In a world where the future is as unpredictable as a summer storm, planning for long-term health care is like building a sturdy ark to weather the unknown. As we journey through life, the inevitable changes in our health become a part of the landscape, often arriving unannounced. The good news? With the right insurance strategy, you can transform these uncertainties into a well-charted course. This guide will equip you with the knowledge to navigate the complex waters of long-term health care planning, ensuring you’re not just prepared, but confidently steering your own ship towards a secure and healthy future. Whether you’re just beginning to consider the horizon or already setting sail, understanding how to harness the power of insurance will empower you to face tomorrow with assurance and peace of mind.

Understanding the Essentials of Long Term Health Care Insurance

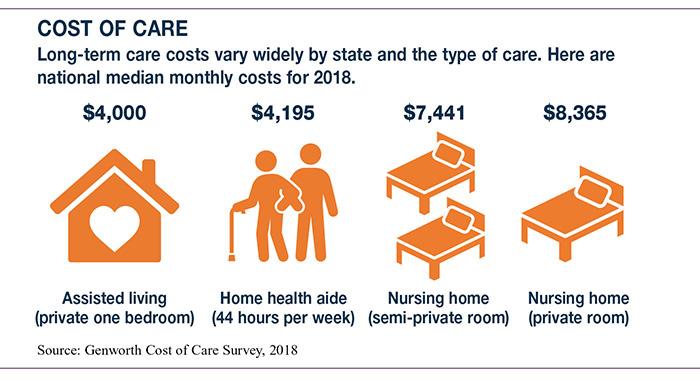

When planning for the future, it’s crucial to understand the role of long term health care insurance in safeguarding your financial stability. This type of insurance is designed to cover services that aren’t typically included in traditional health insurance plans, such as extended nursing home stays, in-home care, or assisted living facilities. By investing in long term care insurance, you are taking proactive steps to ensure that your health needs are met without depleting your savings or becoming a burden to your family.

- Comprehensive Coverage: It includes a variety of services, from personal care to skilled nursing assistance.

- Flexibility: Policies can be tailored to fit your specific needs and budget, providing peace of mind and financial security.

- Asset Protection: Helps protect your assets and savings, allowing you to pass on wealth to your heirs.

- Tax Benefits: Premiums for qualified long term care insurance policies may be tax-deductible, adding another layer of financial advantage.

Understanding these essentials equips you with the knowledge to make informed decisions, ensuring that your golden years are spent with dignity and comfort. A well-chosen policy not only provides financial relief but also offers reassurance to both you and your loved ones.

Tailoring Your Insurance Plan to Meet Future Health Needs

Anticipating future health requirements can be daunting, yet it’s crucial for ensuring peace of mind. Crafting an insurance plan that adapts to your evolving health landscape begins with understanding your unique needs and potential risks. Consider the following factors when designing a personalized plan:

- Family Medical History: Gain insights from the past to predict future needs by examining prevalent conditions within your family. This knowledge can guide you towards specific coverages.

- Lifestyle Choices: Your daily habits play a significant role in shaping your health journey. Whether it’s a penchant for adventure sports or a commitment to wellness, ensure your plan reflects these realities.

- Technological Advancements: Stay informed about emerging medical technologies that could influence treatment options and costs, allowing you to adjust your coverage accordingly.

By considering these elements, you can ensure your insurance plan is not just a safety net, but a proactive partner in your long-term health journey.

Maximizing Benefits and Minimizing Costs in Your Coverage

When it comes to crafting an effective long-term health care plan, strategically balancing your coverage can make all the difference. Begin by conducting a thorough analysis of your existing policy. Look for areas where you might be over-insured or paying for benefits you don’t actually need. This might include duplicate coverage or riders that are no longer relevant. By trimming these excesses, you can allocate resources to areas that provide more substantial benefits.

Consider the following strategies to enhance your plan:

- Leverage Preventive Care: Many insurance plans offer free or low-cost preventive services. Regular check-ups and screenings can help you catch potential health issues early, reducing long-term costs.

- Explore Supplemental Insurance: If your primary policy lacks coverage for certain critical areas, such as vision or dental, adding a supplemental plan could save you money in the long run.

- Utilize Network Providers: Staying within your insurance network can significantly reduce out-of-pocket expenses. Ensure your preferred doctors and hospitals are in-network to maximize benefits.

By fine-tuning your coverage and making informed decisions, you can achieve a harmonious balance between cost and care, ensuring peace of mind for the future.

Navigating Policy Options with Expert Insights and Tips

Planning for long-term health care with insurance can seem daunting, but leveraging expert insights can transform this complex process into a manageable journey. Understanding your policy options is crucial. Evaluate the types of policies available: traditional long-term care insurance, hybrid policies that combine life insurance with long-term care benefits, and annuities with long-term care riders. Each option has its nuances and benefits tailored to different needs.

Consider these expert tips to streamline your planning process:

- Assess Your Needs: Determine the level of care you might need based on family history and personal health conditions.

- Compare Policies: Look for policies that offer flexibility and a range of services, ensuring they cover various care settings.

- Review Financial Impact: Analyze the premium costs against potential out-of-pocket expenses to ensure affordability over time.

- Seek Professional Guidance: Consult with a financial advisor or insurance expert to tailor a plan that aligns with your long-term financial goals.

By thoughtfully navigating these options, you can secure a future where health care needs are met without compromising financial stability.