When planning a trip to a country known for its safety and stability, the question of whether to invest in travel insurance often arises. While it may be tempting to forego this added expense, assuming that a safe destination equates to a risk-free journey, the reality is more nuanced. Travel insurance is designed to cover a broad spectrum of unforeseen events that can disrupt even the most meticulously planned vacations. From unexpected medical emergencies to trip cancellations and lost luggage, the benefits of travel insurance extend far beyond the destination’s safety profile. This article delves into the reasons why purchasing travel insurance might still be a prudent decision, even when venturing to the most secure locales, ensuring peace of mind and financial protection against the unpredictable nature of travel.

Understanding the Basics of Travel Insurance Coverage

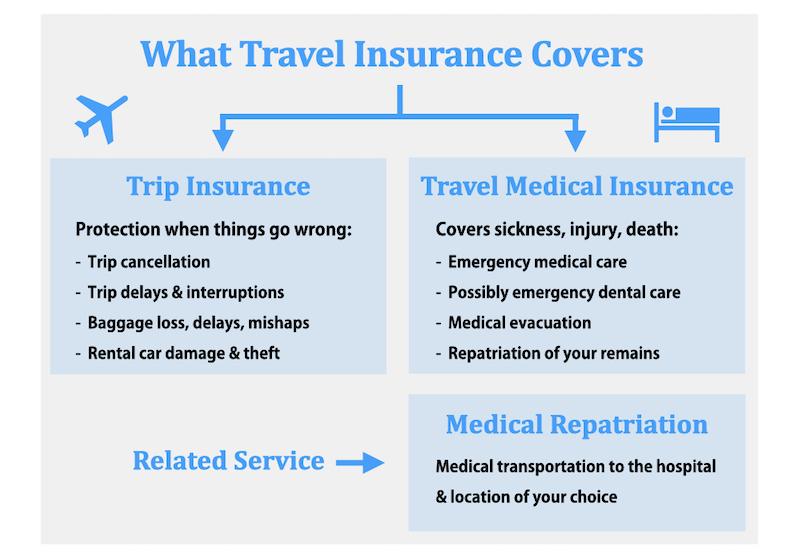

When considering travel insurance, it’s essential to understand what the coverage entails to make an informed decision. Travel insurance typically offers a range of protections that can be vital even when visiting countries perceived as safe. Here are some key components you should look for in a policy:

- Medical Coverage: This is crucial for covering unexpected medical expenses, which can arise from sudden illnesses or accidents, regardless of your destination’s safety.

- Trip Cancellation: Policies often cover non-refundable expenses if you need to cancel your trip due to unforeseen circumstances like illness or family emergencies.

- Luggage Protection: Lost or delayed luggage can be a major inconvenience, and having insurance can provide compensation for essential items.

- Travel Delay: Coverage for costs incurred from flight delays, such as accommodations and meals, can be a relief when plans go awry.

Even in safe countries, unexpected events can disrupt your travel plans, making travel insurance a valuable safety net. Understanding these basics ensures you’re not caught off guard, providing peace of mind on your journey.

Evaluating the Safety of Your Destination and Personal Needs

Before deciding whether to invest in travel insurance, it’s crucial to assess both the safety of your destination and your personal needs. Even if you’re traveling to a country that is generally considered safe, there are multiple factors that can influence your decision:

- Local Health Infrastructure: Consider the quality and accessibility of healthcare services at your destination. In countries with limited medical facilities, travel insurance can provide access to private healthcare.

- Personal Health Conditions: If you have pre-existing medical conditions, ensure your travel insurance covers these. Even in safe countries, medical emergencies can be costly.

- Activity Plans: Engaging in adventurous activities like hiking or water sports? Check if these are covered by your policy, as they may carry additional risks.

- Travel Disruptions: Even in safe regions, flight delays or cancellations can occur. Insurance can offer compensation for such inconveniences.

- Financial Investment: Consider the financial implications of your trip. If you’ve invested significantly in your travel plans, insurance can safeguard against unexpected cancellations or interruptions.

By evaluating these factors, you can make an informed decision about whether travel insurance is a necessary addition to your travel plans, even when visiting a safe country.

Cost-Benefit Analysis of Purchasing Travel Insurance for Safe Destinations

When contemplating the purchase of travel insurance for trips to destinations generally deemed safe, it’s essential to weigh the potential costs against the benefits. Travel insurance often covers unforeseen events that can happen anywhere, such as medical emergencies, trip cancellations, and lost luggage. While a safe country might not pose significant threats in terms of political stability or crime, unexpected incidents can still occur. Consider the following benefits:

- Medical Coverage: Even in safe countries, healthcare costs can be exorbitant for tourists. Insurance can provide peace of mind and financial protection against unexpected medical expenses.

- Trip Cancellations: Unpredictable circumstances, such as personal emergencies or natural events, can lead to trip cancellations. Insurance can help recover non-refundable expenses.

- Lost or Delayed Luggage: Mishandled luggage can disrupt any travel plan. Insurance can offer compensation for essential items and losses.

Ultimately, the decision hinges on your personal risk tolerance and financial situation. While traveling to a safe country reduces certain risks, the unpredictable nature of travel means that insurance can still be a valuable safety net.

Expert Recommendations for Choosing the Right Travel Insurance

When venturing to destinations deemed safe, it’s easy to overlook the need for travel insurance. However, even in the safest countries, unforeseen circumstances can arise. Experts suggest focusing on key factors when selecting a policy to ensure comprehensive protection:

- Medical Coverage: Even in safe countries, healthcare costs can be exorbitant for tourists. Ensure your policy covers medical emergencies, hospital stays, and evacuation if necessary.

- Trip Cancellation and Interruption: Look for policies that protect against unexpected cancellations due to illness, family emergencies, or even sudden geopolitical events.

- Baggage and Personal Belongings: Coverage for lost, stolen, or damaged luggage and personal items can provide peace of mind.

- Adventure Activities: If your itinerary includes activities like skiing or scuba diving, ensure your insurance covers potential risks associated with such activities.

By evaluating these factors, travelers can confidently select a travel insurance policy that aligns with their needs, providing a safety net regardless of the perceived safety of their destination.