In a world where uncertainty is the only certainty, crafting a safety net that shields you from life’s unforeseen twists is not just wise—it’s essential. Yet, the notion of building an insurance portfolio often conjures images of daunting premiums and labyrinthine policies. Fear not, for constructing an affordable and effective insurance portfolio is not a quest reserved for the financial elite. It is a journey accessible to anyone willing to take the reins of their financial future. In this guide, we will demystify the process, equipping you with the tools to navigate the insurance landscape with confidence and clarity. Get ready to unlock the secrets of safeguarding your assets and peace of mind, all while keeping your budget intact. Welcome to the art of intelligent risk management—where practicality meets protection.

Crafting a Cost-Effective Coverage Plan

Creating a coverage plan that doesn’t break the bank requires a strategic approach. Start by evaluating your current needs and risks. Identify your priorities—whether it’s health, auto, or home insurance—and focus on what’s essential. It’s easy to get overwhelmed by a plethora of options, but a targeted approach will help you avoid unnecessary costs. You can also explore bundling different types of insurance policies with the same provider. This often leads to discounts, saving you money without sacrificing coverage quality.

Don’t overlook the power of comparison shopping. Utilize online tools and platforms to compare different insurance providers and policies. Look for policies that offer flexibility and customization, allowing you to adjust coverage as your needs change. Additionally, consider higher deductibles to lower your premiums, but make sure you have enough savings to cover the deductible if necessary. Remember, a cost-effective plan is not just about saving money today but ensuring long-term financial protection.

- Evaluate your insurance needs regularly.

- Consider policy bundling for discounts.

- Utilize online comparison tools for better deals.

- Opt for higher deductibles if financially feasible.

Unveiling Essential Policies for Every Budget

When crafting an insurance portfolio that aligns with both your needs and budget, understanding key policies is crucial. The first step is to focus on coverage essentials. These typically include health, auto, and home insurance, which form the backbone of any sound financial strategy. Each of these policies can be customized with varying levels of coverage, allowing you to prioritize what matters most while managing costs effectively.

- Health Insurance: Consider plans with higher deductibles to reduce monthly premiums, but ensure they still cover critical health needs.

- Auto Insurance: Look for discounts such as safe driver or multi-policy to maximize savings without sacrificing coverage.

- Home Insurance: Evaluate the balance between the cost of premiums and the value of protection for your property and belongings.

Additionally, it’s wise to explore supplemental policies that enhance your coverage without breaking the bank. Options like umbrella insurance can provide extra liability protection, while disability insurance safeguards your income in case of unforeseen circumstances. By strategically selecting these policies, you can build a robust insurance portfolio that offers peace of mind and financial security.

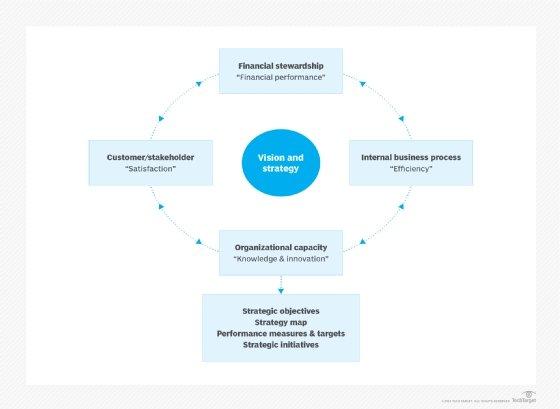

Mastering the Art of Risk Assessment

To craft a robust insurance portfolio, one must first delve into the nuances of evaluating potential risks. This involves a keen understanding of your personal or business vulnerabilities and the likelihood of those risks materializing. Begin by identifying all possible threats—from natural disasters to economic downturns—and then prioritize them based on their impact and probability. A well-rounded risk assessment doesn’t stop at identification; it also includes an analysis of your current coverage to pinpoint any gaps. Consider asking yourself:

- What are the most significant risks I’m exposed to?

- How likely is each risk to occur?

- What financial impact would these risks have?

Once you’ve got a clear picture, align your insurance products to address these risks, ensuring each policy serves a specific purpose. For an affordable yet effective approach, explore policies that offer broad coverage with flexible terms. Look into bundling options, as insurers often provide discounts for multiple policies. Remember, a well-assessed portfolio not only safeguards your assets but also empowers you with the peace of mind to navigate life’s uncertainties confidently.

Maximizing Value with Strategic Policy Selection

Choosing the right mix of insurance policies is akin to crafting a masterpiece—every stroke must be intentional to reveal a cohesive whole. To truly maximize value, it’s crucial to align your insurance portfolio with your specific needs and financial goals. Start by evaluating your current coverage and identifying any gaps or overlaps. Consolidation can often lead to discounts and streamlined management, while eliminating redundant policies can free up resources for more critical coverage.

- Assess your risk tolerance and adjust your deductibles accordingly—higher deductibles can lower premiums, but ensure they remain manageable in an emergency.

- Explore bundling options offered by insurers, which can lead to substantial savings without compromising on coverage quality.

- Regularly review and update your policies to adapt to life changes, ensuring your protection evolves with your circumstances.

By strategically selecting and adjusting your policies, you create an affordable insurance portfolio that offers robust protection without unnecessary expenditure. This thoughtful approach not only safeguards your assets but also enhances your peace of mind.