In the complex world of financial planning, life insurance stands out as a fundamental tool for safeguarding the future of loved ones. However, the standard life insurance policy is often just the starting point for creating a tailored coverage plan. Enter life insurance riders—optional provisions that can be added to a policy to enhance its benefits and address specific needs. Understanding these riders and how they work is crucial for anyone looking to maximize the effectiveness of their life insurance coverage. This article aims to demystify life insurance riders, exploring the various types available, their potential benefits, and the considerations policyholders should weigh when customizing their insurance plan. Whether you are new to life insurance or looking to optimize an existing policy, gaining insight into these riders can empower you to make informed decisions that align with your financial goals and personal circumstances.

Types of Life Insurance Riders and Their Unique Benefits

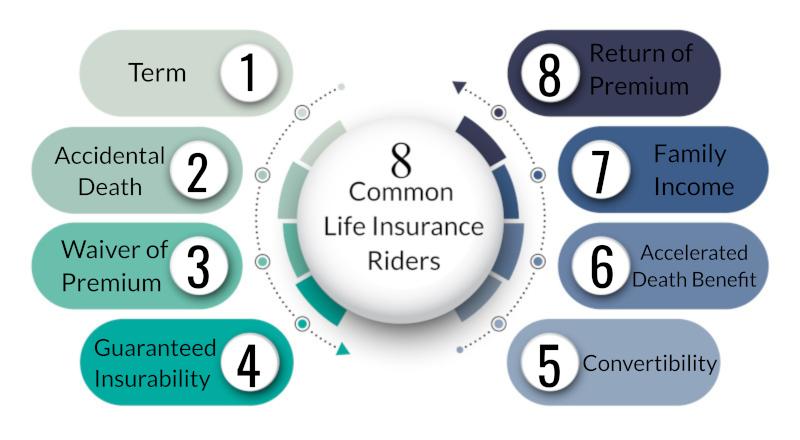

Life insurance riders offer policyholders an opportunity to customize their coverage by adding specific benefits tailored to their unique needs. Here are some of the most common types of life insurance riders and the distinct advantages they offer:

- Accidental Death Benefit Rider: This rider provides an additional payout if the insured dies as a result of an accident. It’s an attractive option for those seeking extra financial protection for their beneficiaries in unforeseen circumstances.

- Waiver of Premium Rider: If the policyholder becomes disabled and unable to work, this rider ensures that the life insurance premiums are waived, allowing the policy to remain in force without financial strain.

- Critical Illness Rider: Offers a lump sum payment if the insured is diagnosed with a serious illness, such as cancer or heart disease, providing financial support for medical expenses and lifestyle adjustments.

- Child Term Rider: This rider provides coverage for the insured’s children, offering peace of mind that they are financially protected in the event of an untimely death.

By understanding these riders and their benefits, policyholders can better tailor their life insurance policies to align with their financial goals and personal circumstances.

Evaluating the Cost-Benefit Ratio of Adding Riders to Your Policy

When considering the addition of riders to your life insurance policy, it’s essential to weigh the costs against the benefits they offer. Riders can provide valuable extra coverage, but they come with additional premiums. Here are some factors to consider:

- Financial Impact: Assess how the rider affects your overall premium. Determine whether the increased cost fits comfortably within your budget without compromising other financial goals.

- Coverage Needs: Identify if the rider meets a specific need that your base policy doesn’t cover, such as critical illness or accidental death benefits.

- Long-term Value: Consider the potential benefits of the rider over time. Will it provide peace of mind or financial support in the future?

Ultimately, the decision should be based on a thorough evaluation of your current financial situation, future needs, and how these additional features align with your overall insurance strategy.

How to Choose the Right Life Insurance Riders for Your Needs

When tailoring your life insurance policy, selecting the appropriate riders can be crucial in ensuring comprehensive coverage that aligns with your specific circumstances. Consider your personal and financial needs as a starting point. If you have dependents who rely heavily on your income, an income replacement rider might be essential. Alternatively, if you anticipate future financial burdens, such as children’s education or mortgage payments, a family income benefit rider could offer additional security. By understanding your priorities, you can better navigate the various options available.

It’s also important to evaluate potential health concerns or lifestyle factors that might influence your decision. For instance, a critical illness rider can provide a lump sum payment if you’re diagnosed with a serious illness, offering peace of mind and financial support during challenging times. Similarly, if you have a high-risk occupation or hobby, an accidental death benefit rider could be beneficial. As you explore these options, consult with an insurance advisor to ensure your selections complement your overall financial strategy and provide the protection you need.

Common Mistakes to Avoid When Selecting Life Insurance Riders

When delving into the realm of life insurance riders, it’s crucial to steer clear of certain pitfalls that can compromise your financial security. Overlooking the fine print is a common blunder; many policyholders neglect to thoroughly understand the terms and conditions, leading to unforeseen limitations. Riders often come with specific exclusions and requirements that could affect your coverage. Additionally, choosing unnecessary riders can inflate your premiums without adding real value. It’s important to assess your personal needs and circumstances to ensure that each rider you select serves a distinct purpose.

- Ignoring future needs: Life circumstances change, and what seems unnecessary now might become essential later. Consider potential life changes, such as marriage or having children, when selecting riders.

- Focusing solely on cost: While budget is important, opting for the cheapest riders might mean sacrificing important benefits. Balance cost with coverage to find the best fit for your situation.

- Neglecting professional advice: Consulting with a financial advisor or insurance expert can provide insights that you might overlook. Their expertise can guide you in making informed decisions tailored to your needs.

By recognizing these common mistakes, you can make more informed choices that enhance the value and protection of your life insurance policy.