Imagine cruising down the highway, the sun setting in a brilliant display of oranges and pinks, your favorite playlist setting the perfect mood. You’re not just enjoying the drive; you’re also on a mission to prove just how safe and responsible a driver you are. In the world of car insurance, this isn’t just a point of pride—it’s an opportunity to save money. Welcome to the realm of telematics, where your driving habits are tracked to potentially unlock discounts on your insurance premiums. But can these telematics discounts really lower your premiums enough to make a difference? Buckle up as we explore the ins and outs of this innovative approach, and see if it’s time for you to take the wheel on this cost-saving journey.

Unlocking Savings: How Telematics Can Transform Your Insurance Costs

In today’s digital age, telematics technology is reshaping the landscape of car insurance by offering a dynamic way to save. Through small devices installed in your vehicle or apps on your smartphone, telematics monitors driving habits in real-time. Safe drivers can potentially unlock significant discounts by demonstrating responsible behaviors such as smooth braking, moderate acceleration, and adherence to speed limits. These savings not only reward careful driving but also encourage safer roads for everyone.

Embracing telematics can be a game-changer for those eager to reduce their insurance premiums. Here’s how you can benefit:

- Real-time Feedback: Get immediate insights into your driving patterns, helping you make safer choices on the road.

- Customized Discounts: Insurance companies offer personalized discounts based on your specific driving data, rewarding you for low-risk behavior.

- Increased Awareness: By actively monitoring your habits, you’ll develop a heightened sense of responsibility behind the wheel.

By opting into telematics, you not only potentially lower your costs but also contribute to a culture of safety and accountability on the roads.

Navigating the Road to Lower Premiums with Telematics Discounts

For those who cherish the thrill of the open road yet yearn for lighter insurance premiums, telematics offers a promising solution. By leveraging technology that monitors your driving habits, insurers can provide discounts tailored to your individual performance. Imagine being rewarded for cautious cornering, steady speeds, and gentle braking. Not only do these discounts serve as a nod to your safe driving skills, but they also pave the way for more conscious and responsible road behavior.

- Personalized Savings: Unlike traditional insurance models, telematics allows for a personalized approach, ensuring that you’re not paying for someone else’s risky behavior.

- Behavioral Feedback: Receive insights into your driving habits, empowering you to make informed changes and potentially save even more.

- Eco-Friendly Impact: By promoting smoother driving, telematics can also contribute to reduced emissions, making your journey not just safer, but greener.

Embracing telematics is more than just a financial decision—it’s a commitment to safety, sustainability, and smart driving. So, buckle up and let technology guide you to savings that truly reflect your dedication to the road.

Understanding the Impact of Safe Driving Data on Your Insurance Bill

In the realm of auto insurance, the advent of telematics has ushered in a new era of personalized premiums. This technology leverages real-time data collected from your vehicle to assess driving behaviors, offering a tangible connection between how you drive and what you pay. Imagine your insurance bill reflecting your unique driving style, rewarding you for every careful lane change and gentle stop. Telematics discounts could potentially revolutionize your insurance premiums, providing savings that align with your commitment to safe driving.

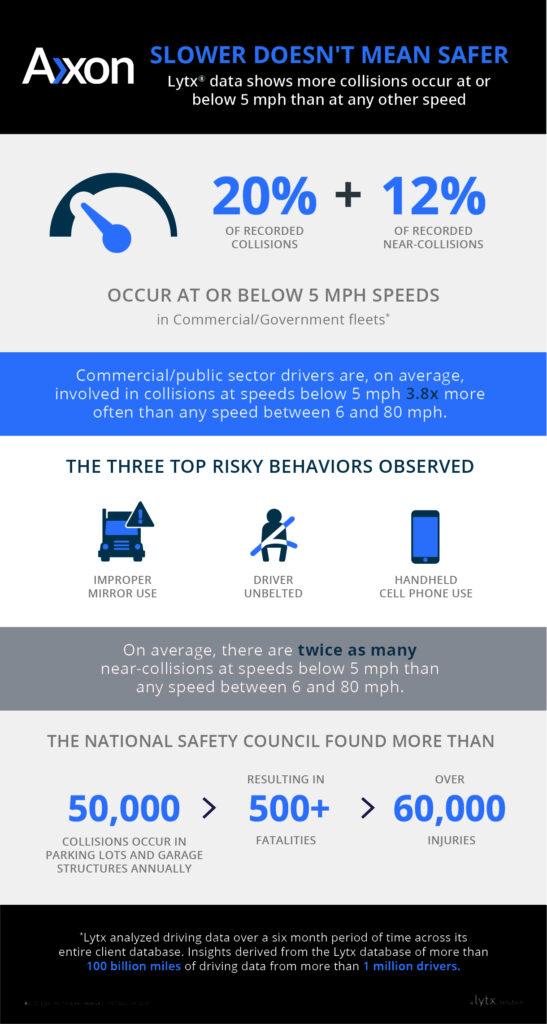

Many insurers are now offering incentives for drivers who embrace telematics. These programs typically monitor aspects such as:

- Speeding habits

- Braking patterns

- Time of day when driving

- Mileage driven

Each of these elements contributes to a comprehensive profile of your driving habits. The better your score, the higher the potential discount on your premium. This tailored approach not only rewards safety but also encourages drivers to adopt more cautious driving behaviors, ultimately fostering safer roads for everyone.

Smart Strategies for Maximizing Your Telematics Benefits

Unlocking the full potential of telematics requires more than just installing a device in your vehicle. To truly maximize your benefits, consider these smart strategies. Start by understanding the metrics that your insurer values most, such as braking patterns, speed consistency, and driving times. Tailoring your driving habits around these parameters can help you improve your score and potentially lower your premiums.

- Consistent Driving: Aim for smooth acceleration and braking. Avoid erratic speed changes to show insurers your commitment to safety.

- Time Your Drives: If possible, plan your trips to avoid peak traffic hours. Less congestion often leads to safer driving conditions and better telematics scores.

- Regularly Review Feedback: Many telematics programs offer real-time feedback. Use this data to continually refine your driving habits.

By implementing these strategies, not only can you enhance your driving experience, but you may also see a tangible reduction in your insurance costs. Remember, it’s all about creating a safer, more efficient driving routine that benefits both you and your insurer.