In the intricate world of insurance, understanding the nuances of your policy can be the difference between financial preparedness and unexpected out-of-pocket expenses. Central to this understanding is the concept of a deductible—a term frequently encountered yet often misunderstood by policyholders. This article delves into the essential role deductibles play in the insurance landscape, elucidating what they are, how they function, and the direct impact they have on your claims. By demystifying deductibles, we aim to equip you with the knowledge necessary to make informed decisions, ensuring that your insurance coverage aligns with your financial needs and risk tolerance. Whether you’re navigating health, auto, or home insurance, grasping the implications of your deductible is crucial for optimizing your coverage and minimizing your financial liability.

Understanding the Basics of Insurance Deductibles

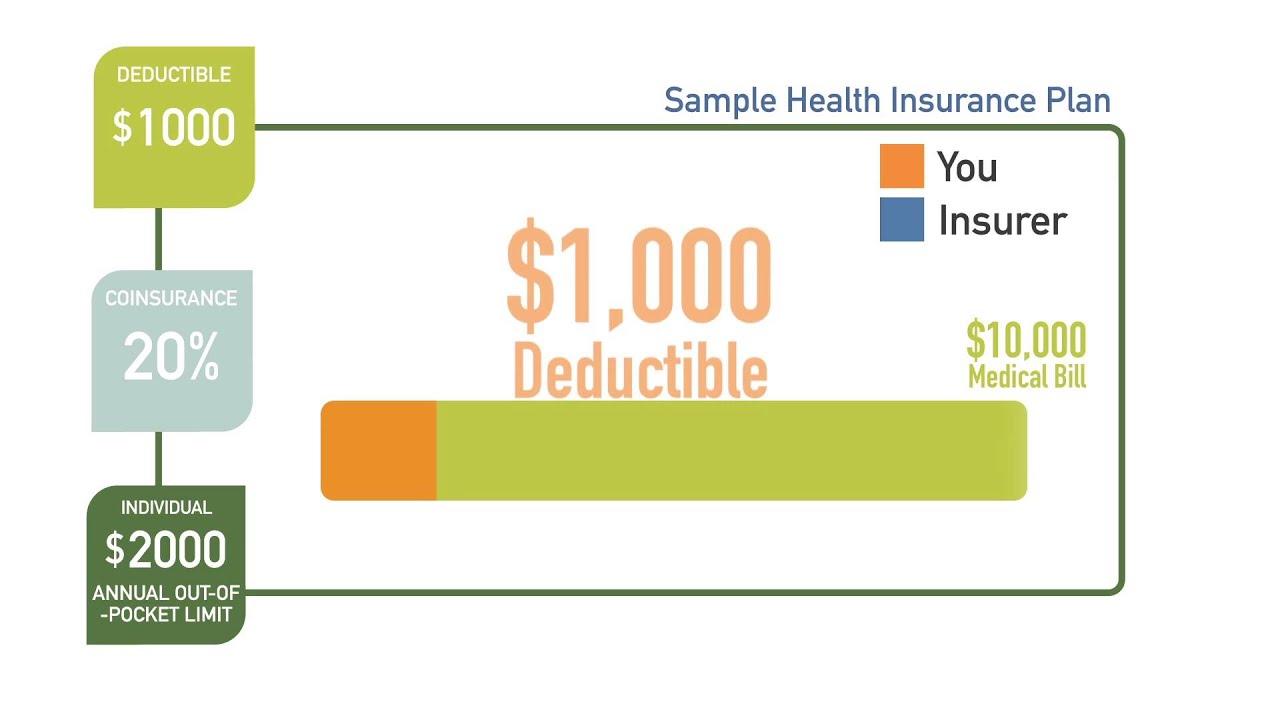

In the world of insurance, a deductible is a critical component that directly influences how your claim is processed. Essentially, it is the amount you, as the policyholder, must pay out-of-pocket before your insurance provider begins to cover the remaining costs of a claim. Understanding the nuances of deductibles can empower you to make informed decisions about your coverage. Here are some key points to consider:

- Types of Deductibles: Deductibles can be a fixed dollar amount or a percentage of the insured value. For instance, in health insurance, deductibles are often set as a specific dollar amount, whereas property insurance might use a percentage based on the value of the insured property.

- Impact on Premiums: Generally, a higher deductible means lower monthly premiums. This is because you are assuming more financial responsibility in the event of a claim, reducing the risk for the insurer.

- Claim Payouts: When you file a claim, the deductible amount is subtracted from the total payout. For example, if you have a $1,000 deductible and your claim is approved for $5,000, you would receive $4,000 from the insurer.

Choosing the right deductible involves balancing your ability to pay the deductible in the event of a claim with the desire for affordable premiums. Consider your financial situation and risk tolerance carefully when deciding on the deductible that best suits your needs.

The Role of Deductibles in Shaping Your Insurance Claims

When it comes to navigating the intricacies of insurance claims, understanding the role of deductibles is crucial. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. This financial threshold can significantly influence your decision-making process when filing a claim. Here’s how:

- Claim Frequency: Higher deductibles often discourage frequent claims, as policyholders may opt to cover smaller expenses themselves to avoid surpassing the deductible threshold.

- Premium Costs: Generally, choosing a higher deductible can lead to lower monthly premiums. This trade-off can be beneficial if you anticipate fewer claims.

- Financial Planning: It’s important to select a deductible that aligns with your financial capacity. A high deductible might save money on premiums, but ensure you’re prepared to cover it in the event of a claim.

Balancing these factors is essential for maximizing your insurance benefits while minimizing out-of-pocket expenses. By strategically selecting your deductible, you can tailor your insurance policy to better fit your financial situation and risk tolerance.

Strategies for Choosing the Right Deductible for Your Needs

When selecting a deductible, it’s crucial to consider your financial situation and risk tolerance. A higher deductible generally means lower premiums, but it also requires more out-of-pocket expenses in the event of a claim. Conversely, a lower deductible increases your premium but decreases your financial burden when a claim arises. Here are some strategies to help you decide:

- Evaluate Your Emergency Fund: Consider how much you have saved for unexpected expenses. If you have a robust emergency fund, a higher deductible might be a viable option.

- Assess Your Risk Level: Think about how often you anticipate making a claim. If you rarely file claims, a higher deductible could save you money over time.

- Analyze Your Budget: Review your monthly expenses and income. Ensure that you can comfortably afford the deductible you choose, without straining your finances.

By carefully weighing these factors, you can select a deductible that aligns with your personal and financial circumstances, ensuring peace of mind and financial stability.

Maximizing Your Claim Benefits by Managing Deductibles

Understanding how to effectively manage your deductible is crucial for maximizing the benefits of your insurance claim. A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in. Strategically choosing your deductible can have a significant impact on both your premiums and the amount you receive when you file a claim. To make the most out of your policy, consider these important factors:

- Evaluate Your Financial Situation: Opt for a higher deductible if you can afford it, as this typically lowers your monthly premiums. However, ensure you have sufficient funds to cover this amount in the event of a claim.

- Assess Risk Levels: Analyze the likelihood of needing to file a claim. For example, if you live in an area prone to natural disasters, a lower deductible might be more beneficial.

- Review Policy Terms Regularly: Insurance needs can change, so revisit your policy annually to adjust your deductible based on your current financial landscape and risk assessment.

By carefully managing your deductible, you can balance the cost of premiums with the protection you need, ensuring that you are well-prepared when the time comes to file a claim.