In a world where every dollar counts, the labyrinth of insurance can often feel like a financial black hole, quietly siphoning away your hard-earned money. Yet, nestled within this intricate web lies an untapped potential for savings that many overlook. “Are You Paying Too Much for Insurance? Adjusting Your Plan to Save Money” is your guiding light through the fog of premiums and policies. This article dares to challenge the status quo, empowering you to take control of your financial destiny with confidence and clarity. Get ready to embark on a journey that transforms the mundane task of reviewing your insurance into a strategic maneuver that could unlock significant savings. It’s time to shift the balance of power in your favor, armed with knowledge and a fresh perspective. Let’s dive in and discover how a few savvy adjustments can lead to a healthier wallet and peace of mind.

Uncover Hidden Costs: The Silent Drain on Your Finances

Insurance is a necessity, but are you unknowingly overpaying for it? Often, policies come with hidden costs that can quietly drain your finances. These costs might include unnecessary coverage, high deductibles, or even outdated policy terms that no longer suit your lifestyle. It’s crucial to evaluate your insurance plans regularly to ensure you’re not paying for more than you need.

To start uncovering these hidden expenses, consider these strategies:

- Review Your Coverage: Analyze your current policies to identify any coverage you may not need or use.

- Compare Rates: Shop around and compare rates from different insurers to find the best deal.

- Adjust Deductibles: Increasing your deductible can significantly lower your premium if you’re financially prepared to handle a larger upfront cost in case of a claim.

- Ask for Discounts: Inquire about any available discounts you might qualify for, such as bundling multiple policies or maintaining a good credit score.

By taking these proactive steps, you can effectively reduce unnecessary expenses and optimize your insurance plans, ensuring your finances are protected without any silent drain.

Tailoring Your Coverage: Aligning Protection with Your Needs

Understanding your insurance needs is pivotal in crafting a plan that offers robust protection without overspending. The first step is assessing your current life situation, financial goals, and risk tolerance. Are you a homeowner, a renter, or perhaps a business owner? Each scenario requires different levels of coverage, and sometimes, policies overlap unnecessarily. By identifying and eliminating redundant coverages, you can reduce your premiums without sacrificing essential protection.

Consider the benefits of customizing your plan through optional endorsements or riders that better suit your lifestyle. For instance, if you drive infrequently, a pay-per-mile auto insurance might be more economical than a standard plan. Similarly, bundling different types of insurance, such as auto and home, can lead to significant discounts. Here are a few steps to streamline your coverage:

- Review your policies annually to ensure they align with your current needs.

- Consult with your insurance agent to explore available discounts and policy adjustments.

- Adjust deductibles according to your financial capacity; higher deductibles often mean lower premiums.

- Evaluate the necessity of each coverage option; remove or reduce those that are no longer relevant.

By aligning your insurance protection with your actual needs, you not only save money but also gain peace of mind, knowing you’re adequately covered against life’s uncertainties.

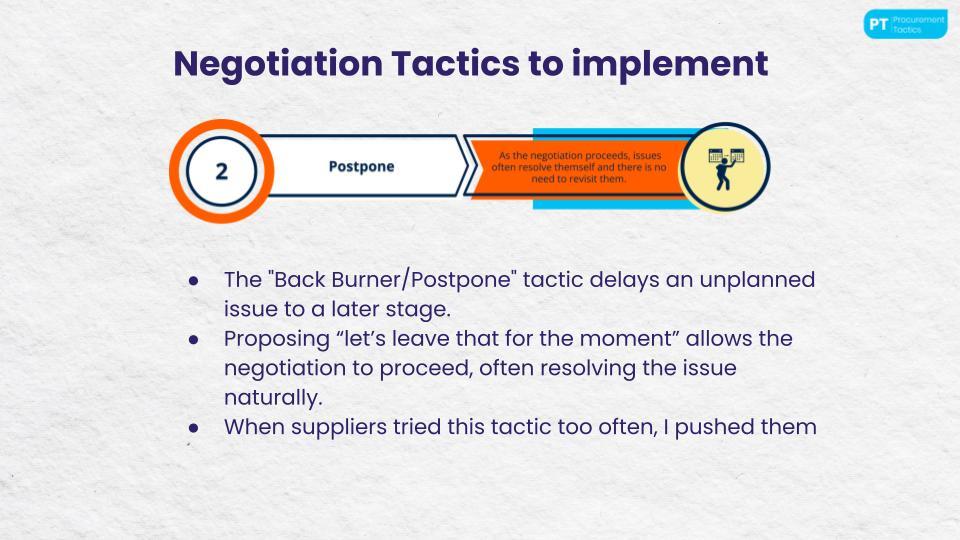

Master the Art of Negotiation: Tips for Lowering Premiums

Unlocking the secrets to lowering your insurance premiums begins with mastering the art of negotiation. It’s all about understanding your policy and identifying areas where you can push for a better deal. Start by reviewing your current coverage and assessing whether you truly need all the bells and whistles. Sometimes, policies include features that aren’t relevant to your situation, and removing these can lead to significant savings. Communicate openly with your insurance provider, demonstrating that you are an informed and proactive client. They may offer discounts or alternative plans to retain your business.

- Bundle Policies: Combining multiple types of insurance, like home and auto, often results in discounts.

- Increase Deductibles: Opt for a higher deductible to lower your premium, but ensure you can afford it in case of a claim.

- Leverage Loyalty: Long-term customers can often negotiate better rates; don’t hesitate to remind your insurer of your loyalty.

- Maintain a Good Credit Score: Insurers may offer lower premiums to individuals with strong credit histories.

- Shop Around: Don’t be afraid to compare quotes from different providers to ensure you’re getting the best deal.

Future-Proof Your Policy: Embracing Flexibility for Long-Term Savings

In an ever-evolving world, the ability to adapt is not just a survival skill; it’s a financial strategy. To safeguard your wallet, consider a flexible insurance policy that evolves with your needs and circumstances. A dynamic plan can not only offer peace of mind but also potential savings. Here’s how:

- Customized Coverage: Tailor your insurance to fit your current lifestyle, ensuring you’re not over-insured or paying for unnecessary coverage.

- Regular Reviews: Schedule annual policy check-ups to align with life changes such as new assets, family growth, or career shifts.

- Multi-Policy Discounts: Consolidate different types of insurance under one provider to benefit from bundling discounts.

- Deductible Adjustments: Opt for a higher deductible if you have the financial cushion to handle potential claims, which can significantly lower premiums.

By embracing flexibility, you not only protect yourself against unforeseen circumstances but also position yourself for long-term financial health. A well-adjusted policy is a cornerstone of a savvy financial strategy.