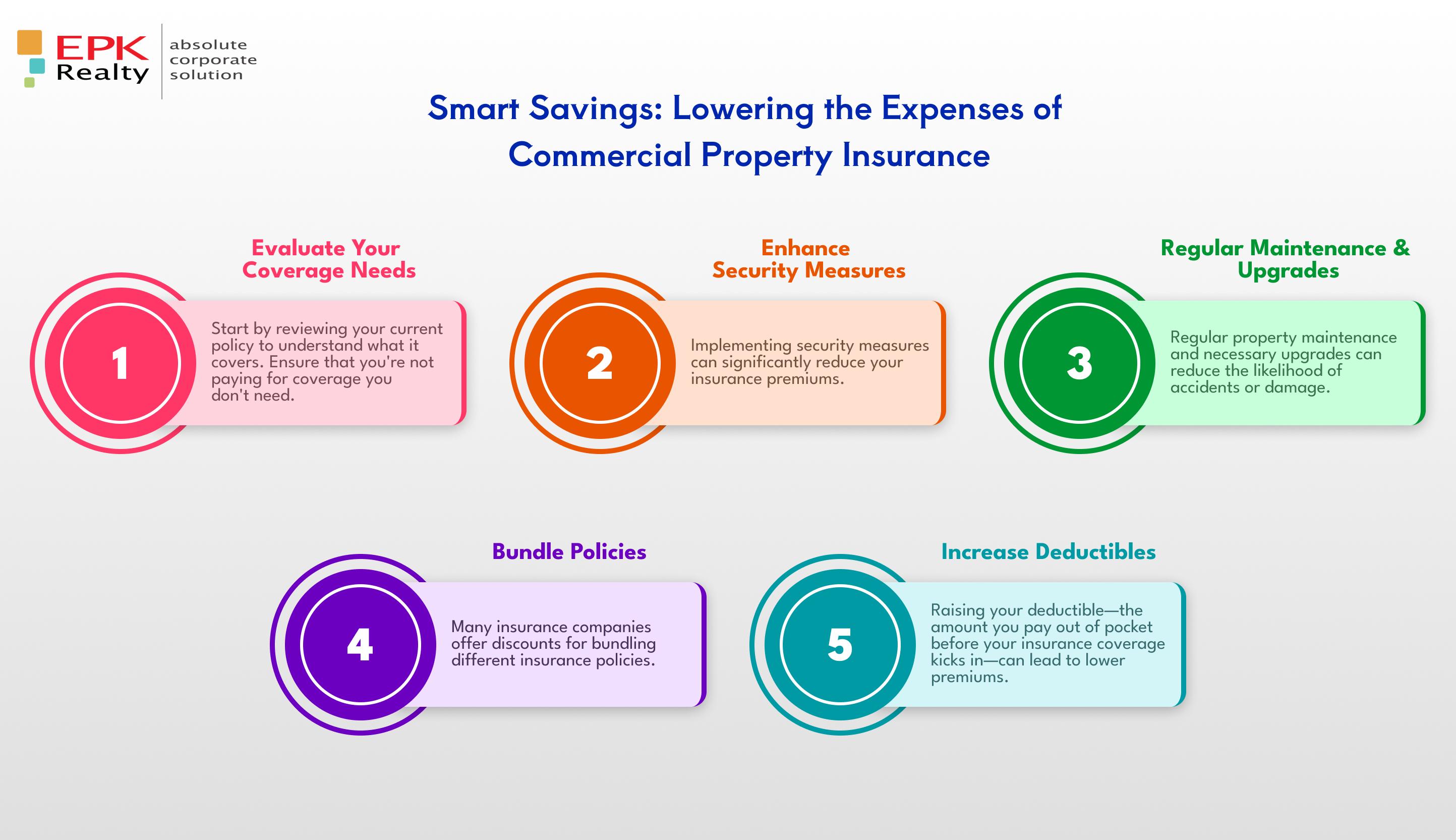

Expert Tips for Navigating the Insurance Maze

Combining insurance policies can be a savvy way to lower your family’s overall premium costs. One effective approach is to explore bundling options with your current provider. Many insurers offer discounts when you consolidate multiple policies, such as home and auto, under one umbrella. This not only simplifies your billing but can also lead to significant savings.

- Home and Auto Bundle: Often, the most popular choice for families, as it can yield discounts up to 25%.

- Multi-Vehicle Discount: If your household has more than one car, insuring them together can further cut costs.

- Add-on Coverages: Consider combining smaller policies, like renters or pet insurance, with your main policies for additional discounts.

Beyond bundling, it’s also beneficial to review and adjust your coverage periodically. As life changes, so do your insurance needs. Assess if you’re paying for coverage that’s no longer necessary or if there are gaps that need addressing. This proactive approach ensures you’re not over-insured or under-insured, optimizing both coverage and cost.