As the landscape of work continues to evolve, the rise of remote work and the travel insurance for digital nomads and remote workers”>digital nomad lifestyle has introduced a new set of challenges and considerations for professionals around the globe. Among these is the critical need for comprehensive travel insurance plans tailored to the unique circumstances faced by individuals who work from diverse locations, often crossing international borders. This article delves into the best travel insurance options available for remote workers and digital nomads, offering an analytical comparison of coverage features, costs, and benefits. By examining the nuances of each plan, we aim to equip readers with the knowledge necessary to make informed decisions that align with their dynamic lifestyles and ensure peace of mind while working from anywhere in the world.

Understanding the Unique Needs of Remote Workers and Digital Nomads

Remote workers and digital nomads have distinct lifestyles that significantly influence their insurance needs. Unlike traditional travelers, these individuals often require coverage that addresses both work-related and personal circumstances. Flexibility is paramount, as their plans might change frequently. Global coverage is another critical aspect, ensuring they are protected no matter where their work takes them. Furthermore, the ability to easily adjust coverage options is essential to accommodate varying durations of stay in different countries.

- Health and Medical Coverage: Given the extended periods abroad, comprehensive medical insurance is crucial, covering routine check-ups, emergency care, and even telehealth services.

- Gadget Protection: For individuals relying heavily on technology, insurance for laptops, smartphones, and other essential devices is a necessity.

- Trip Interruption and Cancellation: Flexibility to manage unexpected changes in travel plans due to work commitments or global events.

- Liability Insurance: Protection against potential legal issues that might arise while working in various jurisdictions.

By understanding these unique requirements, remote workers and digital nomads can select insurance plans that provide peace of mind and enable them to focus on their work and adventures without worry.

Evaluating Coverage Options for Health, Equipment, and Travel Interruptions

When assessing the myriad of insurance options available to digital nomads and remote workers, it’s crucial to consider the unique blend of coverage needed to safeguard against unexpected health, equipment, and travel interruptions. Health insurance should prioritize global coverage with an emphasis on access to quality care in multiple countries. Look for plans that offer emergency evacuation and telemedicine services, as these features can be indispensable when working from remote locations.

For equipment, consider insurance that covers loss, theft, and accidental damage to essential devices like laptops and smartphones. This is especially important for those who rely on their gadgets for work. As for travel interruptions, comprehensive policies should include trip cancellation and delay coverage to mitigate financial losses due to unforeseen changes. When evaluating these plans, compare benefits such as coverage limits, deductibles, and claim processing times to ensure they align with your specific needs and lifestyle.

Analyzing the Cost-Benefit Ratio of Popular Insurance Providers

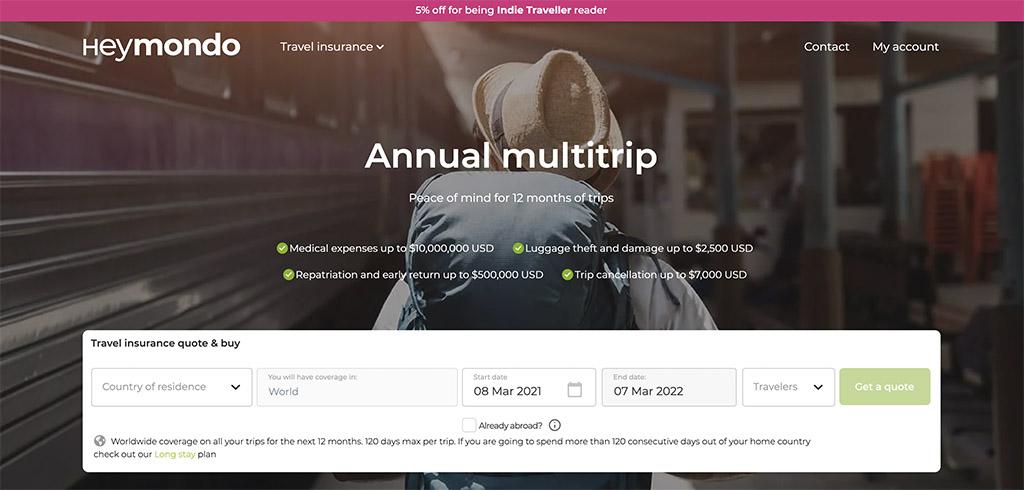

When evaluating the cost-benefit ratio of travel insurance providers for remote workers and digital nomads, it’s crucial to consider both the coverage offered and the price point. Comprehensive coverage is essential for those who are constantly on the move, ensuring protection against unforeseen circumstances like medical emergencies, trip cancellations, and lost belongings. However, balancing these benefits with the premium costs is key to maximizing value. Analyzing popular providers, such as World Nomads, SafetyWing, and Allianz, reveals distinct advantages and potential drawbacks.

- World Nomads: Known for its extensive coverage and flexibility, especially appealing to adventurous travelers. However, premiums can be on the higher side.

- SafetyWing: Offers a budget-friendly option with monthly subscriptions, but some users report limitations in claims processing and coverage specifics.

- Allianz: Provides robust global coverage and strong customer support, yet may have geographical restrictions and higher deductibles for certain regions.

By weighing these factors, digital nomads can select a provider that aligns with their travel lifestyle and financial considerations, ensuring peace of mind without compromising their budget.

Recommendations for Comprehensive and Flexible Travel Insurance Plans

When seeking an insurance plan that suits the dynamic lifestyle of remote workers and digital nomads, it’s essential to consider a few critical features that ensure both flexibility and comprehensive coverage. Coverage for medical emergencies is a top priority, including access to international healthcare networks and emergency evacuation services. Additionally, ensure your plan offers trip cancellation and interruption protection, which is invaluable when dealing with unexpected changes in travel plans due to work commitments or personal emergencies.

Look for policies that provide coverage for lost or stolen gear, particularly if you rely heavily on tech equipment for your work. Plans that offer flexible duration options allow you to tailor the coverage period to your specific travel schedule, while multi-country coverage ensures you’re protected as you cross borders. Some plans even include adventure sports coverage, perfect for those who enjoy exploring more active or risky pursuits during their downtime. Lastly, consider policies that offer 24/7 customer support to assist you anytime, anywhere.