In recent years, the life insurance industry has come under increasing scrutiny as consumers demand greater transparency and clarity in financial products. A central issue in this ongoing debate is the transparency of payout guarantees in life insurance policies. While life insurance serves as a critical financial safety net for many families, the complexities surrounding policy terms and conditions can often lead to confusion and unmet expectations. This article aims to explore whether life insurance companies should enhance transparency regarding payout guarantees, examining the potential benefits and drawbacks for both policyholders and insurers. By analyzing industry practices, regulatory frameworks, and consumer perspectives, we seek to understand the implications of increased transparency and whether it could lead to more informed decision-making and greater trust in the life insurance sector.

Understanding Current Transparency Practices in Life Insurance Policies

In the realm of life insurance, transparency practices vary significantly across different providers and policy types. Currently, payout guarantees often remain a nebulous aspect of these policies, leaving policyholders in the dark about the specifics of their coverage. This lack of clarity can lead to confusion, especially during critical moments when beneficiaries need to claim the benefits. To understand the current practices, one must consider:

- The degree of clarity in policy documentation regarding payout conditions and scenarios.

- How insurers communicate exceptions or limitations to beneficiaries.

- The availability of customer support to explain complex terms and conditions.

Insurers have a responsibility to ensure that their customers are well-informed about their policies, yet the industry’s approach to transparency is often inconsistent. While some companies provide detailed guides and personalized consultations, others may only offer vague descriptions and complex jargon, complicating the understanding of payout guarantees. This inconsistency highlights the need for more standardized practices to ensure that all policyholders receive clear and comprehensive information, empowering them to make informed decisions about their life insurance choices.

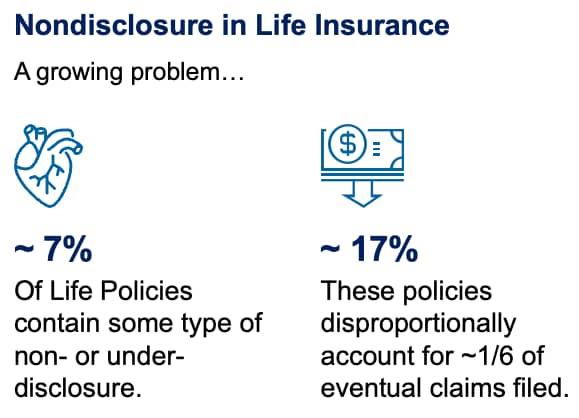

Analyzing the Impact of Non-Transparent Payout Guarantees on Policyholders

In the complex world of life insurance, non-transparent payout guarantees can significantly affect policyholders’ understanding and expectations. When these guarantees are not clearly defined, policyholders may find themselves in a precarious position, unsure of the actual benefits they are entitled to receive. The ambiguity can lead to a myriad of issues, such as unexpected financial shortfalls and dissatisfaction with the policy’s performance. This lack of transparency can undermine the trust that is essential between insurers and their clients, potentially leading to reputational damage for insurance companies.

- Confusion over payout amounts: Policyholders may not fully grasp the conditions under which payouts are adjusted or withheld.

- Unanticipated financial risk: Without clear information, individuals might face unexpected financial burdens at critical times.

- Erosion of trust: A lack of clarity can diminish confidence in the insurance provider, impacting long-term customer relationships.

Addressing these issues requires insurers to adopt a more transparent approach, clearly outlining the terms and conditions of payout guarantees. By doing so, they can enhance trust, improve customer satisfaction, and ensure that policyholders are fully informed about the financial protection their policies offer.

Exploring Benefits of Enhanced Transparency in Life Insurance Payouts

In the intricate world of life insurance, transparency regarding payout guarantees holds significant importance for policyholders. Enhanced transparency ensures that policyholders have a clear understanding of the terms and conditions, helping them make informed decisions. When insurers provide explicit details about how and when payouts will be disbursed, it builds trust and confidence among clients. Clear communication of payout terms also minimizes disputes and confusion, ensuring a smoother claims process.

The benefits of enhanced transparency include:

- Increased Trust: Customers are more likely to trust insurers who are upfront about payout processes.

- Better Decision Making: With clear information, policyholders can choose policies that best fit their needs and expectations.

- Reduced Legal Disputes: Clearly defined payout terms help in minimizing misunderstandings and potential legal challenges.

By fostering a transparent environment, insurers not only adhere to ethical practices but also enhance their reputation and customer satisfaction.

Recommendations for Improving Transparency in Life Insurance Policy Disclosures

Enhancing transparency in life insurance policy disclosures is crucial for building trust between insurers and policyholders. To achieve this, insurers should consider implementing clear and concise language in policy documents. This means avoiding jargon and providing straightforward explanations of terms and conditions, ensuring that policyholders fully understand their coverage and any payout guarantees. Additionally, the use of visual aids, such as charts or infographics, can help illustrate complex concepts, making them more digestible for the average consumer.

- Detailed Breakdown: Offer a comprehensive breakdown of how payout guarantees are calculated, including any influencing factors such as market conditions or policyholder actions.

- Regular Updates: Provide policyholders with regular updates about any changes in terms, conditions, or financial status that might affect payout guarantees.

- Accessibility: Ensure that all policy documents and updates are easily accessible through multiple channels, including online portals and mobile apps, to cater to different preferences and needs.