When planning a travel insurance providers for family vacations abroad”>family vacation, the excitement of exploring new destinations and creating lasting memories often takes center stage. However, amidst the anticipation, one crucial aspect that should never be overlooked is securing travel insurance. This essential step is not just a precaution; it’s a strategic move that ensures peace of mind and financial protection against unforeseen circumstances. From medical emergencies to trip cancellations, travel insurance serves as a reliable safety net, safeguarding your family’s well-being and investment. In this article, we will explore the compelling reasons why travel insurance should be a non-negotiable part of your family vacation planning, empowering you to embark on your adventures with confidence and assurance.

Understanding the Essential Coverage for Family Travel

When planning a family vacation, ensuring comprehensive protection is crucial. Travel insurance is not just a safety net; it’s a necessity. Here are some key components of essential coverage that every family should consider:

- Medical Emergencies: Ensure your policy covers unexpected illnesses or injuries, which can lead to substantial medical expenses, especially abroad.

- Trip Cancellation and Interruption: Protect your investment from unforeseen events such as illness, severe weather, or family emergencies that could force you to cancel or cut short your trip.

- Baggage Loss and Delay: Coverage for lost or delayed luggage can be a lifesaver, especially when traveling with children who may need immediate access to essentials.

- Emergency Evacuation: This is critical if you’re traveling to remote areas where medical facilities are scarce, ensuring you can be transported to a hospital quickly.

- Personal Liability: In the event of an accident where you are held responsible for injury or damage, this coverage can prevent significant financial burdens.

By selecting a travel insurance plan that includes these elements, families can enjoy their vacations with peace of mind, knowing they are protected against potential risks and financial setbacks.

Protecting Your Loved Ones from Unexpected Medical Emergencies

When embarking on a family vacation, the last thing you want to think about is the possibility of a medical emergency. However, unforeseen events can happen anywhere, and being prepared is essential. Travel insurance acts as a safety net, ensuring that you and your loved ones are covered in case of unexpected health issues while away from home. This coverage can provide peace of mind, knowing that you have access to necessary medical care without the burden of exorbitant costs. In many countries, healthcare expenses can quickly escalate, but with the right travel insurance, you can avoid these financial pitfalls and focus on what truly matters—enjoying your time with family.

- Access to quality healthcare: Most travel insurance policies offer access to top-notch medical facilities and professionals, ensuring that your family receives the best care possible.

- Coverage for a wide range of emergencies: From minor injuries to more serious medical conditions, travel insurance can cover hospital stays, doctor visits, and even emergency evacuations.

- Support services: Many policies include 24/7 assistance, providing you with immediate support and guidance in case of a medical emergency.

- Financial protection: Avoid unexpected out-of-pocket expenses that can strain your vacation budget and affect your financial stability.

Ensuring Peace of Mind with Trip Cancellation and Interruption Benefits

When planning a family vacation, unexpected events can disrupt even the most carefully crafted itineraries. Trip cancellation and interruption benefits are invaluable components of travel insurance, providing a safety net that ensures your travel plans remain as stress-free as possible. These benefits offer financial protection for a range of unforeseen circumstances, such as sudden illness, natural disasters, or family emergencies, that may force you to cancel or cut short your trip. This means you can recover non-refundable expenses, such as flights and accommodations, allowing you to focus on what truly matters—enjoying quality time with your loved ones.

- Comprehensive Coverage: From flight delays to unexpected cancellations, you’re covered for a wide array of disruptions.

- Financial Security: Reimbursement for pre-paid, non-refundable travel expenses ensures you don’t lose money on unforeseen cancellations.

- Peace of Mind: Travel with confidence knowing that your investment is protected against the unpredictable.

- Flexibility: Allows for changes in travel plans without incurring additional costs, safeguarding your vacation investment.

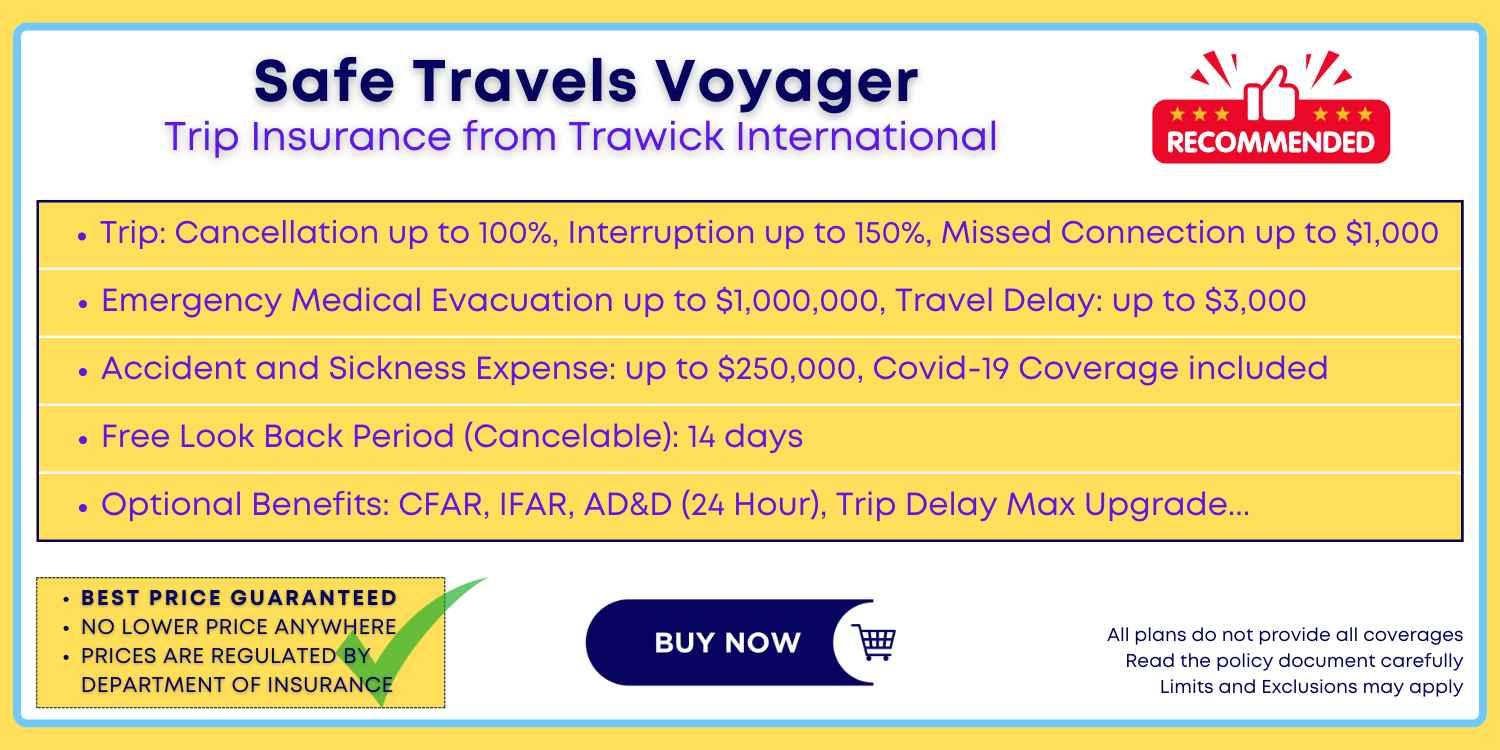

Maximizing Value: Tips for Choosing the Best Family Travel Insurance

Choosing the right family travel insurance can be daunting, but ensuring you maximize value is key. Start by assessing your family’s specific needs. Consider the ages of all travelers, any pre-existing medical conditions, and the type of activities planned. Comprehensive coverage should include medical emergencies, trip cancellations, lost luggage, and unexpected delays. Don’t settle for the cheapest option without comparing what’s included, as the best policy balances cost with coverage quality.

When evaluating options, look for these features:

- Family discounts: Some insurers offer special rates for families traveling together.

- Kids travel free: Policies where children are included at no extra cost can be a great value.

- Flexible policy terms: Consider insurers that allow easy modifications or extensions.

- 24/7 assistance: Ensure the provider offers round-the-clock support in multiple languages.

By focusing on these aspects, you’ll ensure peace of mind and financial protection, allowing you to fully enjoy your family vacation.