Imagine a world where your insurance premiums are no longer a monthly dread but a manageable part of your financial landscape. A world where saving money on insurance becomes as satisfying as finding that hidden gem in a thrift store or scoring the last slice of your favorite pie. Welcome to your guide on reducing insurance premiums for better financial health—a friendly, insightful journey to help you keep more of your hard-earned cash in your pocket. Whether you’re a seasoned policyholder or a newcomer to the world of insurance, this article will arm you with practical tips and creative strategies to trim those premiums and enhance your financial well-being. So, grab a cozy seat and a cup of your favorite brew, and let’s embark on this money-saving adventure together!

Uncover Hidden Discounts and Boost Your Savings

Unlocking hidden discounts on your insurance premiums can be a game-changer for your wallet. Start by reviewing your current policies with a fine-tooth comb to identify potential savings opportunities. Many insurers offer discounts that aren’t always advertised, so it’s crucial to ask about any available savings. Here are a few strategies to get you started:

- Bundle Your Policies: Consider consolidating your insurance policies under one provider. Combining home, auto, or even life insurance can lead to significant discounts.

- Increase Your Deductible: Opting for a higher deductible can lower your premium significantly. Just ensure that you can afford the out-of-pocket cost if you need to file a claim.

- Leverage Loyalty Discounts: Staying with the same insurer for an extended period may qualify you for loyalty rewards, which can reduce your premiums over time.

Additionally, maintaining a good credit score and installing safety devices like smoke detectors or anti-theft systems can further cut costs. By taking these steps, you not only reduce your premiums but also enhance your overall financial health, leaving more room in your budget for other essentials.

Revamp Your Coverage: Tailor Your Plan to Fit Your Needs

Personalizing your insurance plan is a savvy way to not only reduce your premiums but also ensure you’re not paying for coverage you don’t need. Start by reviewing your current policy and identifying any areas where you might be over-insured. For instance, if you own an older vehicle, consider dropping collision coverage if it’s not cost-effective. Bundle your policies to take advantage of multi-policy discounts, often available when you combine auto and home insurance with the same provider. This can lead to significant savings while simplifying your billing process.

Next, adjust your deductible to suit your financial situation. A higher deductible usually means a lower premium, but make sure it’s an amount you can comfortably pay out of pocket if needed. It’s also wise to regularly shop around and compare quotes from different insurers. Look for discounts such as those for being a safe driver, having a good credit score, or even being a member of certain organizations. By customizing your coverage to align with your lifestyle and needs, you’ll not only save money but also gain peace of mind knowing you’re adequately protected.

- Review and adjust coverage limits

- Consider policy bundling

- Increase deductibles wisely

- Shop for competitive quotes

- Seek out available discounts

Elevate Your Credit Score: The Secret to Lower Premiums

Did you know that a stellar credit score could be your golden ticket to reduced insurance premiums? That’s right! Insurers often use credit scores as a measure of your financial responsibility, which can directly impact the rates they offer you. By taking proactive steps to improve your credit score, you can unlock a world of savings. Here’s how:

- Pay Your Bills on Time: Consistently paying your bills before the due date can significantly boost your credit score.

- Keep Credit Card Balances Low: High balances can negatively affect your credit utilization ratio. Aim to keep it below 30%.

- Limit New Credit Inquiries: Each new application for credit can ding your score. Apply only when necessary.

- Check Your Credit Report Regularly: Mistakes happen! Review your report for errors and dispute any inaccuracies promptly.

By focusing on these key strategies, you’ll not only enhance your credit score but also position yourself to negotiate better insurance premiums, contributing to a healthier financial future.

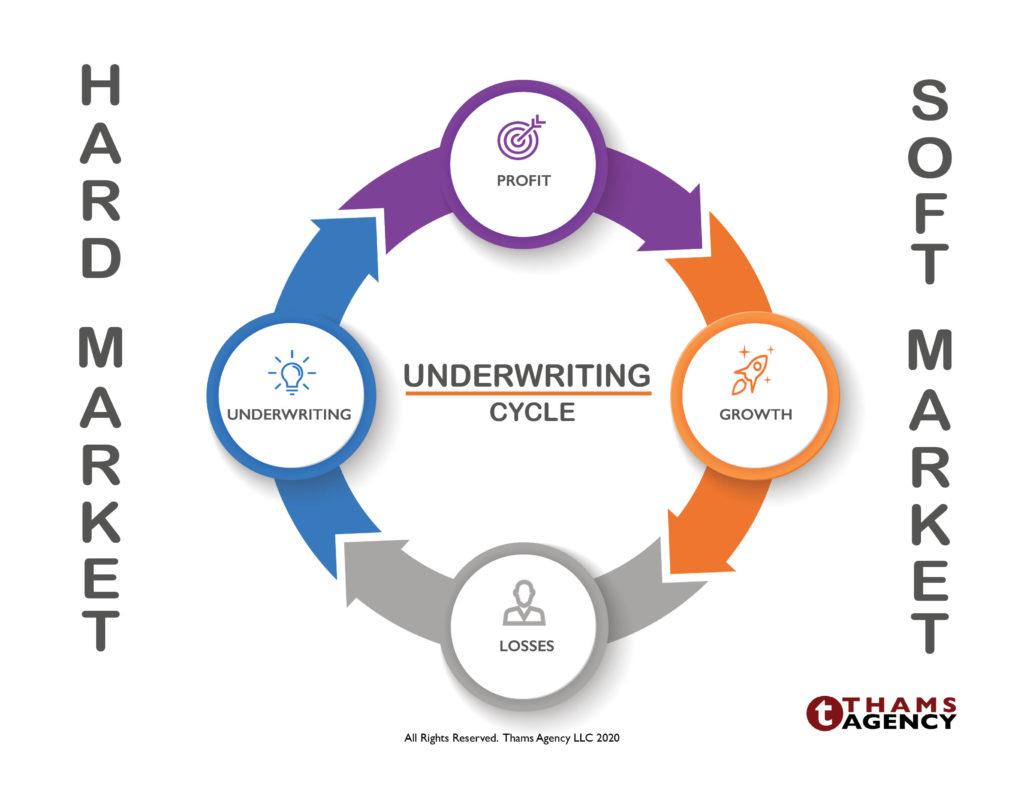

Smart Shopping: Compare and Conquer the Insurance Market

When it comes to insurance, navigating the myriad of options can feel like an overwhelming task. But with a smart shopping approach, you can turn this daunting process into a savvy financial strategy. Start by harnessing the power of comparison tools online. These tools allow you to see side-by-side comparisons of different insurance providers, helping you pinpoint policies that offer the best value for your needs. Remember, the lowest premium isn’t always the best choice; consider the coverage and benefits each policy offers. Thorough research can reveal hidden gems that might not be the cheapest, but offer the best long-term savings.

To further reduce your insurance premiums, consider the following strategies:

- Bundle your policies: Many providers offer discounts if you purchase multiple types of insurance, such as home and auto, from them.

- Raise your deductible: Opting for a higher deductible can significantly lower your monthly premiums, though it means you’ll pay more out-of-pocket in the event of a claim.

- Maintain a good credit score: Insurers often use credit information to price auto and home insurance policies, so a better score could mean lower rates.

- Take advantage of discounts: From being a safe driver to installing home security systems, many insurers offer a variety of discounts that can add up to substantial savings.