In the complex world of financial planning, life insurance stands out as a critical component, offering a safety net for loved ones in the event of unforeseen circumstances. However, determining the appropriate amount of coverage can be a daunting task, often shrouded in uncertainty and confusion. This article aims to demystify the process by exploring the key factors that influence life insurance needs, providing a clear and comprehensive guide to help you make an informed decision. Whether you’re a young professional just starting a family or an established individual reassessing your financial security, understanding how much life insurance coverage you truly need is essential for ensuring peace of mind and financial stability for your dependents.

Determining Your Financial Obligations and Future Needs

When assessing your life insurance needs, it’s essential to take a comprehensive look at both your current financial obligations and future requirements. Start by considering your existing debts such as mortgages, student loans, and credit card balances. These liabilities need to be covered to prevent financial strain on your loved ones. Additionally, factor in your monthly living expenses to ensure your family can maintain their current lifestyle in your absence.

- Evaluate potential future costs, including your children’s education expenses and spouse’s retirement needs.

- Consider any future goals like family vacations, home renovations, or business ventures.

- Account for emergency funds to handle unforeseen circumstances.

Understanding these elements will provide a clearer picture of the total coverage you require, allowing you to choose a policy that aligns with your family’s long-term financial security.

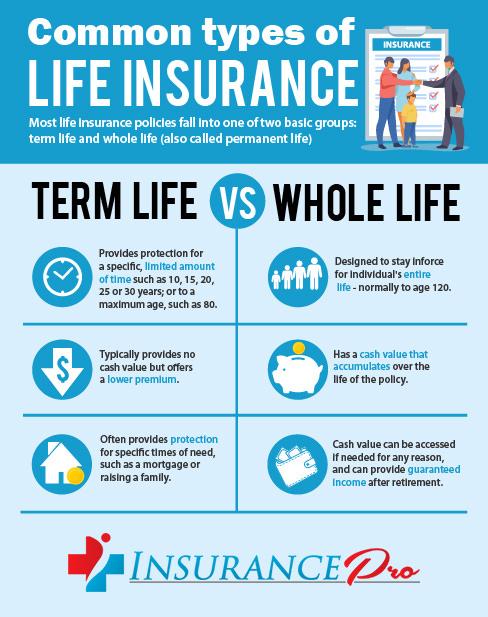

Understanding Different Types of Life Insurance Policies

Life insurance policies come in various forms, each designed to meet different financial goals and personal circumstances. Understanding these differences is crucial to selecting the policy that best suits your needs. Term life insurance is the most straightforward and affordable option, providing coverage for a specified period. It’s ideal for those seeking temporary protection or coverage for specific financial obligations, like a mortgage or children’s education. On the other hand, whole life insurance offers lifelong protection with a savings component, accumulating cash value over time. This makes it a more expensive option but beneficial for those looking to build a financial safety net that can be accessed in the future.

For those interested in flexibility, universal life insurance provides adjustable premiums and death benefits, allowing policyholders to adapt their coverage as their financial situation changes. Variable life insurance combines life coverage with investment opportunities, where the cash value is tied to the performance of various investment options. This can offer significant growth potential but also comes with higher risk. Lastly, simplified issue and guaranteed issue policies cater to individuals who might struggle to obtain traditional life insurance due to health issues, offering coverage without a medical exam. When choosing a policy, consider factors like duration of coverage needed, financial goals, budget, and risk tolerance to ensure you select the right type for your situation.

Evaluating Your Current Financial Situation and Assets

Before determining the appropriate amount of life insurance coverage, it’s crucial to have a clear understanding of your current financial landscape. Start by assessing your assets and liabilities to get a comprehensive view of your financial health. Consider the following elements:

- Liquid Assets: Review your cash savings, checking accounts, and other readily accessible funds.

- Investments: Analyze the value of stocks, bonds, mutual funds, and any other investment vehicles.

- Real Estate: Consider the equity in your home and any other property holdings.

- Debts: Account for outstanding loans, credit card balances, and other liabilities that may impact your financial obligations.

By thoroughly evaluating these components, you can better understand your financial needs and how life insurance can serve as a protective measure for your family. It’s also wise to revisit this assessment periodically, as life circumstances and financial situations can change, influencing the amount of coverage required.

Consulting with Professionals for Tailored Insurance Advice

When navigating the complexities of life insurance, consulting with seasoned professionals can offer invaluable insights tailored to your unique needs. Insurance experts can help you assess factors such as your current financial situation, long-term goals, and family dynamics to determine the appropriate coverage. Their expertise ensures you are not underinsured or overpaying for unnecessary coverage, providing peace of mind and financial security.

Engaging with professionals allows you to explore a range of coverage options, considering elements like:

- Income Replacement: Calculating how much income your family would need in your absence.

- Debt and Expenses: Accounting for outstanding debts and future expenses like education and healthcare.

- Inflation Protection: Ensuring your coverage keeps pace with inflation over time.

- Tax Implications: Understanding how your policy might affect your estate and beneficiaries.

By leveraging the expertise of professionals, you can craft a life insurance plan that is as dynamic and individual as your own life story.