In an increasingly interconnected world, the allure of travel continues to captivate individuals eager to explore new cultures and landscapes. However, for budget-conscious travelers, the excitement of planning a trip is often tempered by the need to safeguard their journey without straining their finances. This is where travel insurance becomes an essential consideration, providing a safety net against unforeseen events such as medical emergencies, trip cancellations, or lost belongings. Navigating the myriad of travel insurance options can be daunting, especially for those aiming to balance comprehensive coverage with affordability. This article delves into the best travel insurance plans tailored for budget travelers, offering an analytical comparison of their features, benefits, and limitations. By examining key factors such as cost, coverage limits, and customer service, we aim to equip budget travelers with the insights needed to make informed decisions that align with their financial constraints and travel aspirations.

Understanding Coverage Essentials for Budget Travelers

When planning an affordable getaway, it’s crucial to grasp the fundamentals of travel insurance to ensure you’re not blindsided by unexpected expenses. Budget travelers should focus on policies that cover the essentials without unnecessary frills. Key components to look for include:

- Medical Coverage: Ensure the plan includes adequate medical and emergency evacuation coverage, especially if you’re traveling to countries with high healthcare costs.

- Trip Cancellation: This protects against unforeseen events that might force you to cancel your trip, such as illness or severe weather.

- Baggage Loss and Delay: Opt for coverage that compensates for lost, stolen, or delayed luggage, which can be a lifesaver when you’re on a tight budget.

By focusing on these essentials, budget travelers can strike a balance between cost and coverage, ensuring peace of mind without breaking the bank.

Comparing Affordability and Benefits of Top Travel Insurance Plans

When evaluating travel insurance plans, budget travelers should consider both the affordability and the benefits offered by each option. Affordability is crucial, but the cheapest plan isn’t always the best choice if it lacks essential coverage. World Nomads is popular among backpackers and offers flexible pricing based on destination and duration. Although slightly pricier, it provides extensive coverage, including adventure sports, which is a significant advantage for thrill-seekers. In contrast, Allianz Global Assistance offers affordable plans with robust medical coverage, perfect for those prioritizing health and safety without breaking the bank.

- World Nomads: Flexible pricing, excellent for adventure sports.

- Allianz Global Assistance: Strong medical coverage, cost-effective.

InsureMyTrip is another noteworthy option, offering a comparison tool that allows travelers to filter plans based on their budget and required benefits. This feature is invaluable for those needing a tailored insurance solution. On the other hand, Travel Guard provides comprehensive packages with customizable options, ensuring travelers can opt for coverage that aligns with their specific needs. While slightly more expensive, these plans offer peace of mind with their extensive protection against trip cancellations and lost baggage.

- InsureMyTrip: Comparison tool for tailored plans.

- Travel Guard: Customizable packages, comprehensive protection.

Evaluating Customer Reviews and Satisfaction Ratings

When diving into the world of travel insurance for budget-conscious explorers, one critical factor is the voice of past users. Customer reviews and satisfaction ratings provide invaluable insights into the actual performance of these plans. Analyzing these reviews helps identify patterns and common experiences among travelers, ensuring you choose a plan that aligns with your needs. Travelers often share their experiences on platforms like Trustpilot and ConsumerAffairs, offering first-hand accounts of claims processing, customer service responsiveness, and overall reliability.

Consider the following when evaluating reviews:

- Claims Process: Look for feedback on how smoothly and quickly claims were handled.

- Customer Service: Note mentions of helpfulness and accessibility of support teams.

- Coverage Satisfaction: Assess if the coverage met expectations during unforeseen events.

- Value for Money: Consider whether customers felt the plan was worth the cost.

These insights, combined with detailed plan comparisons, can guide you to an informed decision, ensuring peace of mind during your travels without stretching your budget.

Recommendations for Maximizing Value on a Tight Budget

When searching for travel insurance plans that align with a budget-conscious lifestyle, it’s crucial to focus on plans that provide essential coverage without unnecessary frills. Here are some tips to ensure you’re getting the most value:

- Compare Multiple Providers: Use comparison tools to evaluate different insurers. Look for plans that offer competitive pricing but still cover major areas like medical emergencies, trip cancellations, and lost baggage.

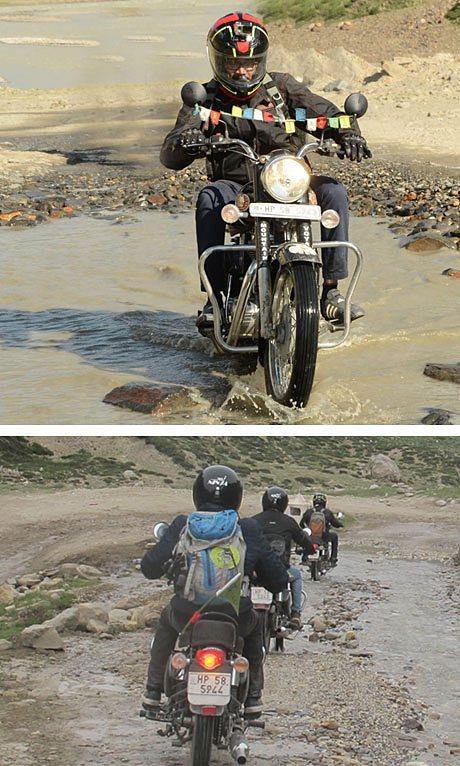

- Customize Your Coverage: Many insurers allow you to tailor your plan. Opt for basic coverage and add only the necessary extras that match your travel needs, such as coverage for adventure sports if you’re planning on partaking in high-risk activities.

- Consider Annual Plans: If you travel frequently, an annual travel insurance plan might be more cost-effective than single-trip policies. This way, you’re covered for multiple trips throughout the year, often at a reduced per-trip cost.

- Check for Discounts: Look for discounts through memberships with organizations like AAA or AARP, or loyalty programs from airlines or credit cards. These affiliations often provide access to exclusive insurance deals.

- Read the Fine Print: Ensure you understand what is and isn’t covered in your policy. Pay particular attention to exclusions and limits to avoid surprises during a claim.

By implementing these strategies, budget travelers can secure comprehensive travel insurance that meets their needs without straining their finances.