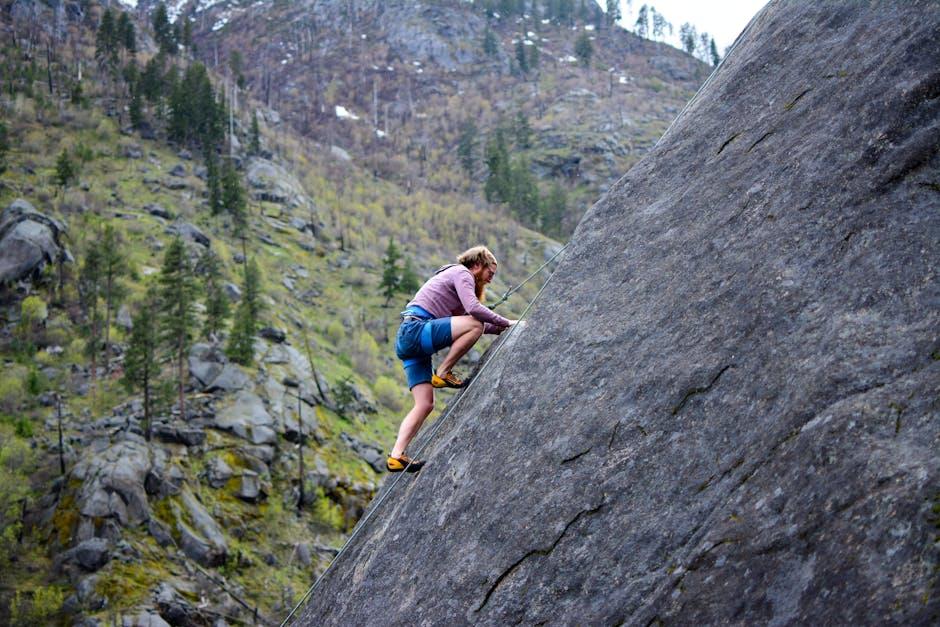

Traveling to high-risk destinations can be an exhilarating adventure, offering the allure of untamed landscapes and unique cultural experiences. However, with such journeys come inherent risks that require careful planning and preparation. One of the most crucial steps in safeguarding your travel plans is ensuring your insurance policy adequately covers these high-risk locales. In this guide, we will walk you through the essential considerations and actions to take to secure comprehensive travel insurance coverage. From understanding policy exclusions to selecting the right insurer, our aim is to equip you with the knowledge and confidence to embark on your adventure, knowing you are well-protected against unforeseen challenges.

Understanding High Risk Destinations in Travel Insurance

Traveling to high-risk destinations can be an exhilarating experience, offering unique adventures and opportunities to explore less-trodden paths. However, ensuring your travel insurance adequately covers these areas is crucial. High-risk destinations often refer to regions affected by political instability, natural disasters, or high crime rates. When choosing travel insurance, it’s important to review the policy details meticulously. Look for exclusions related to specific countries or activities, and ensure the policy includes coverage for emergency evacuations and medical expenses in remote locations.

Consider the following tips to ensure comprehensive coverage:

- Check Government Advisories: Insurance policies often align with government travel advisories. If a destination is marked as high-risk, coverage might be limited.

- Contact Your Insurer: Directly communicate with your insurance provider to clarify coverage details and discuss any additional premiums required for high-risk areas.

- Look for Specialized Insurers: Some companies specialize in high-risk travel insurance, offering tailored policies that cover a wider range of risks.

- Read the Fine Print: Pay close attention to the terms and conditions, especially regarding exclusions and claim procedures in high-risk zones.

By taking these proactive steps, you can embark on your adventure with peace of mind, knowing that you’re prepared for any eventuality.

Evaluating Policy Exclusions and Limitations for High Risk Areas

When planning a trip to a high-risk destination, it’s crucial to thoroughly examine the policy exclusions and limitations of your travel insurance. Many insurance policies have specific clauses that exclude coverage for areas deemed high-risk due to political instability, natural disasters, or health epidemics. Before purchasing, ensure the policy explicitly includes coverage for your intended destination. Pay close attention to the policy’s definition of “high-risk” and check if there are any geographical restrictions.

Consider the following when evaluating your policy:

- Political and Security Risks: Does the policy cover incidents related to political unrest or terrorism?

- Natural Disasters: Are there exclusions for specific natural events common to the area, such as earthquakes or floods?

- Health and Epidemics: Is there coverage for medical emergencies related to outbreaks or pandemics?

Being aware of these limitations can save you from unexpected expenses and ensure you are adequately protected during your travels.

Communicating with Your Insurer for Comprehensive Coverage

When planning a trip to a high-risk destination, effective communication with your insurer is crucial to ensure your travel insurance provides the necessary coverage. Start by clearly outlining your travel itinerary and any specific activities you intend to undertake that may require additional coverage. This clarity helps your insurer understand your needs and assess any potential risks. Don’t hesitate to ask detailed questions, such as:

- Are natural disasters or political unrest covered in my policy?

- What medical emergencies are included, and are there any exclusions?

- Does my policy cover evacuation or repatriation if needed?

- Are there any additional endorsements or riders required for comprehensive coverage?

Document all communications with your insurer, including emails and phone calls, to have a record of the discussions and agreements. If there are any uncertainties, request clarification in writing. By maintaining an open and proactive dialogue, you ensure that you have a clear understanding of what your policy entails and can travel with peace of mind knowing you’re adequately protected.

Strategically Enhancing Your Travel Insurance for High Risk Travel

When planning a journey to high-risk destinations, it’s essential to ensure your travel insurance is up to the task. Begin by thoroughly reviewing your current policy to identify any gaps in coverage. Focus on aspects like emergency medical evacuation, political evacuation, and natural disaster coverage. If these are not adequately covered, it’s time to upgrade your policy or look for a specialized insurer that caters to high-risk travel.

Consider the following strategies to bolster your travel insurance plan:

- Research Specialized Providers: Look for insurers known for covering high-risk regions and activities.

- Customizable Policies: Opt for plans that allow you to add riders for specific risks pertinent to your destination.

- Consult Experts: Engage with travel advisors or risk management consultants who specialize in high-risk travel.

- Stay Informed: Regularly check government advisories and adjust your insurance coverage accordingly.