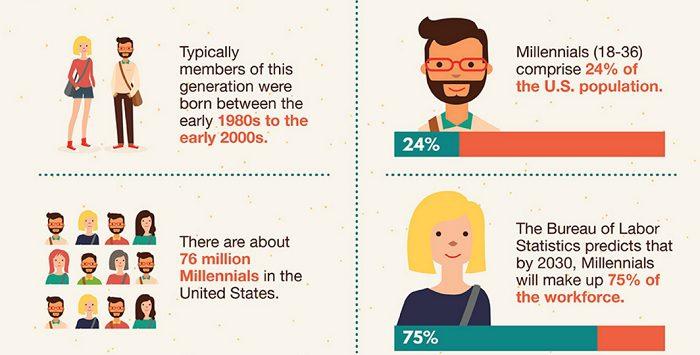

In an era marked by rapid technological advancements and shifting economic landscapes, millennials often find themselves navigating a complex web of financial responsibilities and lifestyle choices. Amidst the plethora of financial products available, life insurance frequently takes a backseat, overshadowed by more immediate concerns such as student loans, homeownership, and retirement savings. However, overlooking life insurance can have significant long-term repercussions. This article delves into five compelling reasons why millennials should reconsider their stance on life insurance, highlighting its potential to provide financial security, peace of mind, and a solid foundation for future planning. By examining these factors, millennials can make informed decisions that align with both their current needs and future aspirations.

Understanding the Financial Safety Net for Millennials

Life insurance might seem like an unnecessary expense for many millennials, especially when juggling student loans, rent, and the pursuit of experiences. However, it plays a crucial role in establishing a robust financial safety net. Life insurance provides a protective cushion that can shield your loved ones from financial distress in the event of unexpected life changes. As millennials increasingly take on responsibilities such as mortgages, starting families, or supporting aging parents, the importance of this safety net becomes more pronounced.

- Debt Protection: Outstanding debts like student loans or credit card balances can burden your family if something happens to you.

- Affordability: Purchasing life insurance at a younger age often means lower premiums, making it a cost-effective decision.

- Peace of Mind: Knowing your family is financially secure can alleviate stress and allow you to focus on other life goals.

Evaluating the Long-term Benefits of Early Life Insurance

When considering financial security, life insurance might not be at the top of every millennial’s list. However, understanding the long-term advantages can provide clarity on why investing early could be a wise decision. Here are some key benefits to consider:

- Lower Premiums: The younger you are, the lower the risk you pose to insurers, which translates to more affordable premiums.

- Building Cash Value: Certain life insurance policies offer a cash value component, which grows over time and can be accessed for future needs.

- Peace of Mind: Knowing that your loved ones are financially protected can reduce stress and provide a sense of security.

- Financial Planning: Early investment in life insurance can be a cornerstone of a robust financial plan, offering a balance of protection and savings.

- Health Benefits: Securing life insurance while you’re young and healthy ensures coverage, even if health issues arise later in life.

By understanding these benefits, millennials can make informed decisions that not only protect their current lifestyle but also ensure a stable future.

Addressing Common Misconceptions About Life Insurance Costs

One of the biggest barriers preventing millennials from considering life insurance is the perception that it is prohibitively expensive. This is often far from the truth. In reality, life insurance can be surprisingly affordable, especially when purchased at a younger age. Millennials may be surprised to learn that term life insurance policies can cost less than a monthly streaming service subscription.

- Overestimation of Costs: Many young adults assume life insurance is expensive without actually researching the prices. The cost of a policy can vary widely depending on factors like age, health, and coverage amount, but it’s often much lower than anticipated.

- Lack of Awareness: Often, the perceived complexity of life insurance deters millennials from exploring it further. However, numerous online tools and resources are available to demystify the process and help find affordable options.

By dispelling these myths, millennials can better understand the true cost and value of life insurance, making informed decisions about their financial futures.

Exploring Customized Life Insurance Options for Millennials

For millennials navigating a world filled with financial responsibilities and uncertainties, customized life insurance options offer a tailored approach to securing their future. Unlike traditional policies, these options allow for flexibility in coverage and premiums, aligning with the unique financial goals and lifestyles of younger generations. By selecting specific benefits and riders, millennials can ensure that their insurance policy grows with them, adapting to changes in income, family size, or career paths.

- Flexible Coverage: Choose the coverage amount that fits your current and future needs.

- Customizable Riders: Add or remove features like critical illness or disability coverage as life changes.

- Affordability: Options for premiums that fit within a millennial’s budget without sacrificing essential coverage.

- Tech-Savvy Solutions: Manage your policy online with ease, reflecting the digital-first lifestyle.

- Investment Potential: Some policies offer investment components, aligning with long-term financial growth goals.