In today’s fast-paced world, the financial security of loved ones remains a top priority for many individuals. Life insurance serves as a fundamental tool in achieving this goal, offering peace of mind by ensuring that dependents are financially protected in the event of an untimely death. Traditionally, obtaining life insurance has involved a comprehensive medical examination, designed to assess the applicant’s health risks and determine policy terms. However, an increasing number of insurers are now offering life insurance policies without requiring a medical exam, appealing to those seeking convenience and speed. This article explores the implications of opting for life insurance without a medical exam, examining the benefits and potential drawbacks to help you make an informed decision.

Understanding No-Exam Life Insurance Policies

No-exam life insurance policies offer a streamlined approach to obtaining coverage without the need for a medical examination. This type of insurance can be particularly appealing for individuals who may have pre-existing health conditions or those who simply wish to avoid the hassle of scheduling and undergoing a physical. Key benefits of these policies include:

- Speed and Convenience: Approval times are often faster, allowing coverage to begin in a matter of days.

- Accessibility: Easier access for individuals with medical conditions that might complicate traditional policy approvals.

- Simplicity: Reduced paperwork and fewer steps in the application process.

However, it’s important to weigh these benefits against potential drawbacks. Higher premiums are common, as insurers assume greater risk without detailed health information. Additionally, coverage limits may be lower compared to traditional policies. Understanding these factors can help you make an informed decision about whether this type of policy aligns with your financial goals and personal circumstances.

Comparing Costs and Coverage Options

When evaluating life insurance policies that do not require a medical exam, it’s essential to consider both the costs and the coverage options available. Costs for no-exam life insurance can vary significantly compared to traditional policies. Typically, these plans tend to have higher premiums due to the increased risk assumed by the insurer. This is because the insurer does not have detailed medical information to assess the applicant’s health status thoroughly. However, for those with pre-existing conditions or who wish to avoid the hassle of medical exams, the higher premium might be a worthwhile trade-off.

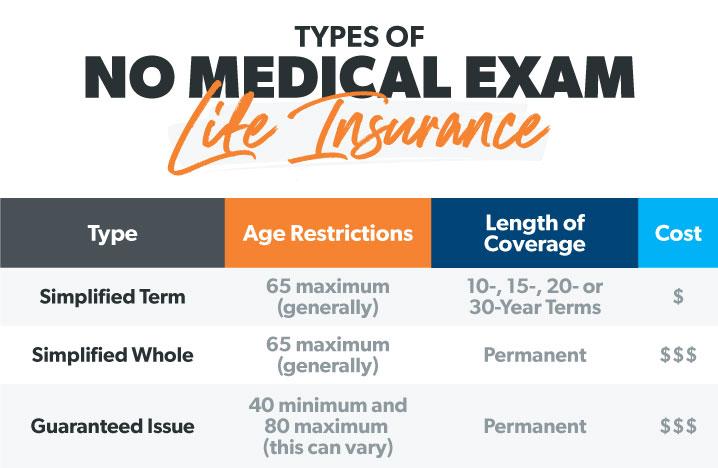

In terms of coverage options, no-exam policies usually offer lower coverage amounts than their medically underwritten counterparts. This limitation is often balanced by the speed and convenience of obtaining coverage. Common types of no-exam policies include:

- Guaranteed Issue: Provides coverage without health questions or exams, but often with a waiting period before full benefits are available.

- Simplified Issue: Requires answers to basic health questions and offers quicker approval times, usually within a few days.

When choosing a policy, it’s crucial to weigh these factors and consider how they align with your financial goals and personal circumstances. Understanding the trade-offs between cost, coverage, and convenience will help you make a more informed decision.

Evaluating the Benefits and Drawbacks

When considering life insurance without a medical exam, it’s essential to weigh both the advantages and disadvantages of such policies. On the positive side, these policies offer quick approval and convenience, making them ideal for individuals who need coverage swiftly or have medical conditions that might complicate traditional insurance applications. Furthermore, they provide a sense of privacy, as applicants can bypass the sometimes invasive process of medical examinations.

- Quick approval: Often, policies can be activated in a matter of days.

- Convenience: No need to schedule or attend medical appointments.

- Privacy: No disclosure of personal health information to insurers.

However, these benefits come with certain trade-offs. The most notable drawback is typically the higher premiums, as insurers assume greater risk without detailed health assessments. Additionally, the coverage limits may be lower compared to traditional policies, potentially leaving gaps in financial protection. Lastly, such policies may include exclusions or restrictions that can affect the overall effectiveness of the coverage.

- Higher premiums: Increased costs due to the lack of medical underwriting.

- Coverage limits: Potentially less coverage available.

- Exclusions/restrictions: Possible limitations that could impact the policy’s value.

Determining If No-Exam Life Insurance Is Right for You

When considering life insurance options, it’s essential to weigh the pros and cons of no-exam policies. No-exam life insurance can be a convenient choice for those who prioritize speed and ease over potentially lower premiums. Without the need for a medical exam, these policies offer a streamlined application process, making them an attractive option for individuals with busy lifestyles or those who prefer to avoid medical appointments. However, this convenience often comes with higher costs, as insurers take on more risk without a detailed health assessment.

Before deciding if this type of policy suits your needs, consider the following factors:

- Health Status: If you have a pre-existing condition or are in poor health, a no-exam policy might be a better fit, as traditional policies could be more costly or even inaccessible.

- Urgency: If you need coverage quickly due to a life event or travel plans, the faster approval process can be beneficial.

- Budget: Be prepared for potentially higher premiums and ensure they align with your financial situation.

Evaluating these aspects will help you make an informed decision about whether no-exam life insurance aligns with your personal and financial goals.